Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Corporate Tax rate is 21% P16: Facts: ABC's tax accounting methods and GAAP accounting methods are the same and there are no permanent differences

The Corporate Tax rate is 21%

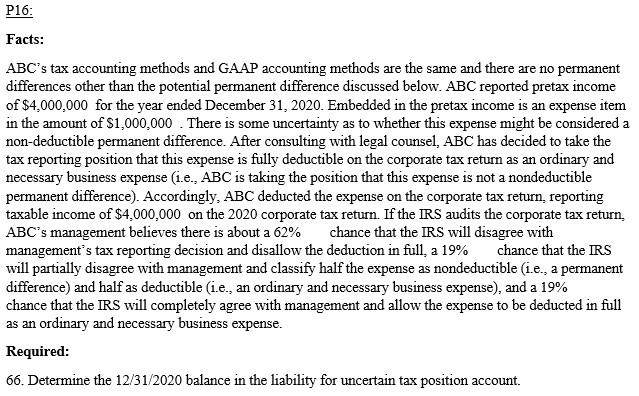

P16: Facts: ABC's tax accounting methods and GAAP accounting methods are the same and there are no permanent differences other than the potential permanent difference discussed below. ABC reported pretax income of $4,000,000 for the year ended December 31, 2020. Embedded in the pretax income is an expense item in the amount of $1,000,000. There is some uncertainty as to whether this expense might be considered a non-deductible permanent difference. After consulting with legal counsel, ABC has decided to take the tax reporting position that this expense is fully deductible on the corporate tax return as an ordinary and necessary business expense (i.e., ABC is taking the position that this expense is not a nondeductible permanent difference). Accordingly, ABC deducted the expense on the corporate tax return, reporting taxable income of $4,000,000 on the 2020 corporate tax return. If the IRS audits the corporate tax return. ABC's management believes there is about a 62% chance that the IRS will disagree with management's tax reporting decision and disallow the deduction in full, a 19% chance that the IRS will partially disagree with management and classify half the expense as nondeductible (i.e., a permanent difference) and half as deductible (i.e., an ordinary and necessary business expense), and a 19% chance that the IRS will completely agree with management and allow the expense to be deducted in full as an ordinary and necessary business expense. Required: 66. Determine the 12/31/2020 balance in the liability for uncertain tax position account. P16: Facts: ABC's tax accounting methods and GAAP accounting methods are the same and there are no permanent differences other than the potential permanent difference discussed below. ABC reported pretax income of $4,000,000 for the year ended December 31, 2020. Embedded in the pretax income is an expense item in the amount of $1,000,000. There is some uncertainty as to whether this expense might be considered a non-deductible permanent difference. After consulting with legal counsel, ABC has decided to take the tax reporting position that this expense is fully deductible on the corporate tax return as an ordinary and necessary business expense (i.e., ABC is taking the position that this expense is not a nondeductible permanent difference). Accordingly, ABC deducted the expense on the corporate tax return, reporting taxable income of $4,000,000 on the 2020 corporate tax return. If the IRS audits the corporate tax return. ABC's management believes there is about a 62% chance that the IRS will disagree with management's tax reporting decision and disallow the deduction in full, a 19% chance that the IRS will partially disagree with management and classify half the expense as nondeductible (i.e., a permanent difference) and half as deductible (i.e., an ordinary and necessary business expense), and a 19% chance that the IRS will completely agree with management and allow the expense to be deducted in full as an ordinary and necessary business expense. Required: 66. Determine the 12/31/2020 balance in the liability for uncertain tax position accountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started