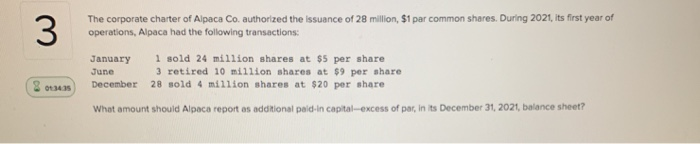

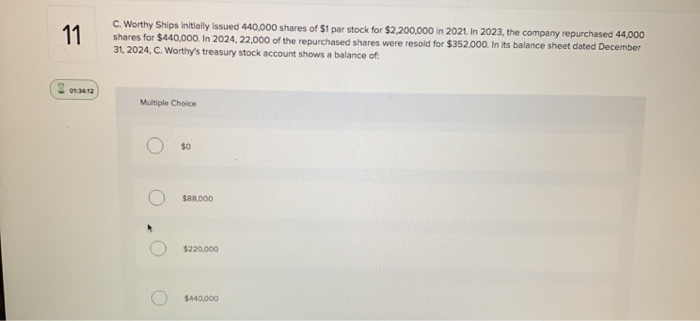

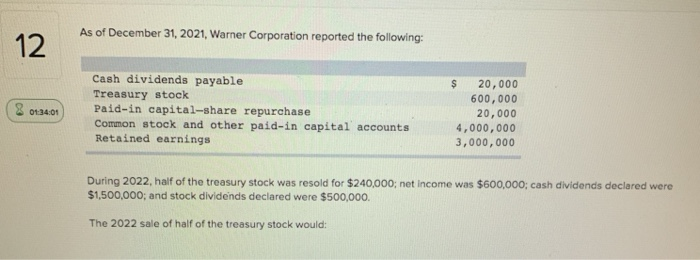

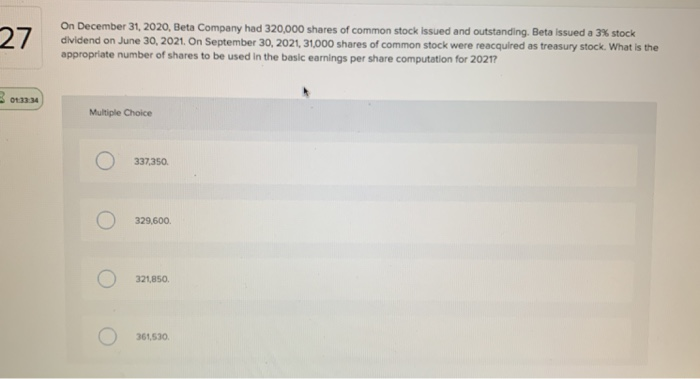

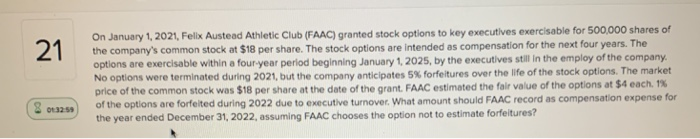

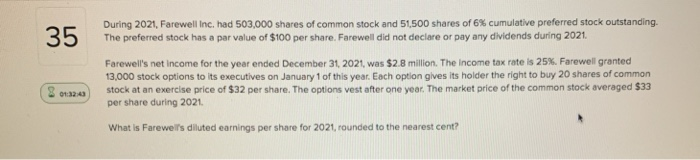

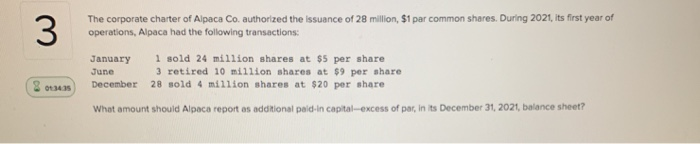

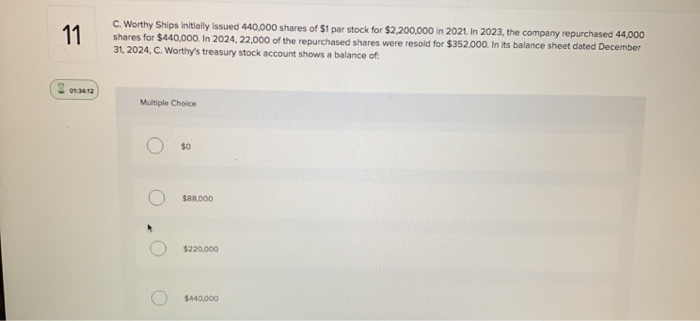

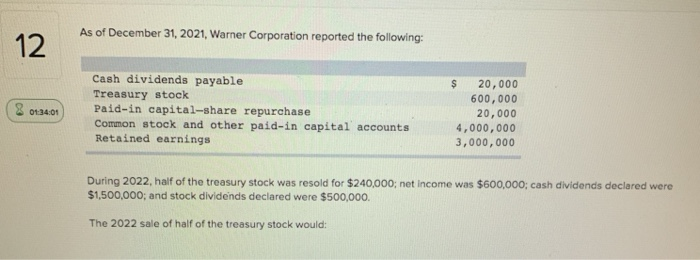

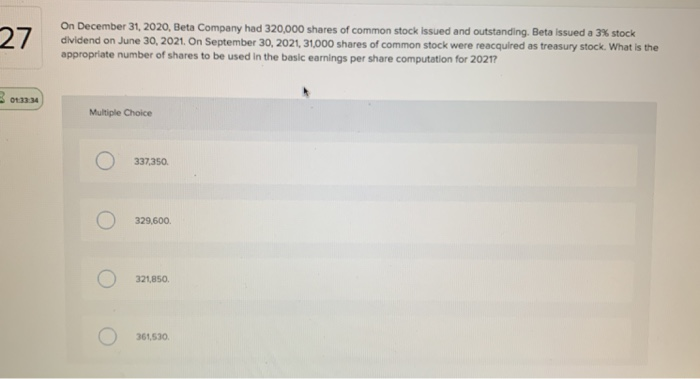

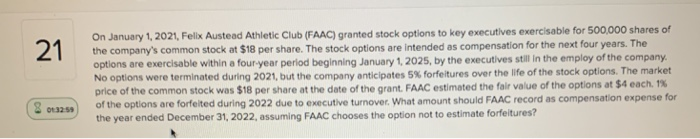

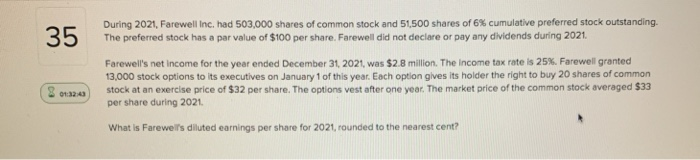

The corporate charter of Alpaca Co. authorized the issuance of 28 million, $1 par common shares. During 2021, its first year of operations, Alpaca had the following transactions: January June December 1 sold 24 million shares at $5 per share 3 retired 10 million shares at $9 per share 28 sold 4 million shares at $20 per share 8 13435 What amount should Alpaca report as additional paid in capital-excess of par, in its December 31, 2021, balance sheet? C. Worthy Ships Initially issued 440,000 shares of $1 par stock for $2,200,000 in 2021. In 2023, the company repurchased 44,000 shares for $440,000. In 2024, 22,000 of the repurchased shares were resold for $352,000. In its balance sheet dated December 31, 2024. C. Worthy's treasury stock account shows a balance of: Multiple Choice Oso C) 588.000 0 0.0 $220,000 $440,000 0 As of December 31, 2021, Warner Corporation reported the following: 12 (8 013401 Cash dividends payable Treasury stock Paid-in capital-share repurchase Common stock and other paid-in capital accounts Retained earnings $ 20,000 600,000 20,000 4,000,000 3,000,000 During 2022, half of the treasury stock was resold for $240,000; net income was $600,000; cash dividends declared were $1,500,000; and stock dividends declared were $500,000. The 2022 sale of half of the treasury stock would: 27 On December 31, 2020, Beta Company had 320,000 shares of common stock issued and outstanding. Beta issued a 3% stock dividend on June 30, 2021. On September 30, 2021, 31,000 shares of common stock were reacquired as treasury stock. What is the appropriate number of shares to be used in the basic earnings per share computation for 2021? - OnA Multiple Choice 373so. 121,850. 21 On January 1, 2021, Felix Austead Athletic Club (FAAC) granted stock options to key executives exercisable for 500,000 shares of the company's common stock at $18 per share. The stock options are intended as compensation for the next four years. The options are exercisable within a four year period beginning January 1, 2025, by the executives still in the employ of the company. No options were terminated during 2021, but the company anticipates 5% forfeitures over the life of the stock options. The market price of the common stock was $18 per share at the date of the grant. FAAC estimated the fair value of the options at $4 each. 1% of the options are forfeited during 2022 due to executive turnover. What amount should FAAC record as compensation expense for the year ended December 31, 2022, assuming FAAC chooses the option not to estimate forfeitures? (9 0321 35 During 2021, Farewell Inc. had 503,000 shares of common stock and 51,500 shares of 6% cumulative preferred stock outstanding. The preferred stock has a par value of $100 per share. Farewell did not declare or pay any dividends during 2021. Farewell's net income for the year ended December 31, 2021, was $2.8 million. The income tax rate is 25%. Farewell granted 13,000 stock options to its executives on January 1 of this year. Each option gives its holder the right to buy 20 shares of common stock at an exercise price of $32 per share. The options vest after one year. The market price of the common stock averaged $33 per share during 2021 What is Farewell's diluted earnings per share for 2021, rounded to the nearest cent