Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The controllers of Splish Brothers, Inc. and Cover Corp. both ask you whether their companies can reclassify short-term obligations as long-term. Here are the

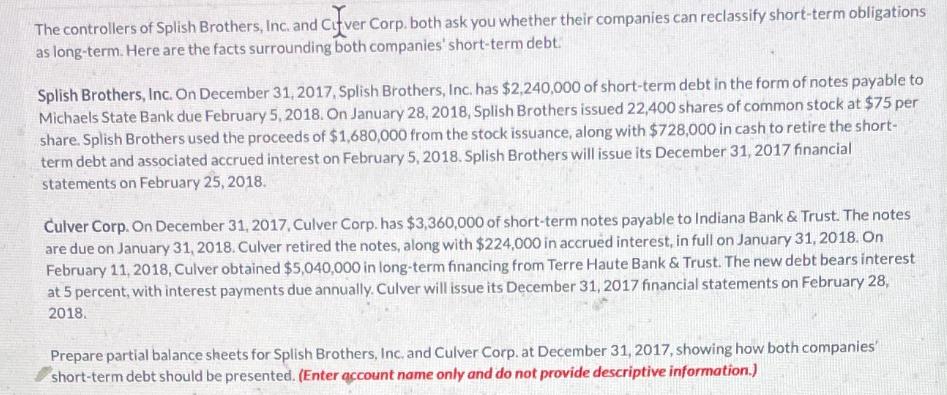

The controllers of Splish Brothers, Inc. and Cover Corp. both ask you whether their companies can reclassify short-term obligations as long-term. Here are the facts surrounding both companies' short-term debt. Splish Brothers, Inc. On December 31, 2017, Splish Brothers, Inc. has $2,240,000 of short-term debt in the form of notes payable to Michaels State Bank due February 5, 2018. On January 28, 2018, Splish Brothers issued 22,400 shares of common stock at $75 per share. Splish Brothers used the proceeds of $1,680,000 from the stock issuance, along with $728,000 in cash to retire the short- term debt and associated accrued interest on February 5, 2018. Splish Brothers will issue its December 31, 2017 financial statements on February 25, 2018. Culver Corp. On December 31, 2017, Culver Corp. has $3,360,000 of short-term notes payable to Indiana Bank & Trust. The notes are due on January 31, 2018. Culver retired the notes, along with $224,000 in accrued interest, in full on January 31, 2018. On February 11, 2018, Culver obtained $5,040,000 in long-term financing from Terre Haute Bank & Trust. The new debt bears interest at 5 percent, with interest payments due annually. Culver will issue its December 31, 2017 financial statements on February 28, 2018. Prepare partial balance sheets for Splish Brothers, Inc. and Culver Corp. at December 31, 2017, showing how both companies' short-term debt should be presented. (Enter account name only and do not provide descriptive information.)

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The image you provided contains detailed financial information about two entities Splish Brothers In...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started