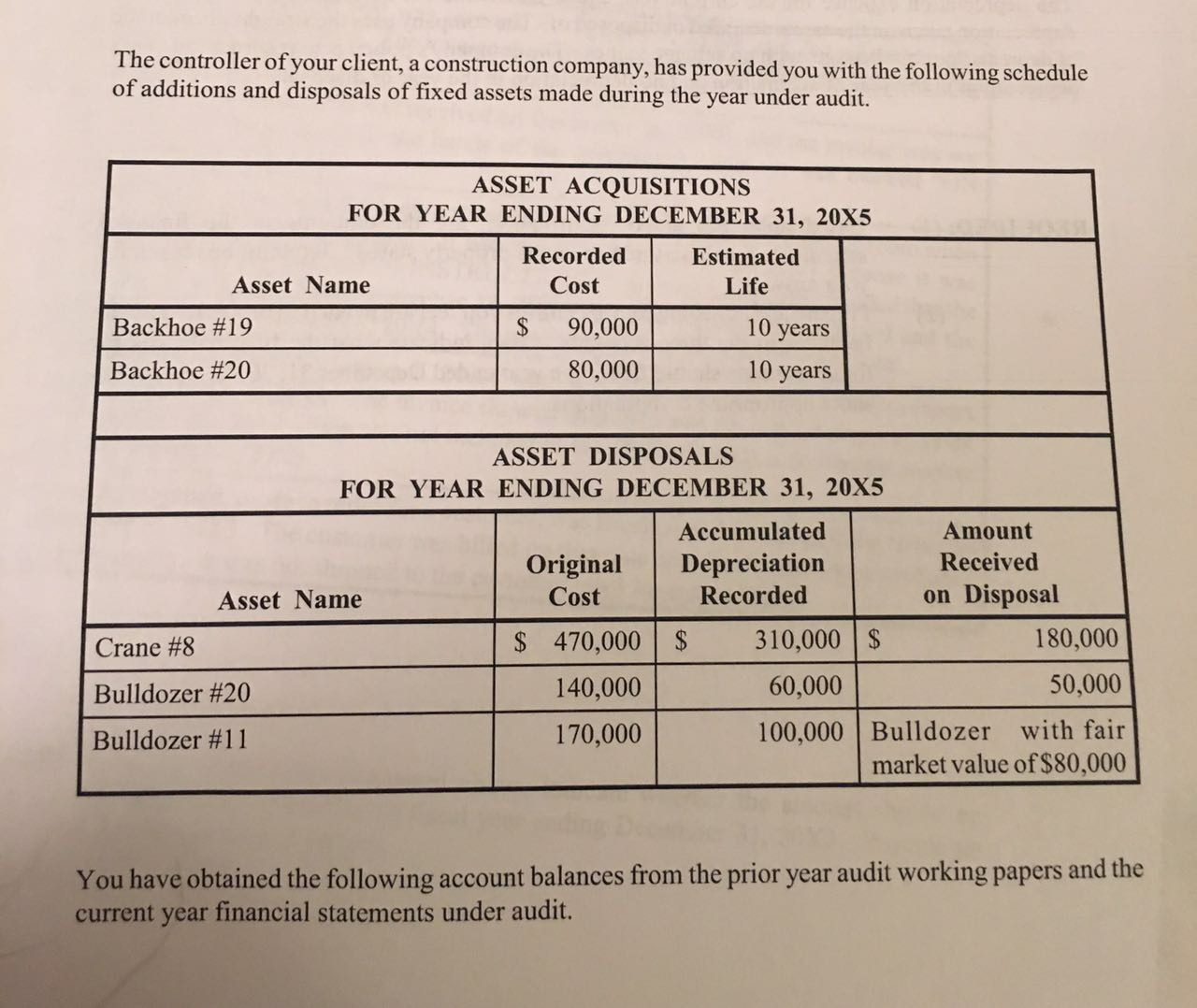

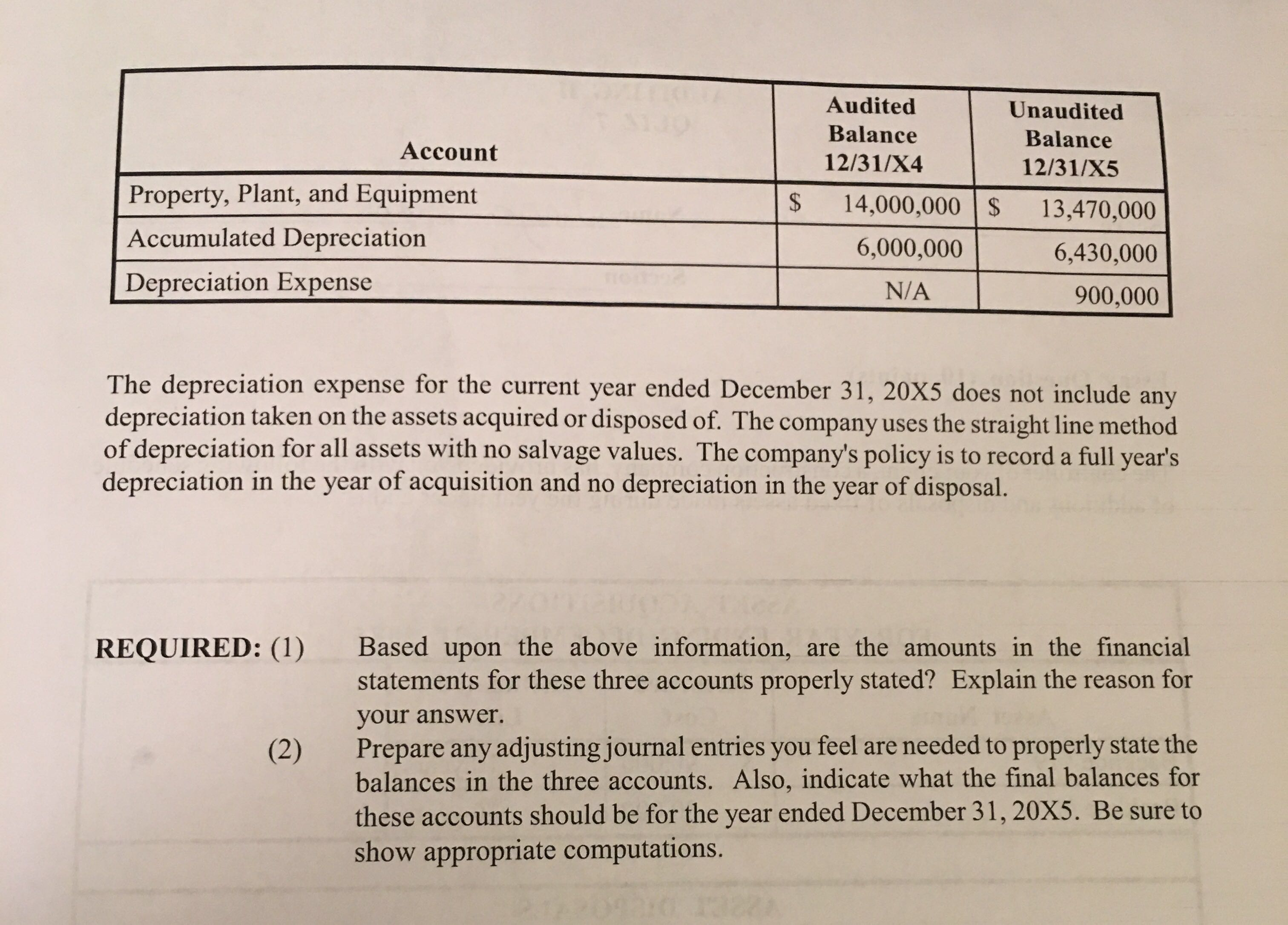

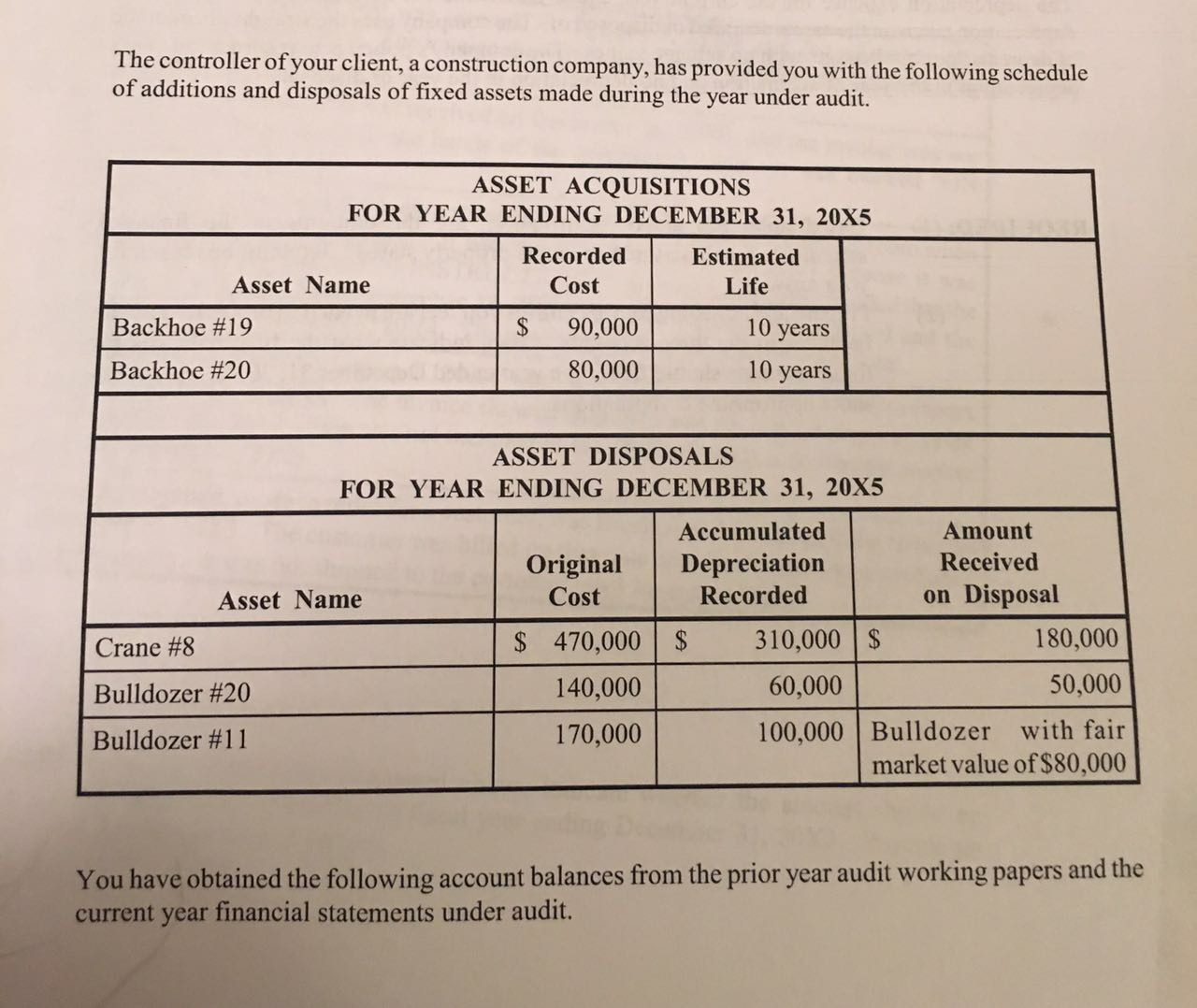

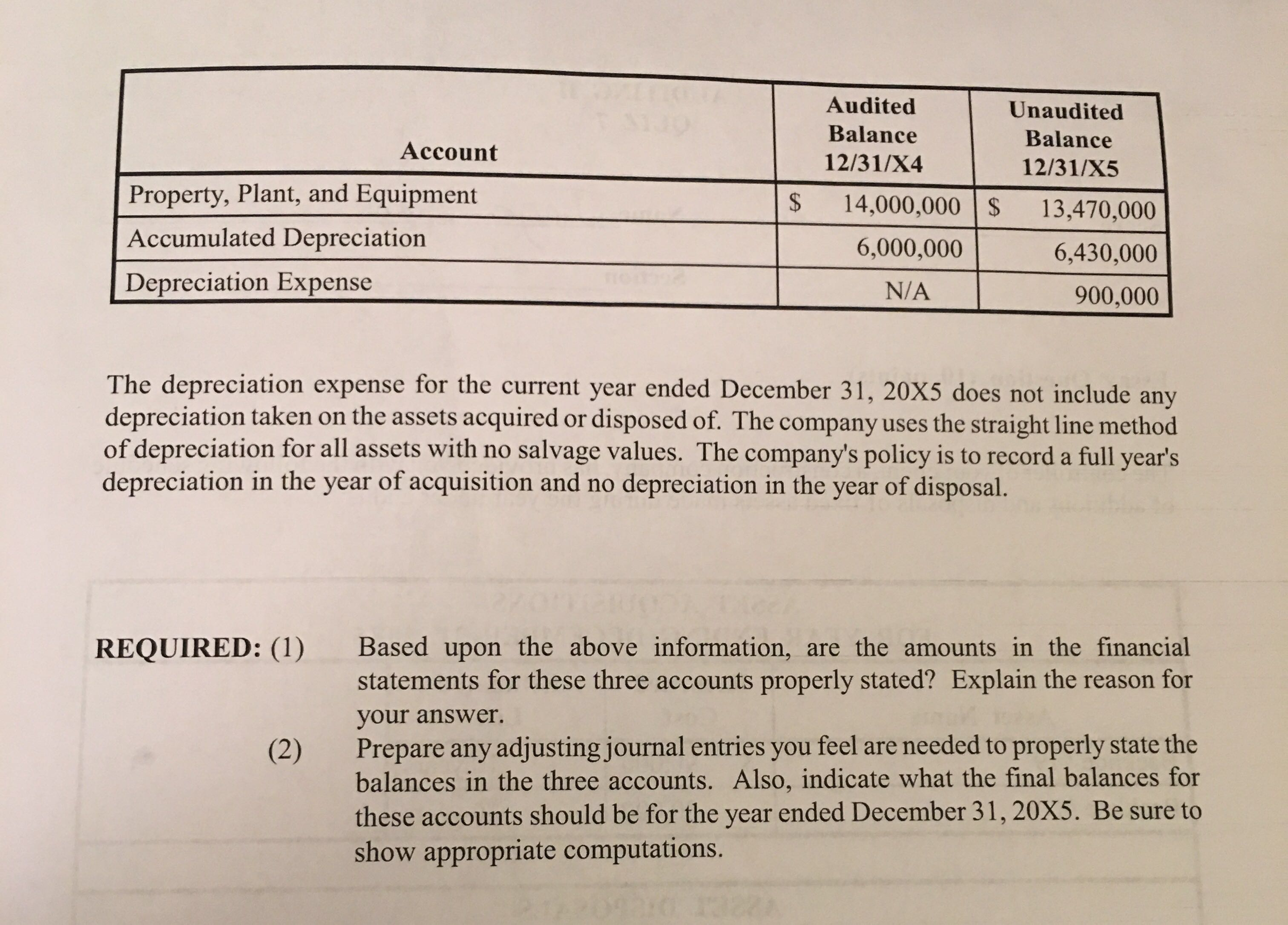

The controller of your client, a construction company, has provided you with the following schedule of additions and disposals of fixed assets made during the year under audit. You have obtained the following account balances from the prior year audit working papers and the current year financial statements under audit. The depreciation expense for the current year ended December 31, 20X5 does not include any depreciation taken on the assets acquired or disposed of. The company uses the straight line method of depreciation for all assets with no salvage values. The company's policy is to record a full year's depreciation in the year of acquisition and no depreciation in the year of disposal. REQUIRED: Based upon the above information, are the amounts in the financial statements for these three accounts properly stated? Explain the reason for your answer. Prepare any adjusting journal entries you feel are needed to properly state the balances in the three accounts. Also, indicate what the final balances for these accounts should be for the year ended December 31,20X5. Be sure to show appropriate computations. The controller of your client, a construction company, has provided you with the following schedule of additions and disposals of fixed assets made during the year under audit. You have obtained the following account balances from the prior year audit working papers and the current year financial statements under audit. The depreciation expense for the current year ended December 31, 20X5 does not include any depreciation taken on the assets acquired or disposed of. The company uses the straight line method of depreciation for all assets with no salvage values. The company's policy is to record a full year's depreciation in the year of acquisition and no depreciation in the year of disposal. REQUIRED: Based upon the above information, are the amounts in the financial statements for these three accounts properly stated? Explain the reason for your answer. Prepare any adjusting journal entries you feel are needed to properly state the balances in the three accounts. Also, indicate what the final balances for these accounts should be for the year ended December 31,20X5. Be sure to show appropriate computations