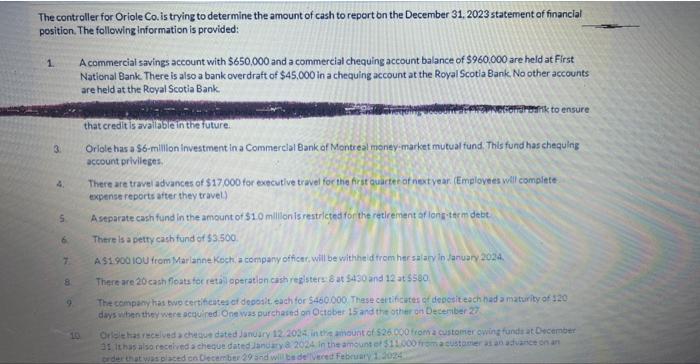

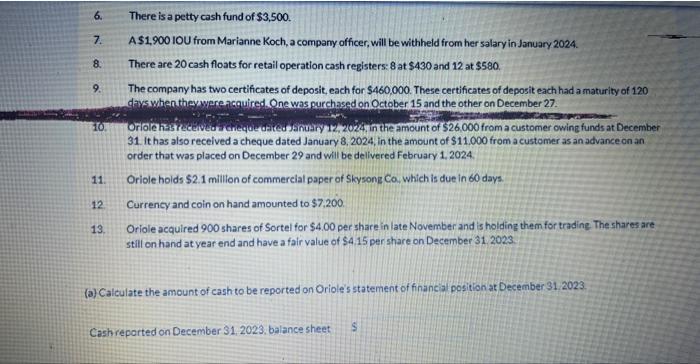

The controller for Oriole Co. is trying to determine the amount of cash to report on the December 31,2023 statement of financial position. The following information is provided: 1. A commercial savings account with $650,000 and a commercial chequing account balance of $960,000 are held at First National Bank. There is also a bank overdraft of $45,000 in a chequing account at the Royal Scotia Bank. No other accounts are held at the Royal Scotia Bank. that credit 15 avalitabe in the future. 3. Oriole has a \$6-million investment ina Commerclal Bank of Montreal meney-market mutual fund This fund has chequing account privileges. 4. There are travel advances of $17,000 for executlive travel for the firit auarter of next year. (Emplovees will compiete expense reports after they travel) 6. There is a petty cash fund of $3500. 7. A $1900 lOU from Marianne Koch, a company officer, will be withhe d trom hersal ary in danuary 2024 . 8. There are 20 cash fioats foc retali operatlon cish reaisters 6 at 5430 and 12 at 5580 9 The company has nwe certifeates of dooosit each for 5400,000 . These cettificites of desesiteach had a maturity of 120 days when ther wece acquired One was purchased on Qctober 15 and the other an becember 27 6. There is a petty cash fund of $3,500. 7. A $1,90010 U from Marianne Koch, a company officer, will be withheld from her salary in January 2024. 8. There are 20 cash floats for retail operation cash registers: 8 at $430 and 12 at $580. 9. The company has two certificates of deposit, each for $460,000. These certificates of deposit each had a maturity of 120 days when theywere anguired One was purchased on October 15 and the other on December 27. 10. Oriole hastreceived enieque daicedeinuary12, 2024, in the amount of $26,000 from a customer owing funds at December 31. It has also received a cheque dated January 8,2024 , in the amount of $11.000 from a customer as an advance on an order that was placed on December 29 and will be delivered February 1. 2024 11. Oriole hoids $2.1 million of commercial paper of Skysong Ca. which is due in 60 days. 12. Currency and coin on hand amounted to $7,200. 13. Oriole acquired 900 shares of Sortel for $4.00 per share in late November and is holding them for trading The shares are still on hand at year end and have a fair value of $4.15 per share on December 31.2023. (a) Calculate the amount of cash to be reported on Oriole's statement of financial position at December 31.2023. Cashreported on December 31, 2023, balance sheet $ The controller for Oriole Co. is trying to determine the amount of cash to report on the December 31,2023 statement of financial position. The following information is provided: 1. A commercial savings account with $650,000 and a commercial chequing account balance of $960,000 are held at First National Bank. There is also a bank overdraft of $45,000 in a chequing account at the Royal Scotia Bank. No other accounts are held at the Royal Scotia Bank. that credit 15 avalitabe in the future. 3. Oriole has a \$6-million investment ina Commerclal Bank of Montreal meney-market mutual fund This fund has chequing account privileges. 4. There are travel advances of $17,000 for executlive travel for the firit auarter of next year. (Emplovees will compiete expense reports after they travel) 6. There is a petty cash fund of $3500. 7. A $1900 lOU from Marianne Koch, a company officer, will be withhe d trom hersal ary in danuary 2024 . 8. There are 20 cash fioats foc retali operatlon cish reaisters 6 at 5430 and 12 at 5580 9 The company has nwe certifeates of dooosit each for 5400,000 . These cettificites of desesiteach had a maturity of 120 days when ther wece acquired One was purchased on Qctober 15 and the other an becember 27 6. There is a petty cash fund of $3,500. 7. A $1,90010 U from Marianne Koch, a company officer, will be withheld from her salary in January 2024. 8. There are 20 cash floats for retail operation cash registers: 8 at $430 and 12 at $580. 9. The company has two certificates of deposit, each for $460,000. These certificates of deposit each had a maturity of 120 days when theywere anguired One was purchased on October 15 and the other on December 27. 10. Oriole hastreceived enieque daicedeinuary12, 2024, in the amount of $26,000 from a customer owing funds at December 31. It has also received a cheque dated January 8,2024 , in the amount of $11.000 from a customer as an advance on an order that was placed on December 29 and will be delivered February 1. 2024 11. Oriole hoids $2.1 million of commercial paper of Skysong Ca. which is due in 60 days. 12. Currency and coin on hand amounted to $7,200. 13. Oriole acquired 900 shares of Sortel for $4.00 per share in late November and is holding them for trading The shares are still on hand at year end and have a fair value of $4.15 per share on December 31.2023. (a) Calculate the amount of cash to be reported on Oriole's statement of financial position at December 31.2023. Cashreported on December 31, 2023, balance sheet $