Question

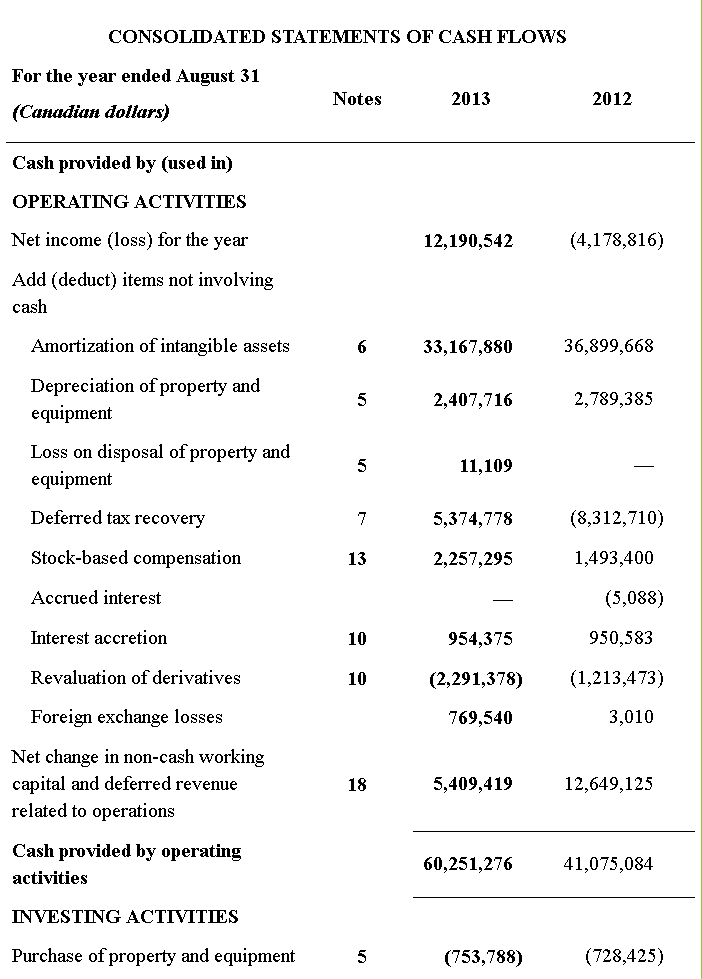

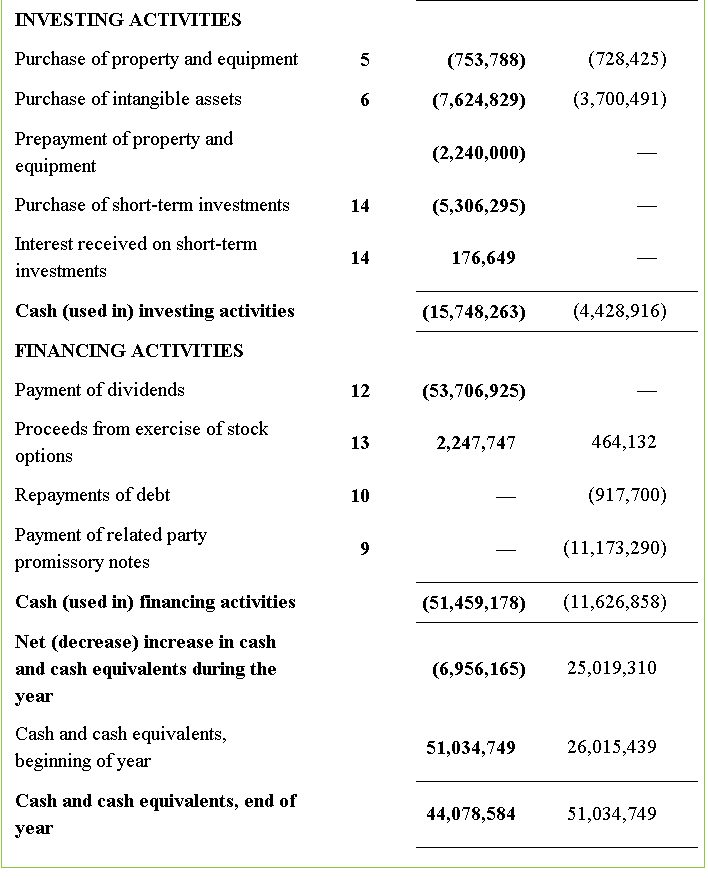

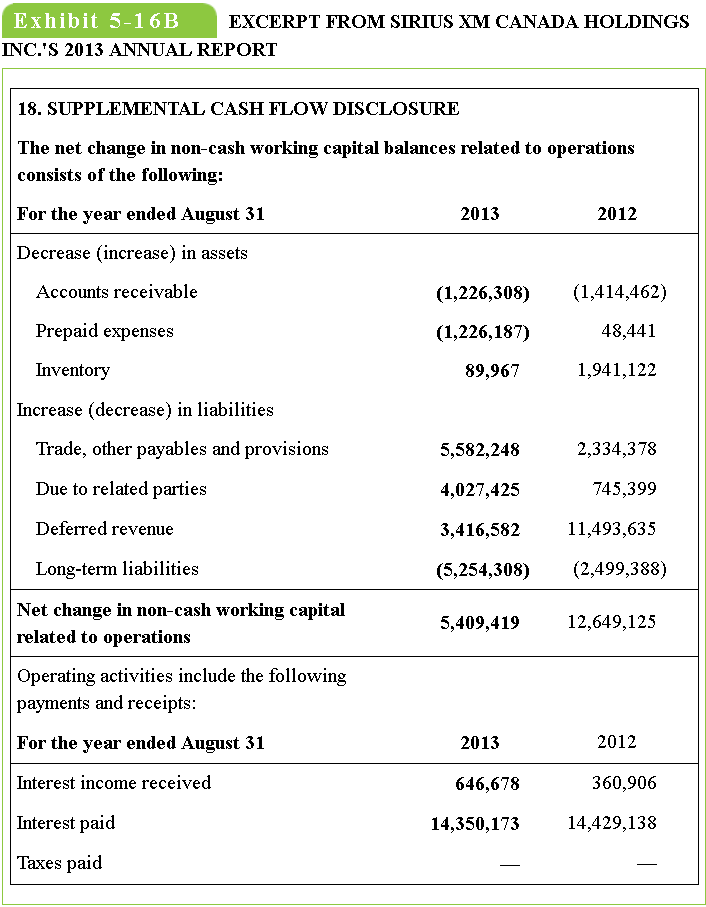

The consolidated statements of cash flows and related note disclosure for Sirius XM Canada Holdings Inc. are in Exhibits 5-16A and 5-16B. Sirius broadcasts satellite

The consolidated statements of cash flows and related note disclosure for Sirius XM Canada Holdings Inc. are in Exhibits 5-16A and 5-16B. Sirius broadcasts satellite radio channels to subscribers.

Problem:

a.

In total, how much did Second Cup's cash and cash equivalents change during 2013? Was this an increase or a decrease? How did this compare with the previous year?

b.

Did Second Cup have net income or a net loss in 2013? How did this compare with the cash flows from operating activities? What was the largest difference between these two amounts?

c.

Did Second Cup purchase property, plant, and equipment during 2013? Did the company receive any proceeds from the sale of property, plant, and equipment during the period?

d.

Calculate Second Cup's net free cash flow for 2013 and 2012. Is the trend positive or negative?

e.

Second Cup's total liabilities were $31,376 at December 28, 2013, and $31,980 at December 29, 2012. Determine the company's cash flows to total liabilities ratio. Comment on the change year over year.

f.

If you were a user of Second Cup's financial statementsa banker or an investorhow would you interpret the company's cash flow pattern? How would you assess the risk of a loan to or an investment in Second Cup? Do you think the company is growing rapidly?

CONSOLIDATED STATEMENTS OF CASH FLOWS For the year ended August 31 (Canadian dollars) Cash provided by (used in) OPERATING ACTIVITIES Net income (loss) for the year Add (deduct) items not involving Notes 2013 2012 12,190,542 (4,178,816) cash Amortization of intangible assets Depreciation of property and equipment 33,167,880 36,899,668 2,407,716 2,789,38.5 Loss on disposal of property and 11,109 equipment Deferred tax recovery 5,374,778 (8,312,710) Stock-based compensation 13 2,257,29:5 1,493,400 Accrued interest (5,088) Interest accretion 10 954,375 950,583 Revaluation of derivatives 10 (2,291,378) (1,213,473) Foreign exchange losses Net change in non-cash working capital and deferred revenue related to operation:s Cash provided by operating activities INVESTING ACTIVITIES Purchase of property and equipment 769,540 3,010 18 5,409,419 12,649,125 60,251,276 41,075,084 (753,788) (728,425)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started