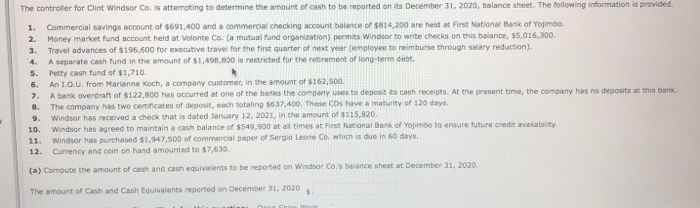

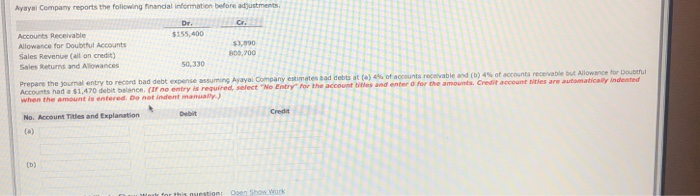

The controller for Clint Windsor Co. is attempting to determine the amount of cash to be reported on its December 31, 2020, balance sheet. The following information is provided. 1. Commercial savings account of $691.400 and a commercial checking account balance of $814,200 are held at First National Bank of Yojimbo 2. Money market fund account held at Volonte Co. (a mutual fund organization) permits Windsor to write checks on this balance, $5,016,300 3. Travel advances of $196,600 for executive travel for the first quarter of next year employee to reimburse through salary reduction) 4. A separate cash fund in the amount of $1,498.800 is restricted for the retirement of long-term debt 5. Petty cash fund of $1,710 6. An 1.0.0, from Marianne Koch, a company customer, in the amount of $162,500. 7. A bank overdraft of $122.800 has occurred at one of the banks the company uses to deposit cash receipts. At the present time, the company has no deposits at this bank, 8. The company has two certificates of deposit, each totaling $637,400. These CDs have a maturity of 120 days. 9. Windsor has received a check that is dated January 12, 2021, in the amount of $115,820 10. Windsor has agreed to maintain a cash balance of $549,900 at all times at First National Bank of Yojimbo to ensure future credit availability 11. Windsor has purchased $1,947,500 of commercial paper of Sergio Leone Co, which is due in 60 days. 12. Currency and coin on hand amounted to $7,630 (a) Compute the amount of cash and cash equivalents to be reported on Windsor Coi's balance sheet at December 31, 2020 The amount of Cash and Cash Equivalents reported on December 31, 2020 Ayayal Company reports the following financial information before adjustments, De $155,400 Accounts Receivable Allowance for Doubtful Accounts Sales Revenue Call on credit) Sales Returns and Allowances $3,990 800,700 50,330 ints receivable and (b) 45 of accounts receivable but Allowance for Doubtful amounts Credit account titles are automatically indented Prepare the journal entry to record bad debt expense assuming Ayayal Company estimates bad debts Accounts had a $1,470 debit balance. (I no entry is required, select "No Entry for the acco when the amount is entered. Do not indent manually.) No. Account Titles and Explanation (b)