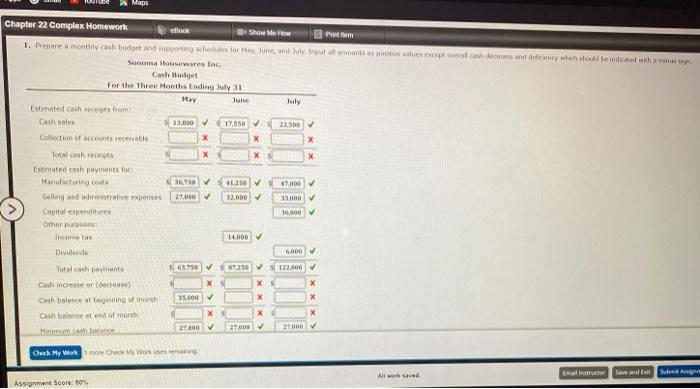

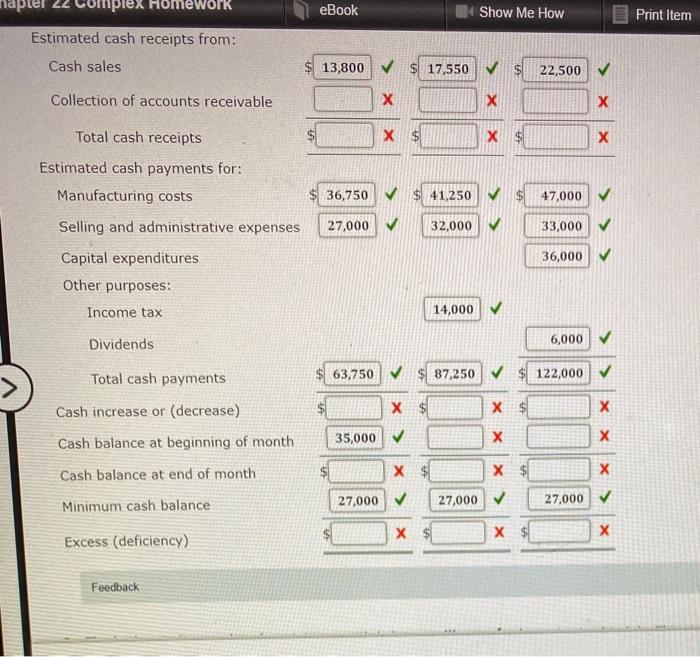

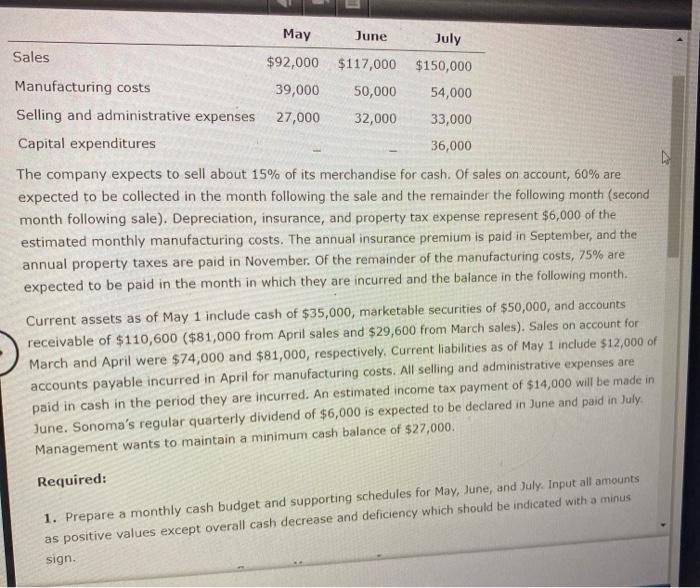

The control Sucoma Instructs you to wash dot for the third with the May Tan July 592,000 5117,000 $150,00 Marco 39,000 50,000 114.000 Selling and exposes 27.000 32.000 33,000 Cel centres the competition of mount, to be colested in the living the theme for the Derections, and property tax expense represene 1.000 the estate mothman The Mind me a roartcomes out over the render of the manufacture, are expected to be paid there ish they were and the one in the two month Cure Mayech 35.000, metable seties 50,001, nr receivable et $10.00 (0.00 on sale wd 820.00 hor March on our forced for 574,000 and 100, pely Care of May include $12,000 of accounts payable incurred in der for manufacturing and even put in the pred the wed. An estimated income tax payment of $14.000 mil he made Jun. Sonra orterid of Oplected to be in and and Wall Managerent wart tartanium til 27,000 Required 1. Perhe budget and sport White Mon, and you must be indekicy which should them Somewaresince Cash Budget For the Three Months Ending July 31 mely Ouck My Work Chuy Maps Chapter 22 Complex Homework LOCK Show Mew Prum 1. Prepare a conthly cal body and cons for May June July Automotivas para decrease and decency which should be indicate with Sonoma Housewares Inc Cash Budget For the Three Months Ending July 31 May July Estimated Care Cash sales 13,000 23.500 Collection of accounts receivable X Totalcarceos X Estimated the payments for Manufacturing costs 360 41.250 TOD 53000 Copend 1.00 Other purpo 1400D OD 610 67,25 132.000 x X Dividindo Total payment Cash increase or decreas) Cuthbeating the Cash bacate of month Minimum 35.00 X X 20 21.00 27.000 Ouck My Wome Check Woman July All werk saved Assignment Score: 60% complex Homework eBook Show Me How Print Item Estimated cash receipts from: Cash sales 13,800 V $ 17,550 22,500 Collection of accounts receivable Total cash receipts X $ 36,750 $ 41,250 47,000 Estimated cash payments for: Manufacturing costs Selling and administrative expenses Capital expenditures 27,000 32,000 33,000 36,000 Other purposes: Income tax 14,000 Dividends 6,000 Total cash payments 63,750 87,250 $ 122,000 Cash increase or (decrease) $ $ x x 35,000 > Cash balance at beginning of month Cash balance at end of month X $ X $ 27,000 Minimum cash balance 27,000 27,000 X $ X Excess (deficiency) Feedback May June July Sales $92,000 $117,000 $150,000 Manufacturing costs 39,000 50,000 54,000 Selling and administrative expenses 27,000 32,000 33,000 Capital expenditures 36,000 The company expects to sell about 15% of its merchandise for cash. Of sales on account, 60% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance, and property tax expense represent $6,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in September, and the annual property taxes are paid in November. Of the remainder of the manufacturing costs, 75% are expected to be paid in the month in which they are incurred and the balance in the following month Current assets as of May 1 include cash of $35,000, marketable securities of $50,000, and accounts receivable of $110,600 ($81,000 from April sales and $29,600 from March sales). Sales on account for March and April were $74,000 and $81,000, respectively. Current liabilities as of May 1 include $12,000 of accounts payable incurred in April for manufacturing costs. All selling and administrative expenses are paid in cash in the period they are incurred. An estimated income tax payment of $14,000 will be made in June. Sonoma's regular quarterly dividend of $6,000 is expected to be declared in June and paid in July Management wants to maintain a minimum cash balance of $27,000. Required: 1. Prepare a monthly cash budget and supporting schedules for May, June, and July. Input all amounts as positive values except overall cash decrease and deficiency which should be indicated with a minus sign