Answered step by step

Verified Expert Solution

Question

1 Approved Answer

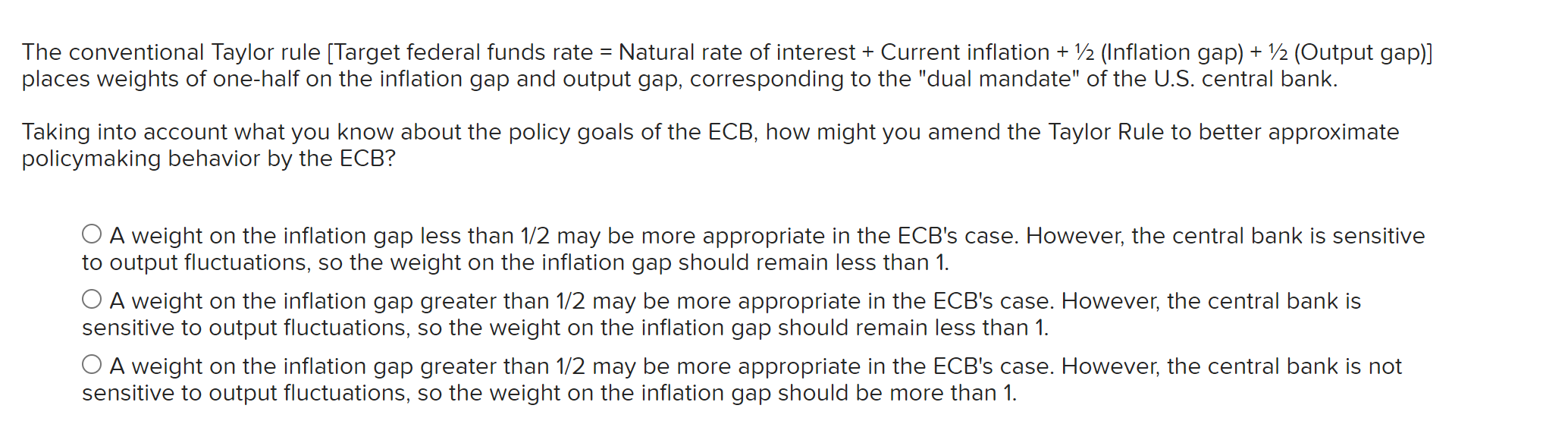

The conventional Taylor rule [Target federal funds rate = Natural rate of interest + Current inflation +1/2( (Inflation gap) +1/2( Output gap)] olaces weights of

The conventional Taylor rule [Target federal funds rate = Natural rate of interest + Current inflation +1/2( (Inflation gap) +1/2( Output gap)] olaces weights of one-half on the inflation gap and output gap, corresponding to the "dual mandate" of the U.S. central bank. Taking into account what you know about the policy goals of the ECB, how might you amend the Taylor Rule to better approximate policymaking behavior by the ECB? A weight on the inflation gap less than 1/2 may be more appropriate in the ECB's case. However, the central bank is sensitive to output fluctuations, so the weight on the inflation gap should remain less than 1 . A weight on the inflation gap greater than 1/2 may be more appropriate in the ECB's case. However, the central bank is sensitive to output fluctuations, so the weight on the inflation gap should remain less than 1 . A weight on the inflation gap greater than 1/2 may be more appropriate in the ECB's case. However, the central bank is not sensitive to output fluctuations, so the weight on the inflation gap should be more than 1

The conventional Taylor rule [Target federal funds rate = Natural rate of interest + Current inflation +1/2( (Inflation gap) +1/2( Output gap)] olaces weights of one-half on the inflation gap and output gap, corresponding to the "dual mandate" of the U.S. central bank. Taking into account what you know about the policy goals of the ECB, how might you amend the Taylor Rule to better approximate policymaking behavior by the ECB? A weight on the inflation gap less than 1/2 may be more appropriate in the ECB's case. However, the central bank is sensitive to output fluctuations, so the weight on the inflation gap should remain less than 1 . A weight on the inflation gap greater than 1/2 may be more appropriate in the ECB's case. However, the central bank is sensitive to output fluctuations, so the weight on the inflation gap should remain less than 1 . A weight on the inflation gap greater than 1/2 may be more appropriate in the ECB's case. However, the central bank is not sensitive to output fluctuations, so the weight on the inflation gap should be more than 1 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started