Answered step by step

Verified Expert Solution

Question

1 Approved Answer

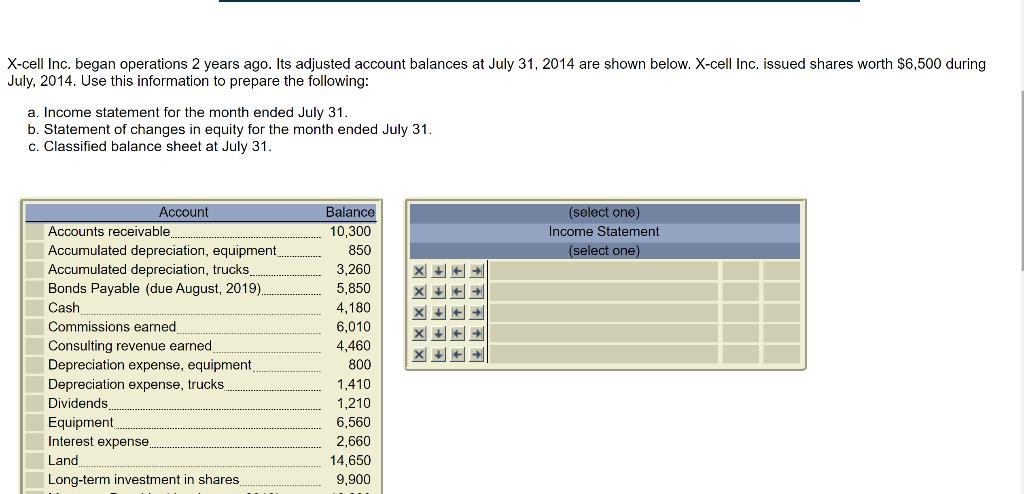

X-cell Inc. began operations 2 years ago. Its adjusted account balances at July 31, 2014 are shown below. X-cell Inc. issued shares worth $6,500

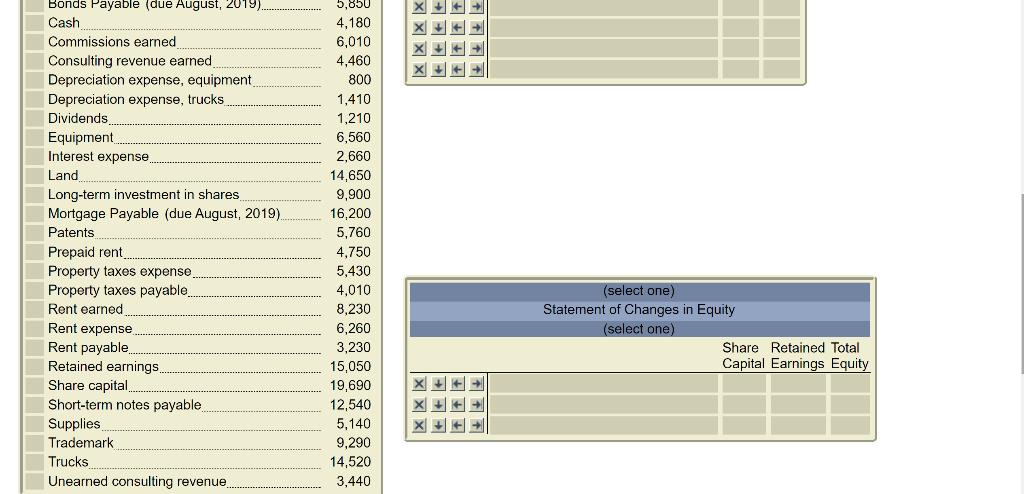

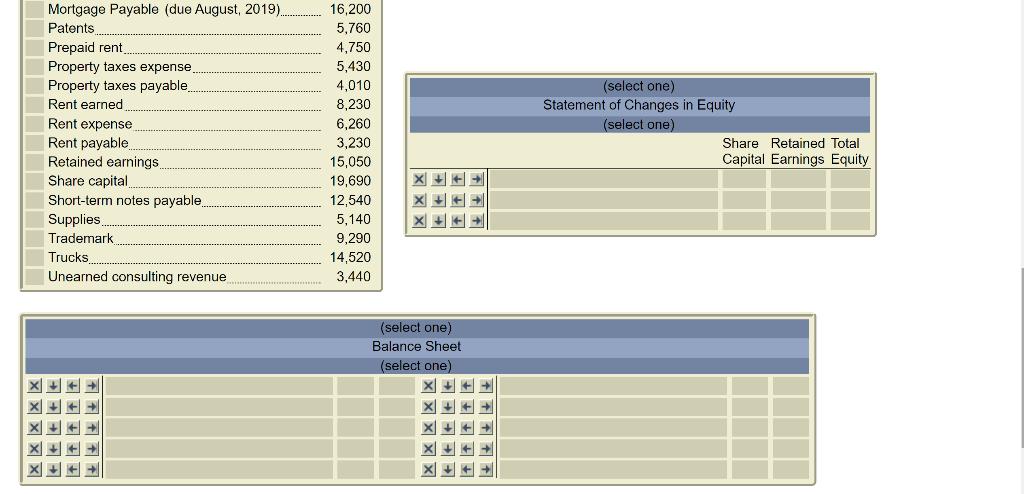

X-cell Inc. began operations 2 years ago. Its adjusted account balances at July 31, 2014 are shown below. X-cell Inc. issued shares worth $6,500 during July, 2014. Use this information to prepare the following: a. Income statement for the month ended July 31. b. Statement of changes in equity for the month ended July 31. c. Classified balance sheet at July 31. Account Accounts receivable Accumulated depreciation, equipment Accumulated depreciation, trucks. Bonds Payable (due August, 2019). Cash Commissions earned Consulting revenue earned, Depreciation expense, equipment, Depreciation expense, trucks Dividends, Equipment Interest expense Land Long-term investment in shares Balance 10,300 850 3,260 5,850 4,180 6,010 4,460 800 1,410 1,210 6,560 2,660 14,650 9,900 X X X X X FE (select one) Income Statement (select one) Bonds Payable (due August, 2019). Cash Commissions earned Consulting revenue earned Depreciation expense, equipment Depreciation expense, trucks Dividends Equipment, Interest expense Land Long-term investment in shares Mortgage Payable (due August, 2019). Patents Prepaid rent Property taxes expense.. Property taxes payable. Rent earned Rent expense Rent payable... Retained earnings. Share capital Short-term notes payable. Supplies Trademark Trucks Unearned consulting revenue, 5,850 4,180 6,010 4,460 800 1,410 1,210 6,560 2,660 14,650 9,900 16,200 5,760 4,750 5,430 4,010 8,230 6,260 3,230 15,050 19,690 12,540 5,140 9,290 14,520 3,440 X X X X 44 (select one) Statement of Changes in Equity (select one) Share Retained Total Capital Earnings Equity Mortgage Payable (due August, 2019). Patents Prepaid rent Property taxes expense Property taxes payable. Rent earned Rent expense Rent payable Retained earnings, Share capital Short-term notes payable Supplies Trademark Trucks Unearned consulting revenue 16,200 5,760 4,750 5,430 4,010 8,230 6,260 3,230 15,050 19,690 12,540 5,140 9.290 14,520 3,440 (select one) Balance Sheet (select one) X + (select one) Statement of Changes in Equity (select one) Share Retained Total Capital Earnings Equity

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started