The correct answer has been given, please provide the process.

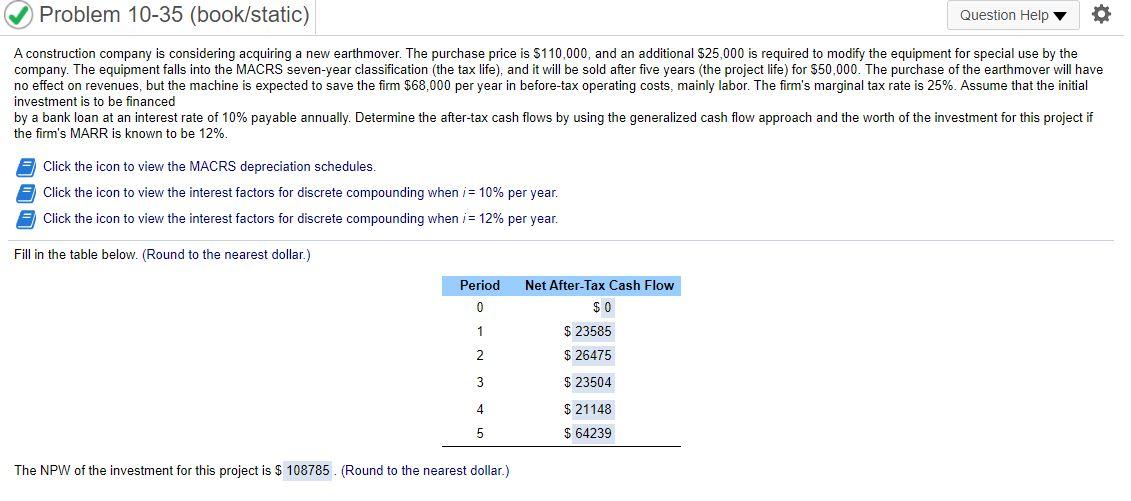

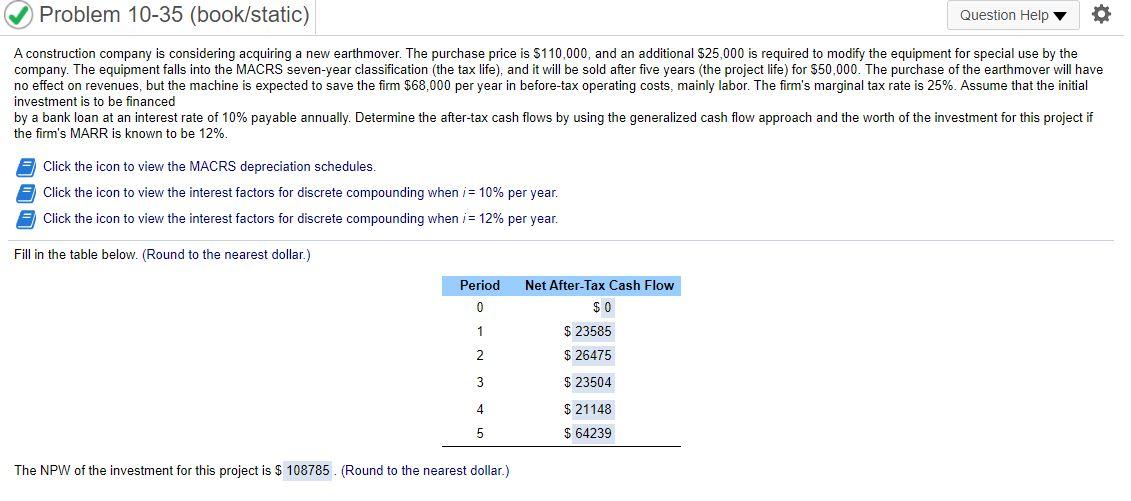

Problem 10-35 (book/static) Question Help A construction company is considering acquiring a new earthmover. The purchase price is $110,000, and an additional $25,000 is required to modify the equipment for special use by the company. The equipment falls into the MACRS seven-year classification (the tax life), and it will be sold after five years (the project life) for $50,000. The purchase of the earthmover will have no effect on revenues, but the machine is expected to save the firm $68,000 per year in before-tax operating costs, mainly labor. The firm's marginal tax rate is 25%. Assume that the initial investment is to be financed by a bank loan at an interest rate of 10% payable annually. Determine the after-tax cash flows by using the generalized cash flow approach and the worth of the investment for this project if the firm's MARR is known to be 12%. Click the icon to view the MACRS depreciation schedules. Click the icon to view the interest factors for discrete compounding when i = 10% per year. Click the icon to view the interest factors for discrete compounding when i = 12% per year. Fill in the table below. (Round to the nearest dollar.) Period Net After-Tax Cash Flow $0 0 1 $ 23585 $ 26475 2 3 $ 23504 4 5 $ 21148 $ 64239 The NPW of the investment for this project is $ 108785. (Round to the nearest dollar.) 3 10 15 20 Class Depreciation rate Year n 200% 200% 200% 200% 150% 150% 1 2 3 33.33 44.45 14.81 7.41 20.00 32.00 19.20 11.52 11.52 5.76 14.29 24.49 17.49 12.49 5.00 9.50 8.55 3.750 7.219 6.677 6.177 4 7.70 5 6 8.93 8.92 8.93 4.46 10.00 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 7 8 9 10 11 12 13 14 15 16 17 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 Problem 10-35 (book/static) Question Help A construction company is considering acquiring a new earthmover. The purchase price is $110,000, and an additional $25,000 is required to modify the equipment for special use by the company. The equipment falls into the MACRS seven-year classification (the tax life), and it will be sold after five years (the project life) for $50,000. The purchase of the earthmover will have no effect on revenues, but the machine is expected to save the firm $68,000 per year in before-tax operating costs, mainly labor. The firm's marginal tax rate is 25%. Assume that the initial investment is to be financed by a bank loan at an interest rate of 10% payable annually. Determine the after-tax cash flows by using the generalized cash flow approach and the worth of the investment for this project if the firm's MARR is known to be 12%. Click the icon to view the MACRS depreciation schedules. Click the icon to view the interest factors for discrete compounding when i = 10% per year. Click the icon to view the interest factors for discrete compounding when i = 12% per year. Fill in the table below. (Round to the nearest dollar.) Period Net After-Tax Cash Flow $0 0 1 $ 23585 $ 26475 2 3 $ 23504 4 5 $ 21148 $ 64239 The NPW of the investment for this project is $ 108785. (Round to the nearest dollar.) 3 10 15 20 Class Depreciation rate Year n 200% 200% 200% 200% 150% 150% 1 2 3 33.33 44.45 14.81 7.41 20.00 32.00 19.20 11.52 11.52 5.76 14.29 24.49 17.49 12.49 5.00 9.50 8.55 3.750 7.219 6.677 6.177 4 7.70 5 6 8.93 8.92 8.93 4.46 10.00 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 7 8 9 10 11 12 13 14 15 16 17 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462