Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the correlation coefficient is not required to answer the questions. Consider the returns for the following stocks. Skywalker, Inc. Empire, Inc. 2015 - 5.0% 40.0%

the correlation coefficient is not required to answer the questions.

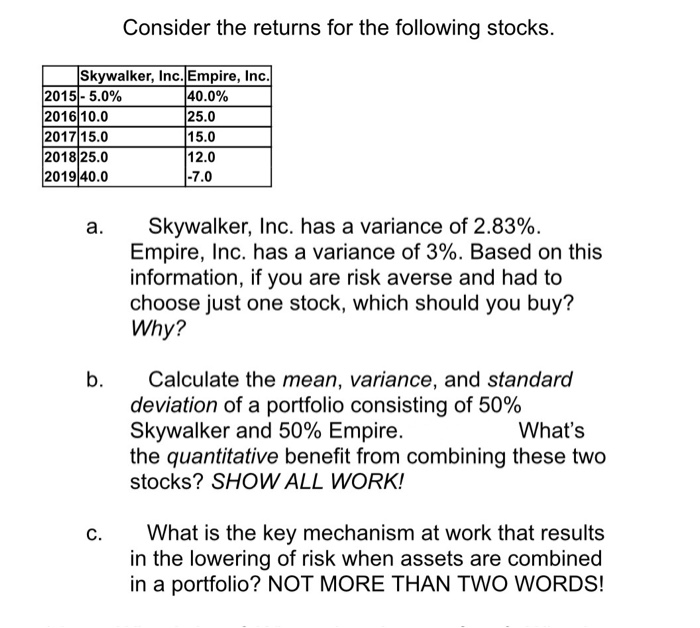

Consider the returns for the following stocks. Skywalker, Inc. Empire, Inc. 2015 - 5.0% 40.0% 201610.0 25.0 2017 15.0 15.0 2018 25.0 12.0 2019 40.0 -7.0 a. Skywalker, Inc. has a variance of 2.83%. Empire, Inc. has a variance of 3%. Based on this information, if you are risk averse and had to choose just one stock, which should you buy? Why? b. Calculate the mean, variance, and standard deviation of a portfolio consisting of 50% Skywalker and 50% Empire. What's the quantitative benefit from combining these two stocks? SHOW ALL WORK! c. What is the key mechanism at work that results in the lowering of risk when assets are combined in a portfolio? NOT MORE THAN TWO WORDS Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started