Answered step by step

Verified Expert Solution

Question

1 Approved Answer

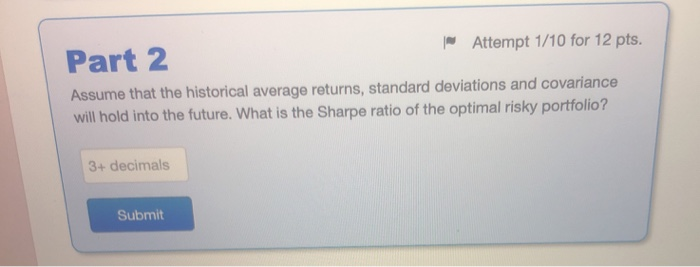

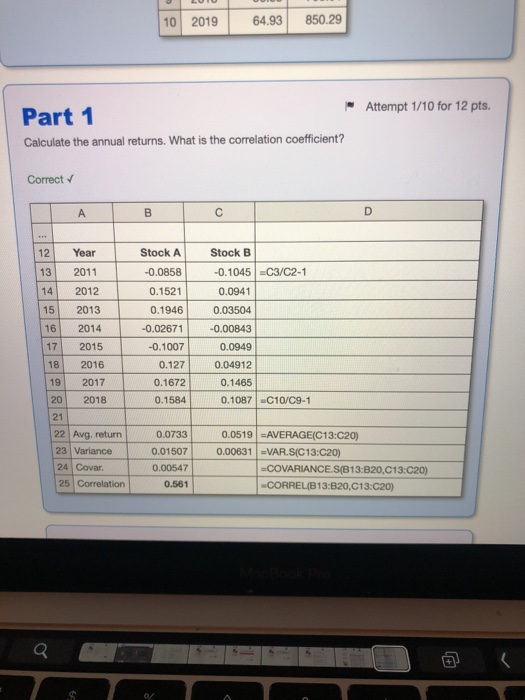

the correlation coefficient is 0.560879 this is the responce for the first part excel or by hand works the same for me.. Intro The following

the correlation coefficient is 0.560879

this is the responce for the first part

excel or by hand works the same for me..

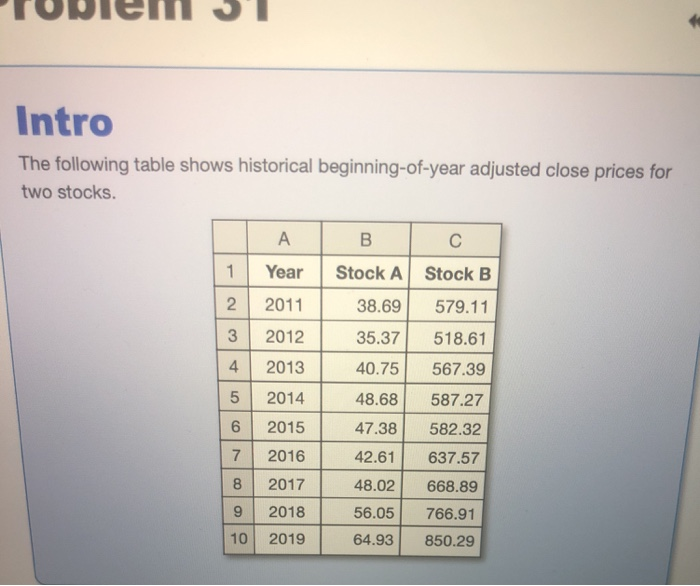

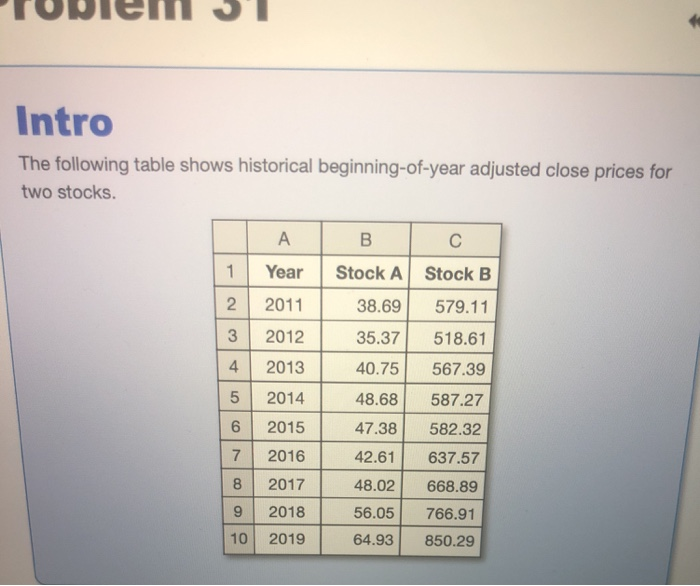

Intro The following table shows historical beginning-of-year adjusted close prices for two stocks. 1 Year Stock A Stock B 2 2011 3 2012 4 2013 5 2014 6 2015 7 2016 8 2017 9 2018 10 2019 38.69 579.11 35.37518.61 40.75 567.39 48.68 587.27 47.38 582.32 42.61 637.57 48.02668.89 56.05 766.91 64.93 850.29 Attempt 1/10 for 12 pts. Part 2 Assume that the historical average returns, standard deviations and covariance will hold into the future. What is the Sharpe ratio of the optimal risky portfolio 3+ decimals Submit 0 2019 64.93 850.29 Attempt 1/10 for 12 pts. Part 1 Calculate the annual returns. What is the correlation coefficient? Correct Stock A Stock B 0.0858 12 Year 13 2011 -0.1045 C3/C2-1 14 2012 15 2013 16 2014 17 2015 18 2016 19 2017 0.0941 0.1946 0.03504 0.02671 0.00843 0.0949 0.127 0.04912 0.1465 0.1521 -0.1007 0.1672 20 20180.1584 0.1087C10/C9-1 21 22 Avg. return0.0733 0.0519 AVERAGE(C13:C20) 23 Variance 0.015071 0.00547 0.561 0.00631 VAR.S(C13:C20) -COVARIANCE.S(B13:820,C13:C20) CORREL(B13:820,C13:C20) 24 Covar ] Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started