Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Cornel company manager is considering investing in 2 projects. Project X is an investment of $ 75.000 to replace its refrigeration equipment works but

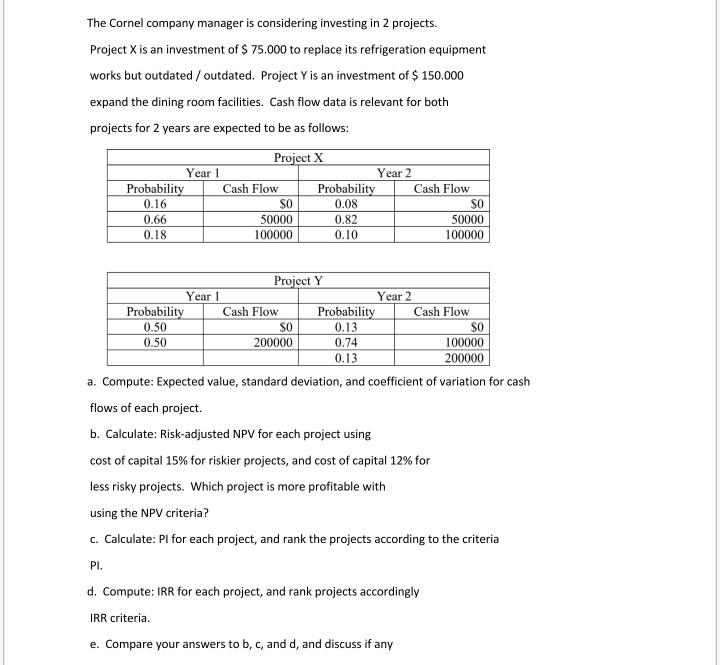

The Cornel company manager is considering investing in 2 projects. Project X is an investment of $ 75.000 to replace its refrigeration equipment works but outdated / outdated. Project is an investment of $ 150.000 expand the dining room facilities. Cash flow data is relevant for both projects for 2 years are expected to be as follows: Project X Year 1 Year 2 Probability Cash Flow Probability Cash Flow 0.16 SO 0.08 SO 0.66 50000 0.82 50000 0.18 100000 0.10 100000 Project Y Year 1 Year 2 Probability Cash Flow Probability Cash Flow 0.50 SO 0.13 SO 0.50 200000 0.74 100000 0.13 200000 a. Compute: Expected value, standard deviation, and coefficient of variation for cash flows of each project. b. Calculate: Risk-adjusted NPV for each project using cost of capital 15% for riskier projects, and cost of capital 12% for less risky projects. Which project is more profitable with using the NPV criteria? C. Calculate: Pl for each project, and rank the projects according to the criteria PI. d. Compute: IRR for each project, and rank projects accordingly IRR criteria. e. Compare your answers to b, c, and d, and discuss if any The Cornel company manager is considering investing in 2 projects. Project X is an investment of $ 75.000 to replace its refrigeration equipment works but outdated / outdated. Project is an investment of $ 150.000 expand the dining room facilities. Cash flow data is relevant for both projects for 2 years are expected to be as follows: Project X Year 1 Year 2 Probability Cash Flow Probability Cash Flow 0.16 SO 0.08 SO 0.66 50000 0.82 50000 0.18 100000 0.10 100000 Project Y Year 1 Year 2 Probability Cash Flow Probability Cash Flow 0.50 SO 0.13 SO 0.50 200000 0.74 100000 0.13 200000 a. Compute: Expected value, standard deviation, and coefficient of variation for cash flows of each project. b. Calculate: Risk-adjusted NPV for each project using cost of capital 15% for riskier projects, and cost of capital 12% for less risky projects. Which project is more profitable with using the NPV criteria? C. Calculate: Pl for each project, and rank the projects according to the criteria PI. d. Compute: IRR for each project, and rank projects accordingly IRR criteria. e. Compare your answers to b, c, and d, and discuss if any

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started