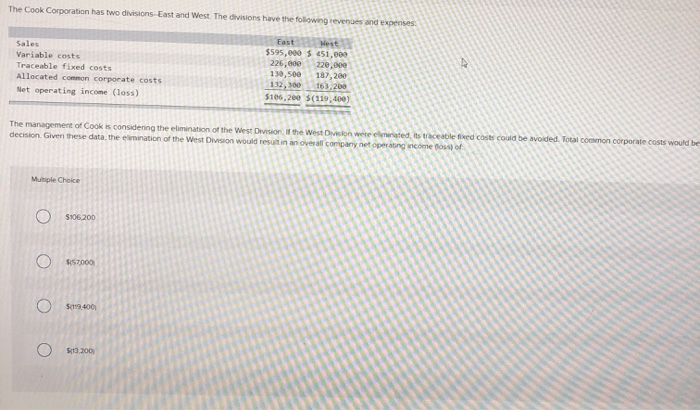

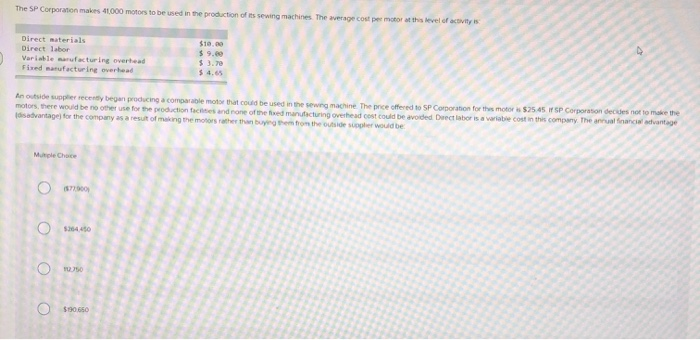

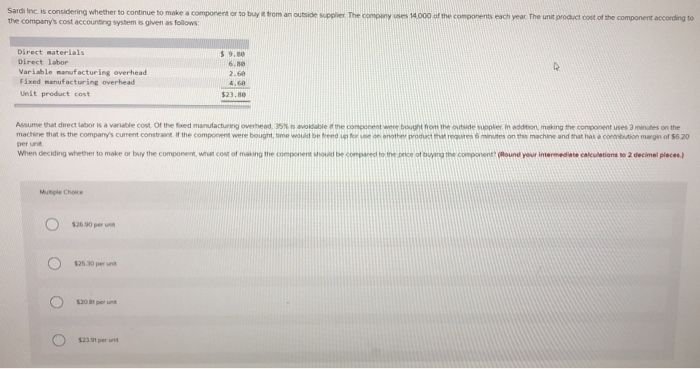

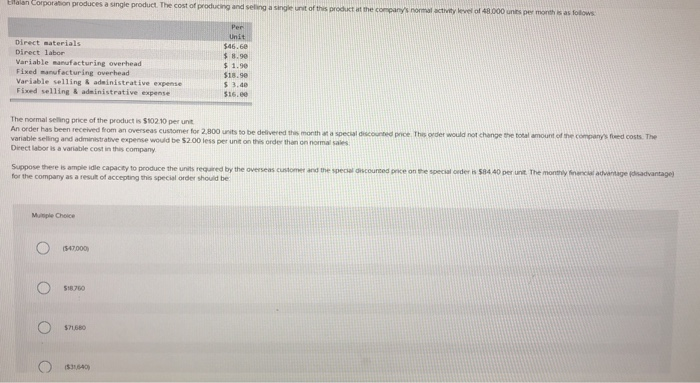

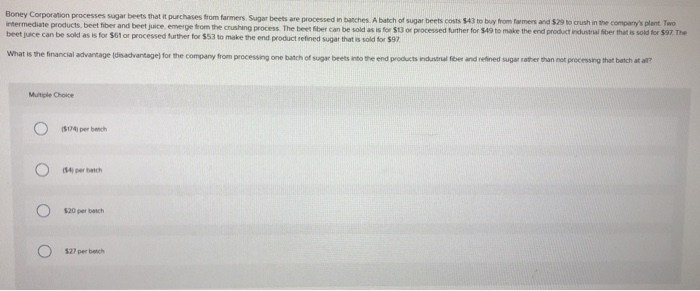

The Cook Corporation has two divisions-East and West. The divisions have the folowing revenues and expenses West $595,ee0 451,000 226,e00 130,500 East Sales Variable costs 220,000 187,200 163,200 $106,200 $(119,400) Traceable fixed costs Allocated common corporate costs 132,300 Net operating income (loss) The management of Cook is considenng the elimination of the West Division If the West Divislon were elimiriated, its traceable foxed costs could be avoided. Total coemon corporate costs would be decision. Given these data, the eimination of the West Division would resutin an overall company net operating income Boss) of Muhiple Choice $106 200 SI57000 S19400 Si13,200 O OOO The SP Corporation makes 41,000 motors to be used in the production of its sewing machines The average cost per motor at this level ef activity is Direct materials Direct labor Variable naufacturing overhead Fised manufacturing overhead $10.00 9.60 $3.7e $ 4.65 An outside supplier recently began producing a comparable motor that could be used in the sewng machine The prce offered to SP Corporation for thes motor is $25.45 if SP Corporasion decides not to make the motors, there would be no other use for the production factes and none of the fxed manufacturing overhead cost could be avoded Deect labor is a variable cost in this company The annual financial advantage (dsadvantage) for the company as a result of making the motors rather than buying them from the outside suplher would be Mutple Choce 87100) $264 450 50 $190650 Eilalan Corporaion produces single product. The cost of producing and seling a single unit of this produT at the company's normal actvity level of 48.000 units per month is as follows Per Unit $46.6e S8.90 $ 1.90 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable se1ling & adeinistrative expense Fixed selling & adeinistrative expense $18.90 $3.40 $16.00 The normal selling price of the product is $102.10 per unt An order has been received from an overseas customer for 2.800 units to be delivered this month at a special discounted pice Ths order would not change the total amount.of the company's feed costs. The variable selling and administrative expense would be $2.00 less per unit on this order than on normal sales Direct labor is a variable cost in this company Suppose there is ample idle capacty to produce the units required by the overseas customer and the special dscourted price on the special oeder is S8440 per unit The monthly finencial advantage (dnadvantage) for the company as a result of accepting this special order should be Mutiple Choice ($47000 S18760 $71,680 ($31640 Boney Corporation processes sugar beets that it purchases from farmers. Sugar beets are processed in banches. A batch of sugar beets costs $43 to buy from farmers and $29 to crush in the company's plant. Two intermediate products, beet fiber and beet juice, emerge from the crushing process The beet fiber can be sold as is for $13 or processed further for $49 to make the end product industrial Sber that is sold for $97 The beet juice can be sold as is for $61 or processed further for $53 to make the end product refined sugar that is sold for $97 What is the financial advantage (disacvantage) for the company from processing one batch of sugar beets into the end products industrial fiber and refined sugar rather than not processing that batch at al? Mutiple Choice ($174) per bench (54 per batch $20 per batch $27 per betch