Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the correct answer to the question is posted! please show me the correct steps to get to the correct answer. please make sure you show

the correct answer to the question is posted! please show me the correct steps to get to the correct answer. please make sure you show exactly how you're getting your calculation numbers

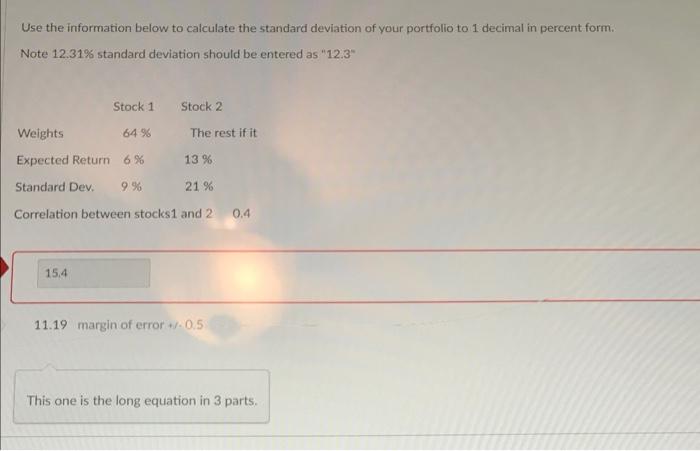

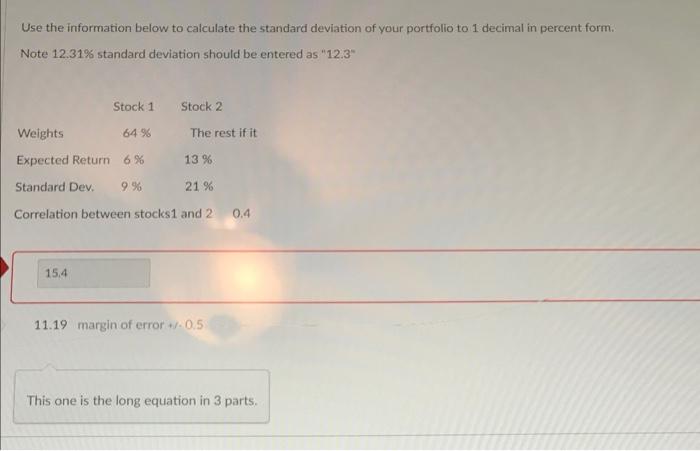

Use the information below to calculate the standard deviation of your portfolio to 1 decimal in percent form. Note 12.31% standard deviation should be entered as "12.3" Stock 1 Weights 64 % Expected Return 6% Stock 2 The rest if it 13 % Standard Dev. 9% 21 % Correlation between stocks1 and 2 0.4 15.4 11.19 margin of error +/-0.5 This one is the long equation in 3 parts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started