Question

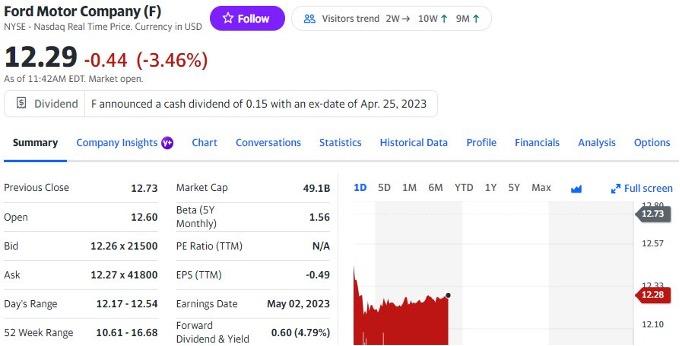

The cooked-up Spread Trade. You are bullish on Ford motor company (F). You are bullish on F, and want to take a position. You think

The cooked-up Spread Trade. You are bullish on Ford motor company (F). You are bullish on F, and want to take a position. You think that today provides an opportunity as they have taken a hit on their price. You feel that the true intrinsic value of the firm is $15 a share. You decide that the December calls giving you about eight months of exposure is optimal, and you have the data on the calls below. You also feel that the maximum value that the firm could have under the best circumstance is $17 a share.

Your first spread trade idea. You decide you want to decide to purchase (long) a $12 call option. To decrease the cost, you decide you want to sell (short) ten $17 calls. If you made this trade, what is the:

a) Graph the trade

b) Maximum profit

c) Maximum loss

F announced a cash dividend of 0.15 with an ex-date of Apr. 25,2023 Calls for December 15,2023Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started