Question

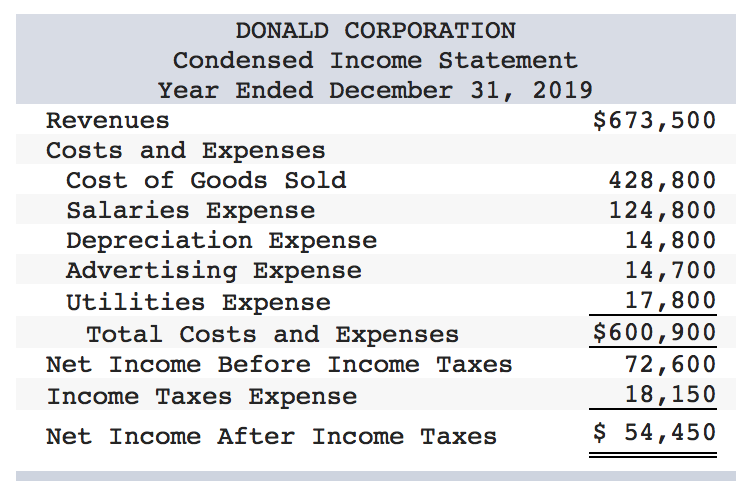

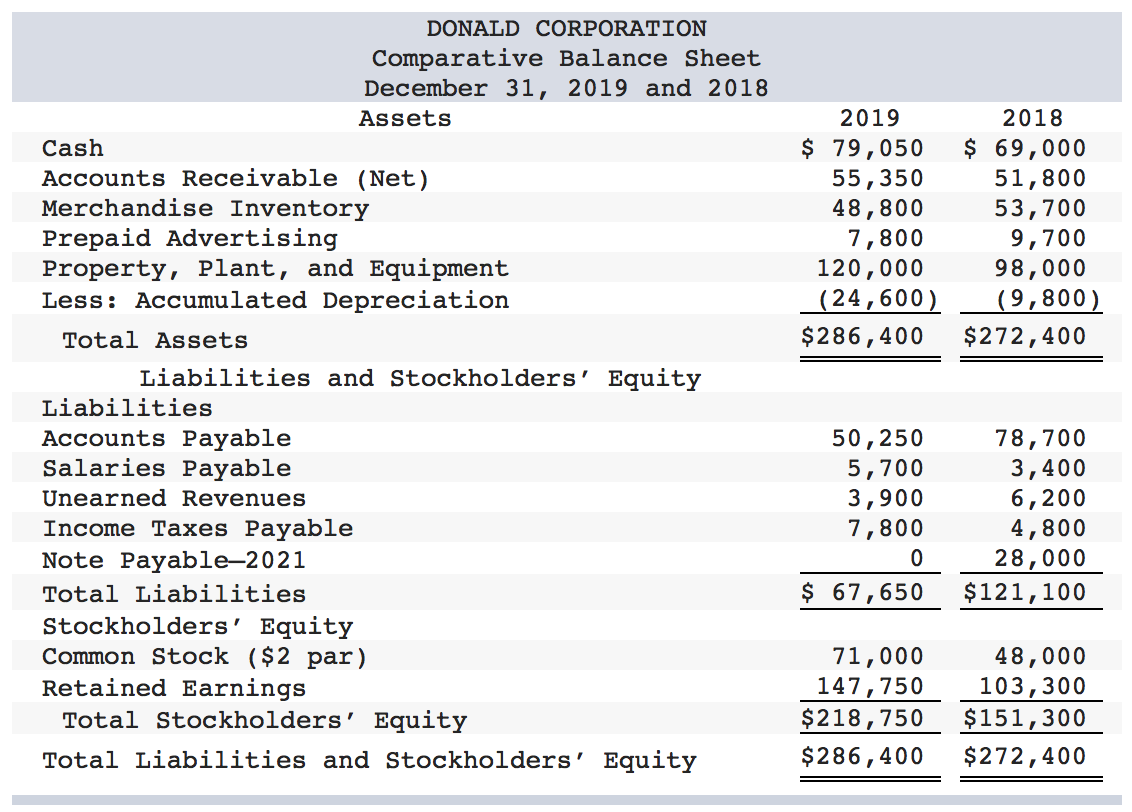

The condensed income statement and comparative balance sheet of Donald Corporation as of December 31, 2019 and 2018, are provided below. Other financial data is

The condensed income statement and comparative balance sheet of Donald Corporation as of December 31, 2019 and 2018, are provided below. Other financial data is also given.

Additional information for the year that is pertinent to its preparation follows.

- No items of property, plant, and equipment were disposed of during the year.

- Paid cash for the additions to property, plant, and equipment during the year.

- Paid $10,000 dividends on the common stock in cash during the year.

- Issued common stock at par value for cash.

- Paid cash to retire the long-term note payable.

Required: Prepare a statement of cash flows for Donald Corporation for 2019. (Amounts to be deducted should be indicated with a minus sign.)

Analyze: If Donald Corporation had written off an uncollectible account receivable of $5,700 during this fiscal period, what adjustment, if any, would be required on the statement of cash flows?

A. Increase in cash flow or net income

B. Decrease in cash flow or net income

C. No effect

DONALD CORPORATION Condensed Income Statement Year Ended December 31, 2019 $673,500 Revenues Costs and Expenses 428,800 124,800 14,800 14,700 17,800 Cost of Goods Sold Salaries Expense Depreciation Expense Advertising Expense Utilities Expense Total Costs and Expenses $600,900 Net Income Before Income Taxes 72,600 18,150 Income Taxes Expense $ 54,450 Net Income After Income Taxes DONALD CORPORATION Comparative Balance Sheet December 31, 2019 and 2018 2019 2018 Assets $ 69,000 51,800 53,700 9,700 98,000 (9,800) $ 79,050 55,350 48,800 7,800 120,000 Cash Accounts Receivable (Net) Merchandise Inventory Prepaid Advertising Property, Plant, and Equipment Less: Accumulated Depreciation (24,600) $286,400 $272,400 Total Assets Liabilities and Stockholders' Equity Liabilities Accounts Payable Salaries Payable 78,700 3,400 6,200 4,800 28,000 50,250 5,700 3,900 7,800 Unearned Revenues Income Taxes Payable Note Payable-2021 $ 67,650 $121,100 Total Liabilities Stockholders' Equity Common Stock ($2 par) Retained Earnings Total Stockholders' Equity 71,000 147,750 48,000 103,300 $151,300 $218,750 $286,400 $272,400 Total Liabilities and Stockholders' Equity DONALD CORPORATION Statement of Cash Flows Year Ended December 31, 2019 Cash flows from operating activities Adjustments: Total adjustments Cash Flows from investing activities Cash flows from financing activitiesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started