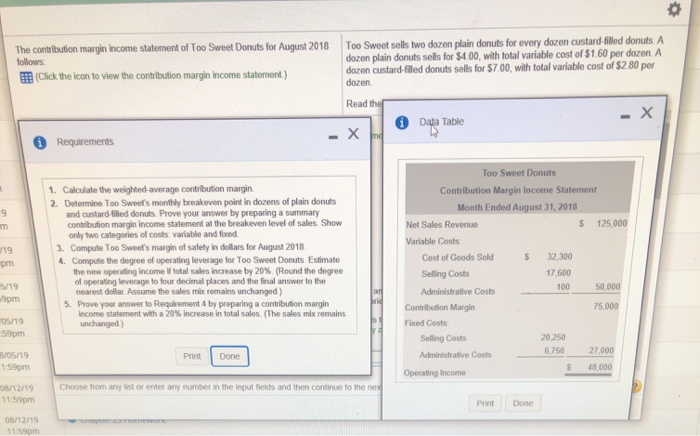

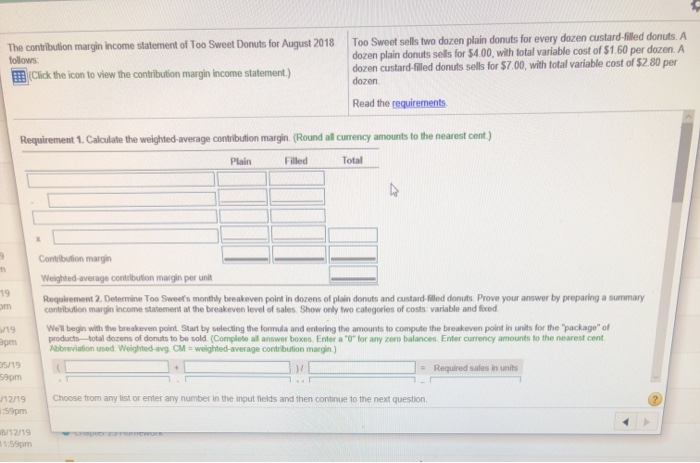

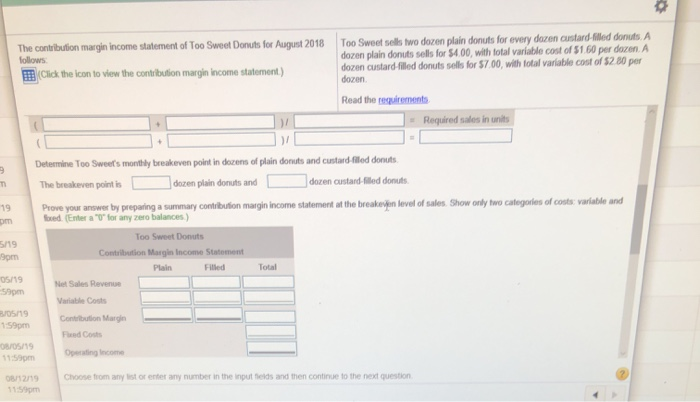

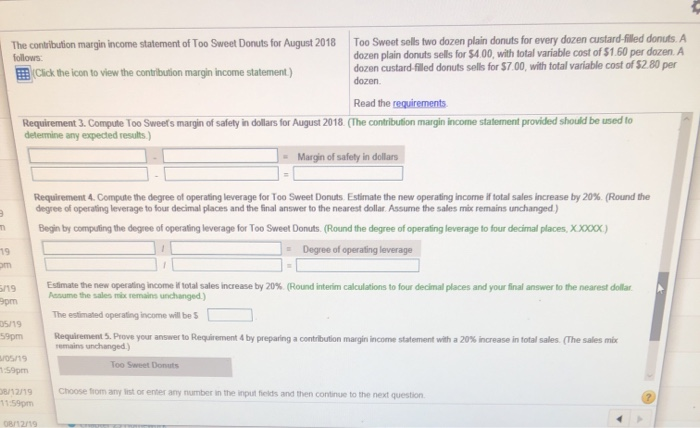

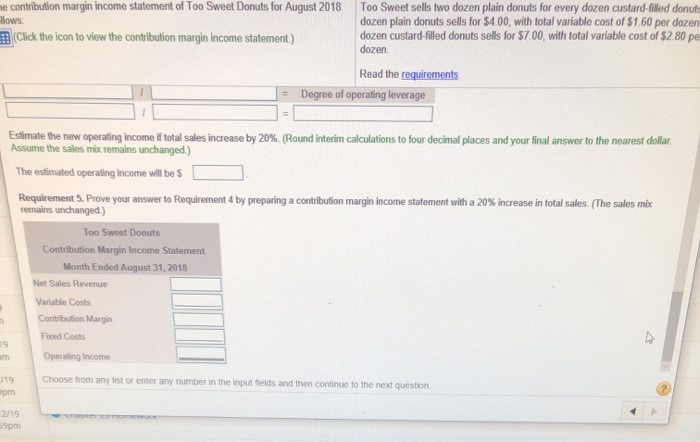

The contribution margin income statement of Too Sweet Donuts for August 2018 ws Click the icon to view the contribution margin income statement) Too Sweat sells two dozen plain donuts for every dozen custard-filled donuts. A dozen plain donuts sells for $4.00, with total variable cost of $1 60 per dozen. A dozen custard filled donuts sells for $7.00, with total variable cost of $280 per dozen Read the Data Table 1 Requirements - X 1. Calculate the weighted average contribution margin 2. Determine Too Sweet's monthly breakeven point in dozens of plain donuts and custard filled donuts. Prove your answer by preparing a summary contribution margin income statement at the breakeven level of sales Show only two categories of costs: variable and fored 3. ComputeToo Sweet's margin of safety in dollars for August 2018 4. Compute the degree of operating leverage for Too Sweet Donuts Estimate the new operating income total sales increase by 20% (Round the degree of operating leverage to four decimal places and the final a ver to the nearest dollarAssume the sales mbremains unchanged) 5. Prove your answer to Requirement by preparing a contribution margin Income statement with a 20% increase in total sales (The sales mix remains unchanged) Too Sweet Donuts Contribution Margin Income Statement Month Ended August 31, 2018 Net Sales Revenue $ 125,000 Variable Costs Cost of Goods Sold 5 32,300 Selling Costs 17.600 Administrative Costs 100 50.000 Contribution Margin 75,000 Fixed Costs Selling Costs 2010 27 Administrative Costs Operating Income 59 spm 05/19 -59pm 05/19 Pont Done | Choose from any list or enter any number in the input fields and then continue to the nes 3/12/19 11:59 pm Print Done 08/12/19 The contribution margin income statement of Too Sweet Donuts for August 2018 follows: Click the icon to view the contribution margin income statement.) Too Sweet sells two dozen plain donuts for every dozen custard-filled donuts. A dozen plain donuts sells for $4.00, with total variable cost of $1.60 per dozen. A dozen custard-filled donuts sells for $7.00, with total variable cost of $2.80 per dozen Read the requirements Requirement 1. Calculate the weighted average contribution margin (Round al currency amounts to the nearest cent.) Plain Filled Total Contribution margin Weighted average contribution margin per unit 19 Requirement 2. Determine Too Sweet's monthly breakeven point in dozens of plain donuts and custard-filled donuts. Prove your answer by preparing a summary contribution margin income statement at the breakeven level of sales Show Only two categories of costs variable and food 5/19 pe Well begin with the breakeven point. Start by selecting the formula and entering the amounts to compute the breakeven point in units for the package of products total dozens of donuts to be sold (Complete all answer boxes Entra "O" for any oro balances Enter currency amounts to the nearest cent Abbreviation used Weighted avg CM = weighted average contribution margin) 05/19 59pm = Required sales in units Choose from any list or enter any number in the input fields and then continue to the next question 112/19 1:59pm 8/12/19 11:59pm The contribution margin income statement of Too Sweet Donuts for August 2018 follows Click the icon to view the contribution margin income statement) Too Sweet sells two dozen plain donuts for every dozen custard filled donuts. A dozen plain donuts sells for $4.00, with total variable cost of 51 60 per dozen. A dozen custard-filled donuts sells for $7.00, with total variable cost of $2 80 per dozen Read the requirements = Required sales in units Determine Too Sweets monthly breakeven point in dozens of plain donuts and custard filled donuts The breskeven point is d ozen plain donuts and dozen custard filled donuts Prove your answer by preparing a summary contribution margin income statement at the breakeve level of sales. Show only two categories of costs: variable and Goed Entera" for any er balances) om 5/19 29pm Total 05/19 59pm Too Sweet Donuts Contribution Margin income Statement Plain Filled Net Sales Revenue Variable Costs Contribution Margin Find out Operating Income 05/19 1:59pm 08/05/19 11:59pm Choose from any list or enter any number in the input fields and then continue to the next question 1219 11:59pm The contribution margin income statement of Too Sweet Donuts for August 2018 follows: Click the icon to view the contribution margin income statement) Too Sweet sells two dozen plain donuts for every dozen custard-filled donuts. A dozen plain donuts sells for $400, with total variable cost of $1.60 per dozen. A dozen custard filled donuts sells for $7.00, with total variable cost of $2 80 per dozen Read the requirements Requirement 3. Compute Too Sweets margin of safety in dollars for August 2018. (The contribution margin income statement provided should be used to determine any expected results.) Margin of safety in dollars Requirement 4. Compute the degree of operating leverage for Too Sweet Donuts. Estimate the new operating income if total sales increase by 20% (Round the degree of operating leverage to four decimal places and the final answer to the nearest dollar Assume the sales mix remains unchanged) Begin by computing the degree of operating leverage for Too Sweet Donuts. (Round the degree of operating leverage to four decimal places, XXOX) Degree of operating leverage 5/19 pm Estimate the new operating income of total sales increase by 20% (Round interim calculations to four decimal places and your final answer to the nearest dollar Monume the sales remains unchanged.) The estimated operating income will be 05/19 59pm Requirements. Prove your answer to Requirement 4 by preparing a contribution margin income statement with a 20% increase in total sales. (The sales mix remains unchanged.) 05/19 1.59pm Too Sweet Donuts Choose from any list or enter any number in the input fields and then continue to the next question 38/12/19 11:59pm 08/12/19 me contribution margin income statement of Too Sweet Donuts for August 2018 llows Click the icon to view the contribution margin income statement.) Too Sweet sells two dozen plain donuts for every dozen custard-filled donuts dozen plain donuts sells for $4.00, with total variable cost of $1.60 per dozen dozen custard-filled donuts sells for $7.00, with total variable cost of $2.80 pe dozen Read the requirements Degree of operating leverage Estimate the new operating income if total sales increase by 20% (Round interim calculations to four decimal places and your final answer to the nearest dollar Assume the sales mix remains unchanged.) The estimated operating income will be $ Requirement 5. Prove your answer to Requirement 4 by preparing a contribution margin income statement with a 20% increase in total sales. The sales mix remains unchanged.) Too Sweet Donuts Contribution Margin Income Statement Month Ended August 31, 2018 Net Sales Revenue Variable Costs Contribution Margin Foxed Costs Operating Income Choose from any list of enter any number in the input fields and then continue to the next question 119 pm 2/19 59pm