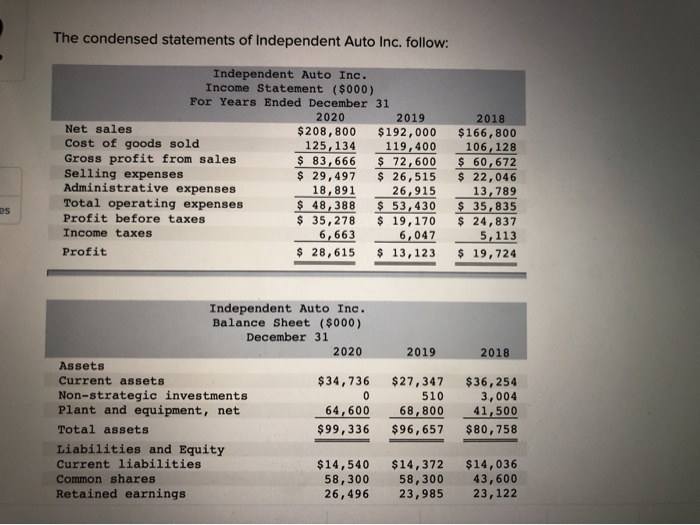

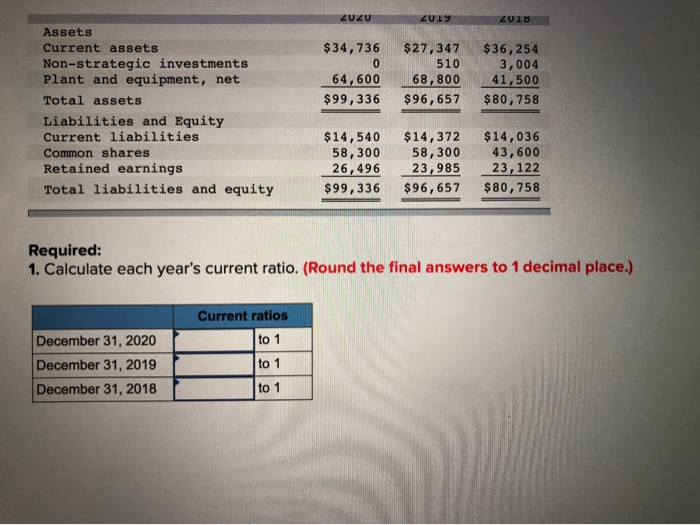

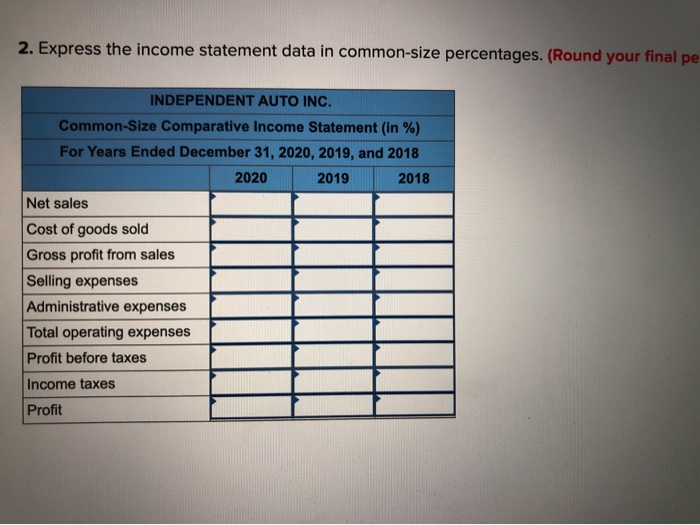

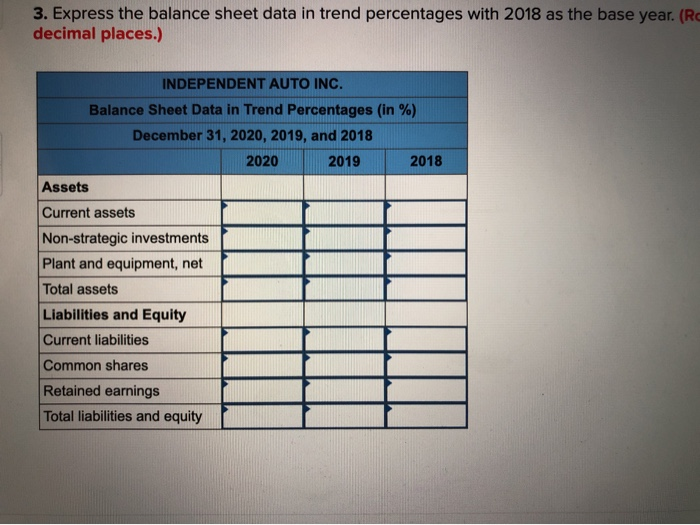

The condensed statements of Independent Auto Inc. follow: Independent Auto Inc. Income Statement ($000) For Years Ended December 31 2020 2019 Net sales $208,800 $192,000 Cost of goods sold 125, 134 119,400 Gross profit from sales $ 83,666 $ 72,600 Selling expenses $ 29,497 $ 26,515 Administrative expenses 18,891 26,915 Total operating expenses $ 48,388 $ 53,430 Profit before taxes $ 35,278 $ 19,170 Income taxes 6,663 6,047 Profit $ 28,615 $ 13,123 2018 $166,800 106,128 $ 60,672 $ 22,046 13,789 $ 35, 835 $ 24,837 5,113 $ 19,724 2019 2018 Independent Auto Inc. Balance Sheet ($000) December 31 2020 Assets Current assets $34,736 Non-strategic investments 0 Plant and equipment, net 64,600 Total assets $99,336 Liabilities and Equity Current liabilities $14,540 Common shares 58,300 Retained earnings 26,496 $27,347 510 68,800 $ 96,657 $36,254 3,004 41,500 $80, 758 $14,372 58,300 23,985 $14,036 43,600 23, 122 ZUZU 2019 2018 $34,736 64,600 $99,336 $ 27,347 510 68,800 $96,657 $36,254 3,004 41,500 $80,758 Assets Current assets Non-strategic investments Plant and equipment, net Total assets Liabilities and Equity Current liabilities Common shares Retained earnings Total liabilities and equity $14,540 58,300 26,496 $99,336 $14,372 58,300 23,985 $96,657 $14,036 43,600 23,122 $80,758 Required: 1. Calculate each year's current ratio. (Round the final answers to 1 decimal place.) Current ratios to 1 December 31, 2020 December 31, 2019 December 31, 2018 to 1 to 1 2. Express the income statement data in common-size percentages. (Round your final pe INDEPENDENT AUTO INC. Common-Size Comparative Income Statement (in %) For Years Ended December 31, 2020, 2019, and 2018 2020 2019 2018 Net sales Cost of goods sold Gross profit from sales Selling expenses Administrative expenses Total operating expenses Profit before taxes Income taxes Profit 3. Express the balance sheet data in trend percentages with 2018 as the base year. (Rq decimal places.) INDEPENDENT AUTO INC. Balance Sheet Data in Trend Percentages (in %) December 31, 2020, 2019, and 2018 2020 2019 2018 Assets Current assets Non-strategic investments Plant and equipment, net Total assets Liabilities and Equity Current liabilities Common shares Retained earnings Total liabilities and equity