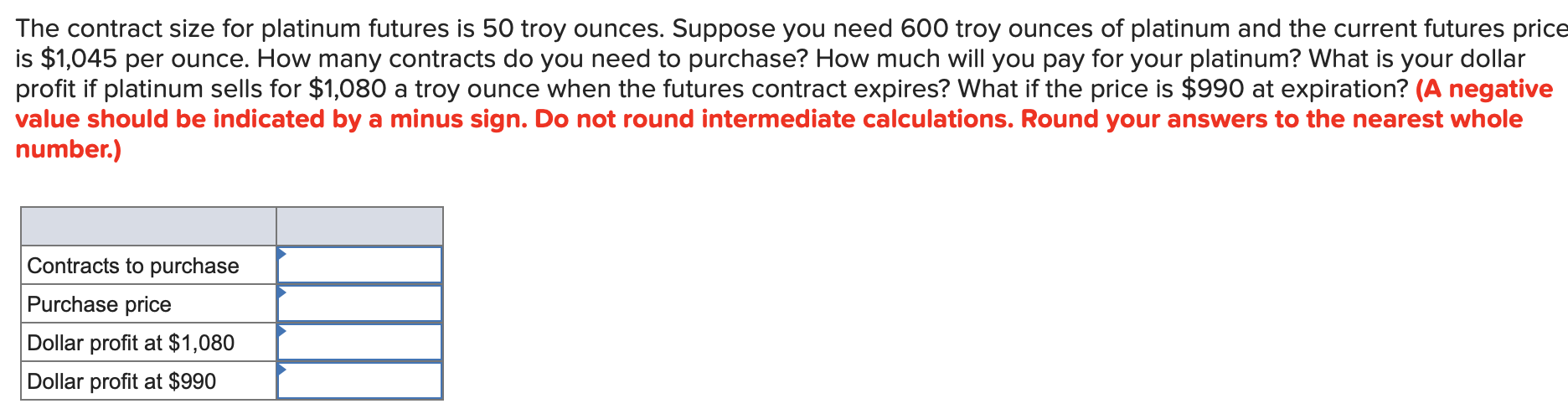

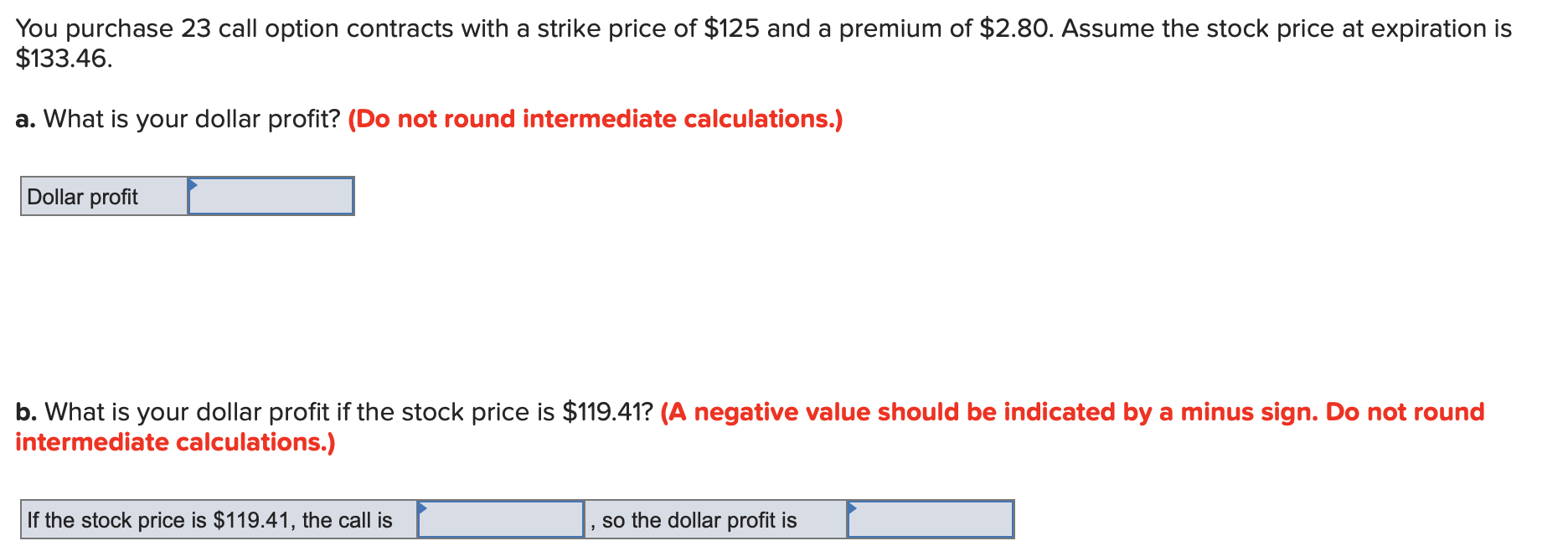

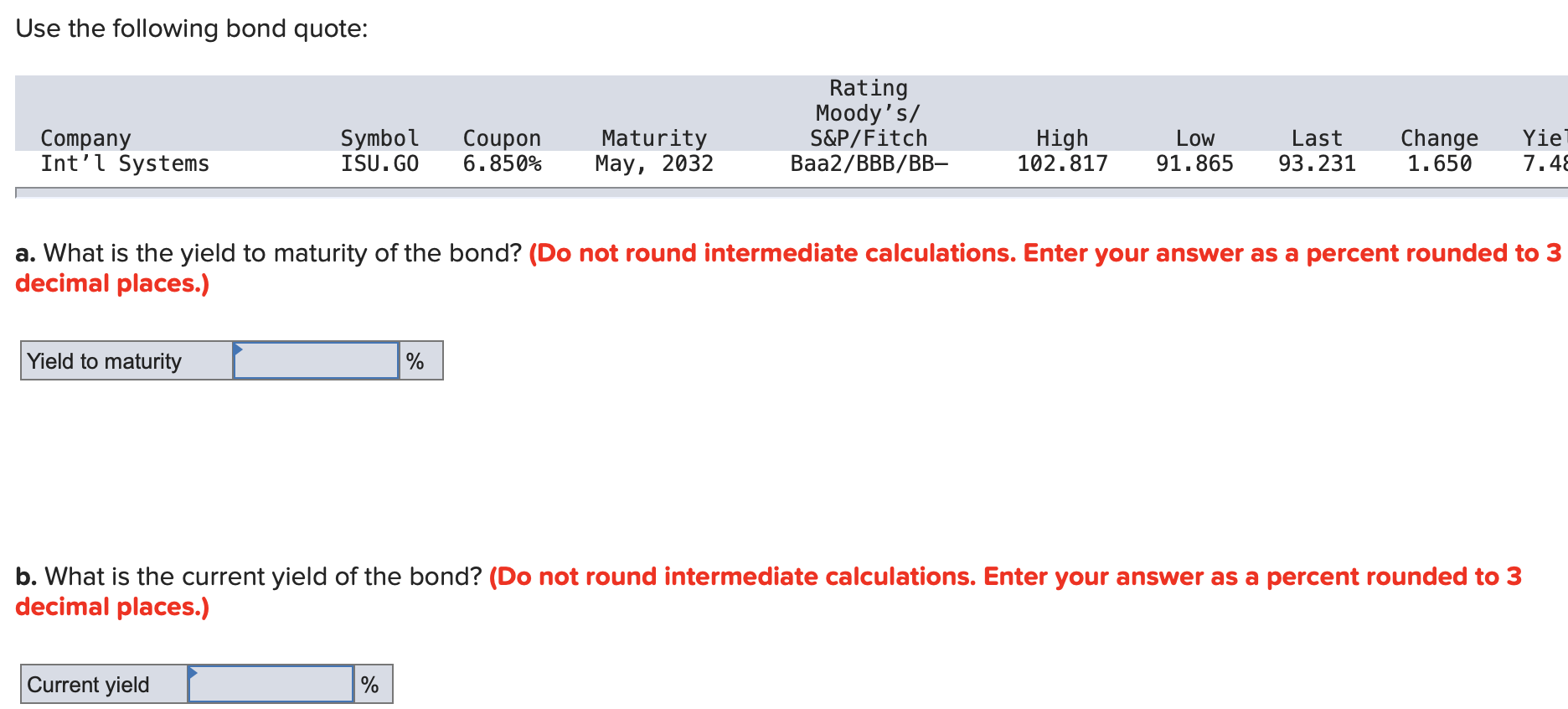

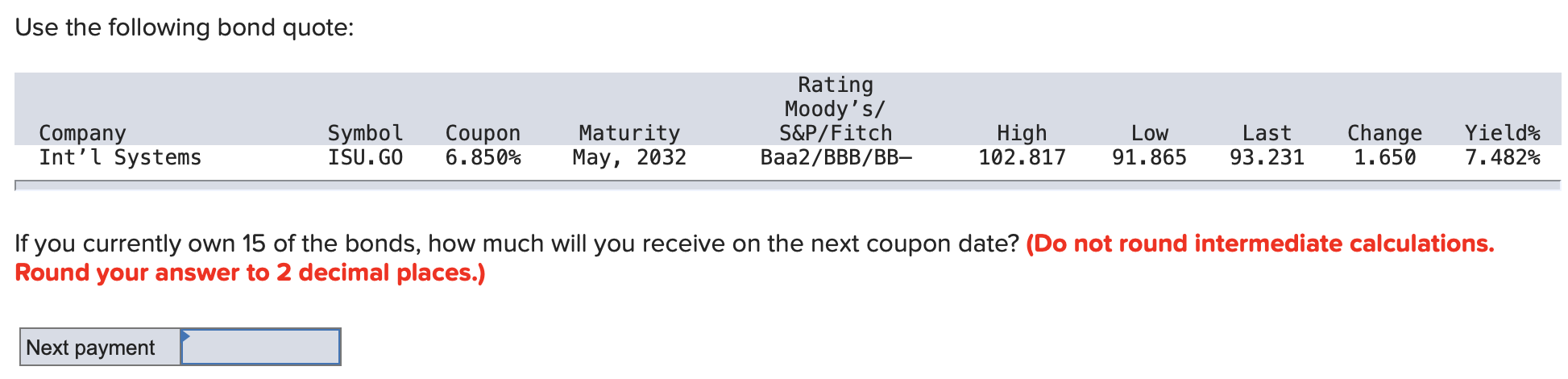

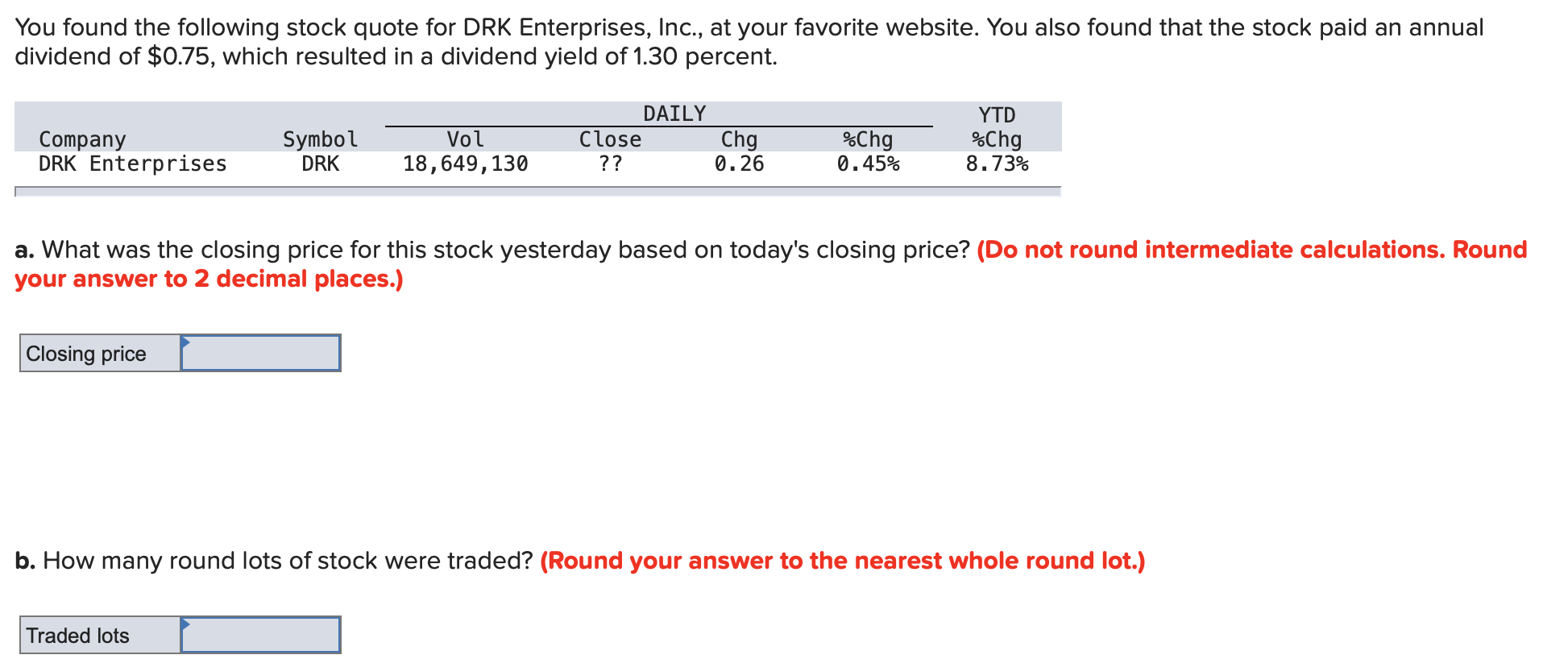

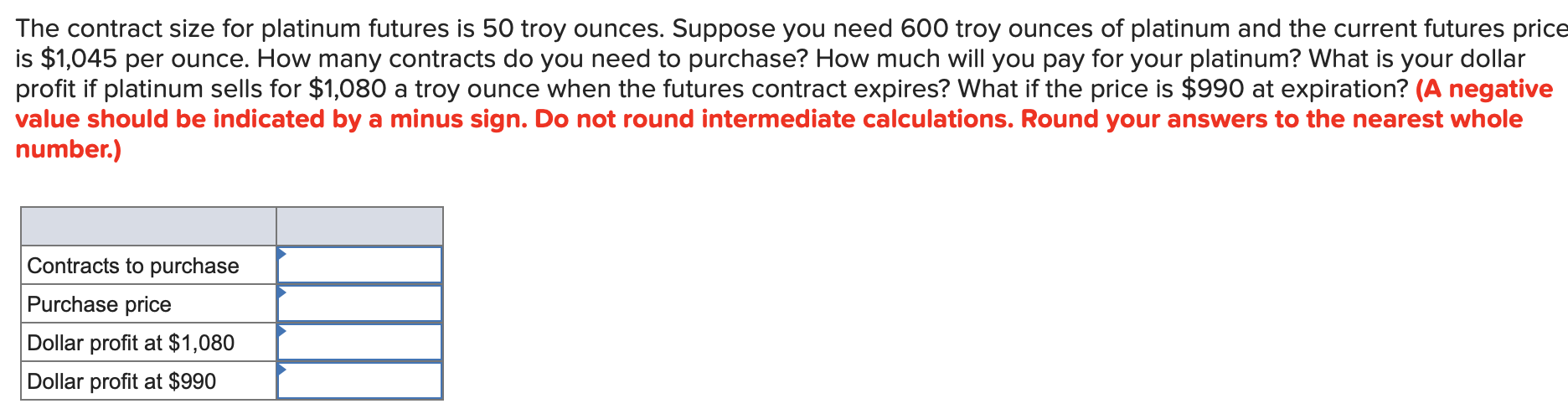

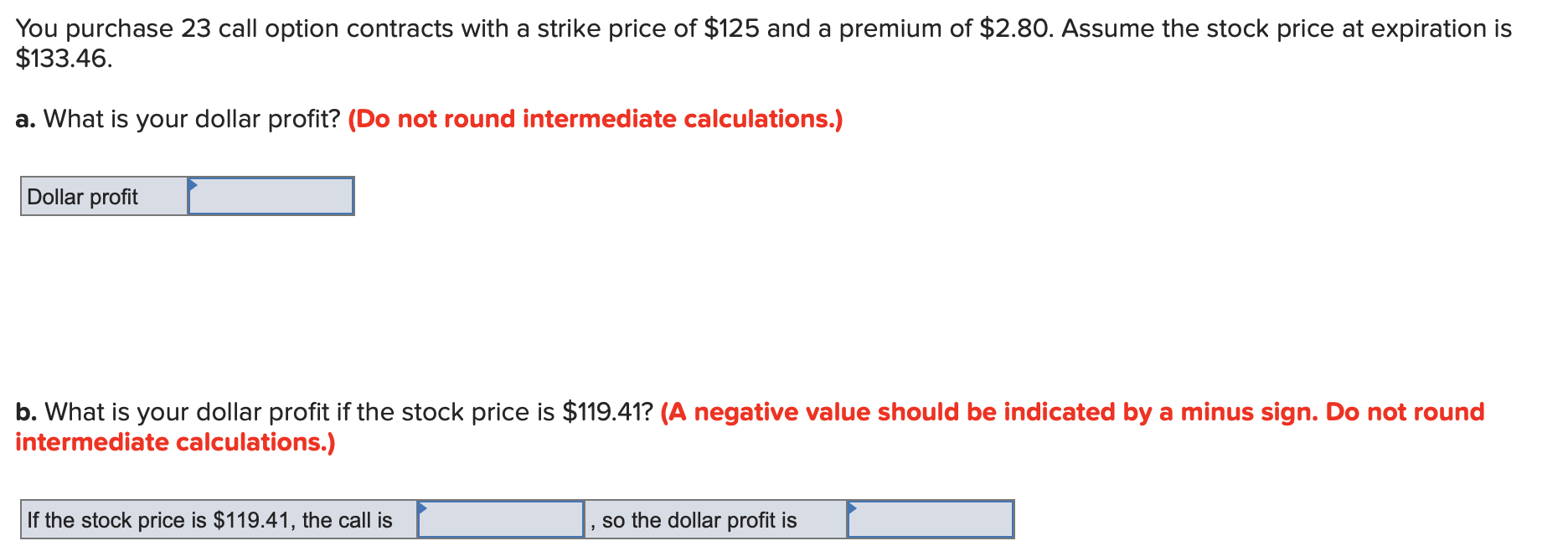

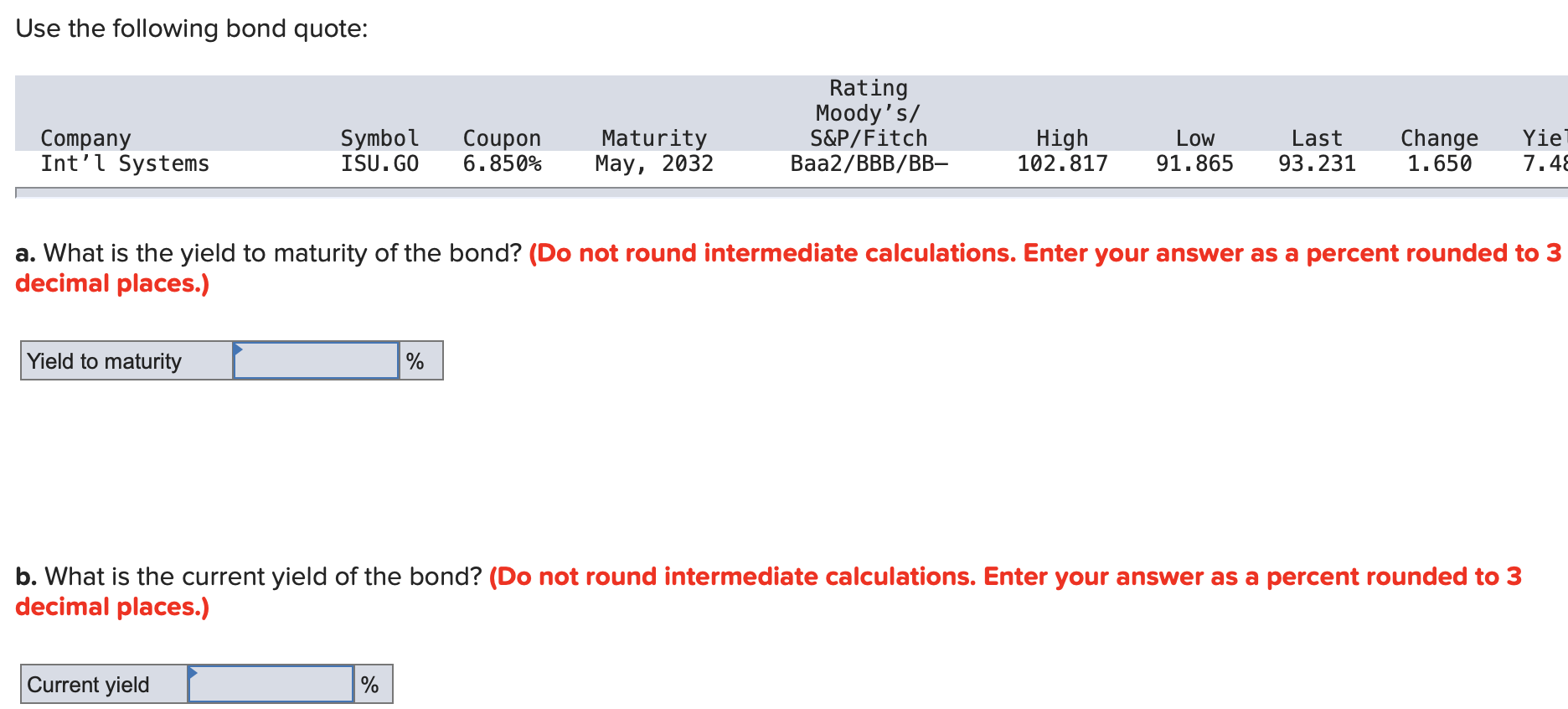

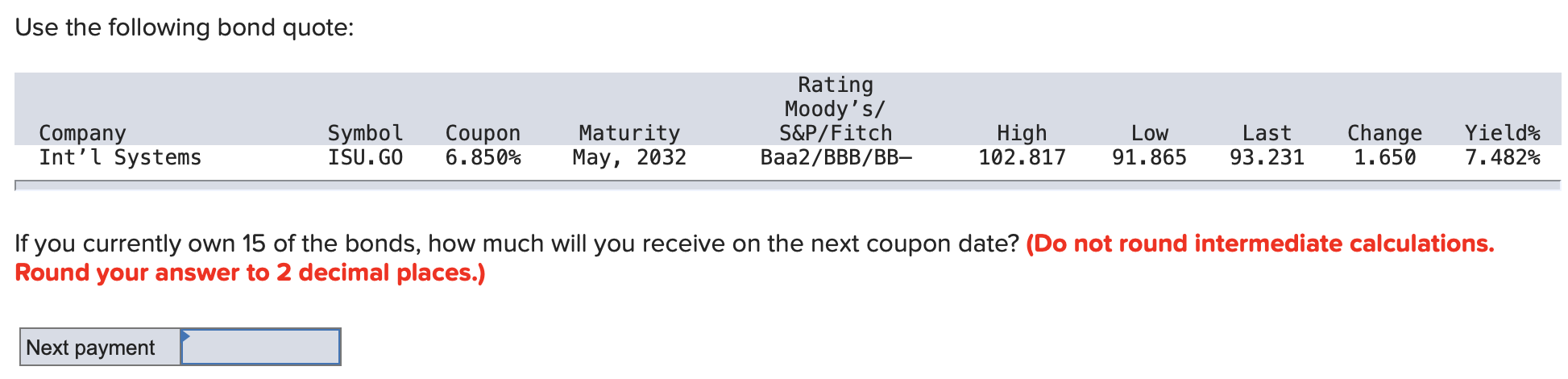

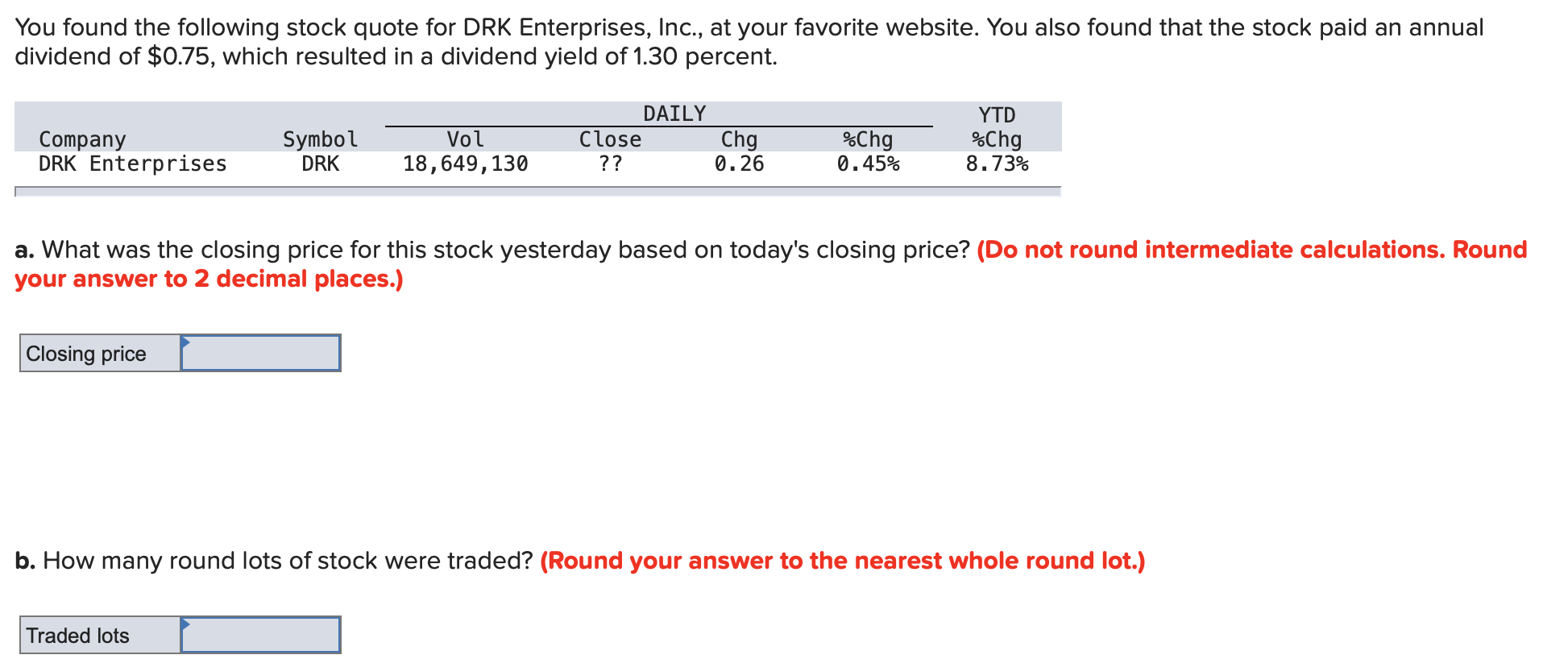

The contract size for platinum futures is 50 troy ounces. Suppose you need 600 troy ounces of platinum and the current futures price is $1,045 per ounce. How many contracts do you need to purchase? How much will you pay for your platinum? What is your dollar profit if platinum sells for $1,080 a troy ounce when the futures contract expires? What if the price is $990 at expiration? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest whole number.) Contracts to purchase Purchase price Dollar profit at $1,080 Dollar profit at $990 You purchase 23 call option contracts with a strike price of $125 and a premium of $2.80. Assume the stock price at expiration is $133.46. a. What is your dollar profit? (Do not round intermediate calculations.) Dollar profit b. What is your dollar profit if the stock price is $119.41? (A negative value should be indicated by a minus sign. Do not round intermediate calculations.) If the stock price is $119.41, the call is , so the dollar profit is Use the following bond quote: Company Int'l Systems Symbol ISU. GO Coupon 6.850% Rating Moody's/ S&P/Fitch Baa2/BBB/BB- Maturity May, 2032 High 102.817 Low 91.865 Last 93.231 Change 1.650 Yie 7.48 a. What is the yield to maturity of the bond? (Do not round intermediate calculations. Enter your answer as a percent rounded to 3 decimal places.) Yield to maturity % b. What is the current yield of the bond? (Do not round intermediate calculations. Enter your answer as a percent rounded to 3 decimal places.) Current yield Current yield [ olo % Use the following bond quote: Company Int'l Systems Symbol ISU. GO Coupon 6.850% Rating Moody's/ S&P/Fitch Baa2/BBB/BB- Maturity May, 2032 High 102.817 Low 91.865 Last 93.231 Change 1.650 Yield% 7.482% If you currently own 15 of the bonds, how much will you receive on the next coupon date? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Next payment You found the following stock quote for DRK Enterprises, Inc., at your favorite website. You also found that the stock paid an annual dividend of $0.75, which resulted in a dividend yield of 1.30 percent. Company DRK Enterprises Chg Symbol DRK DAILY Close ?? 0.26 Vol 18,649,130 %Chg 0.45% YTD %Chg 8.73% a. What was the closing price for this stock yesterday based on today's closing price? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Closing price b. How many round lots of stock were traded? (Round your answer to the nearest whole round lot.) Traded lots