The Cost of Capital Assume that you work in Walt Disney Companys corporate finance and treasury department and have been assigned to the team estimating Disneys WACC (weighted average cost of capital). You must estimate the WACC in preparation for a team meeting later today. You quickly realize that the information you need is readily available online. Create a model in Excel to calculate the WACC for Walt Disney Company. Be sure to set up your spreadsheet so that it is possible to change the inputs so that the WACC can be calculated for other companies. Cost of Capital Formulas These formulas may be helpful as you work through this project. WACC (Weighted Average Cost of Capital) = + rWACC = cost of capital for the firm xD =percent of firm financed with debt rD Aftertax =Aftertax cost of debt xE =percent of firm financed equity rE =cost of common stock equity Market Value of Firm (MV Firm) = + Capital Structure Weights ( and ) = =

1. Risk-free rate a. Include a label and input cell for the Risk-free Rate (). For example, b. The U.S. Treasury website (Link to U.S. Treasury) provides the Treasury rates. c. To make it easier to look up the Risk-free rate in the future include a hyperlink to the U.S. Treasury website to your model. d. Choose the 10-year rate on May-06-2022 as the risk-free rate to use. 2. Company Name/Ticker a. Include a label and input cell for the Company Name. Enter Walt Disney Company as the name. For example, b. Include a label and input cell for the Stock Ticker. Enter the Disney stock ticker as the Stock Ticker. 3. Market Value of Equity (Market Cap) a. Include a label and input cell for Market Value of Equity (Market Cap). b. Go to http://finance.yahoo.com to get the Market Cap (market value of equity) for Disney (DIS). 4. Beta a. Include a label and input cell for Beta (). b. Go to http://finance.yahoo.com to get the Beta for Disney (DIS).

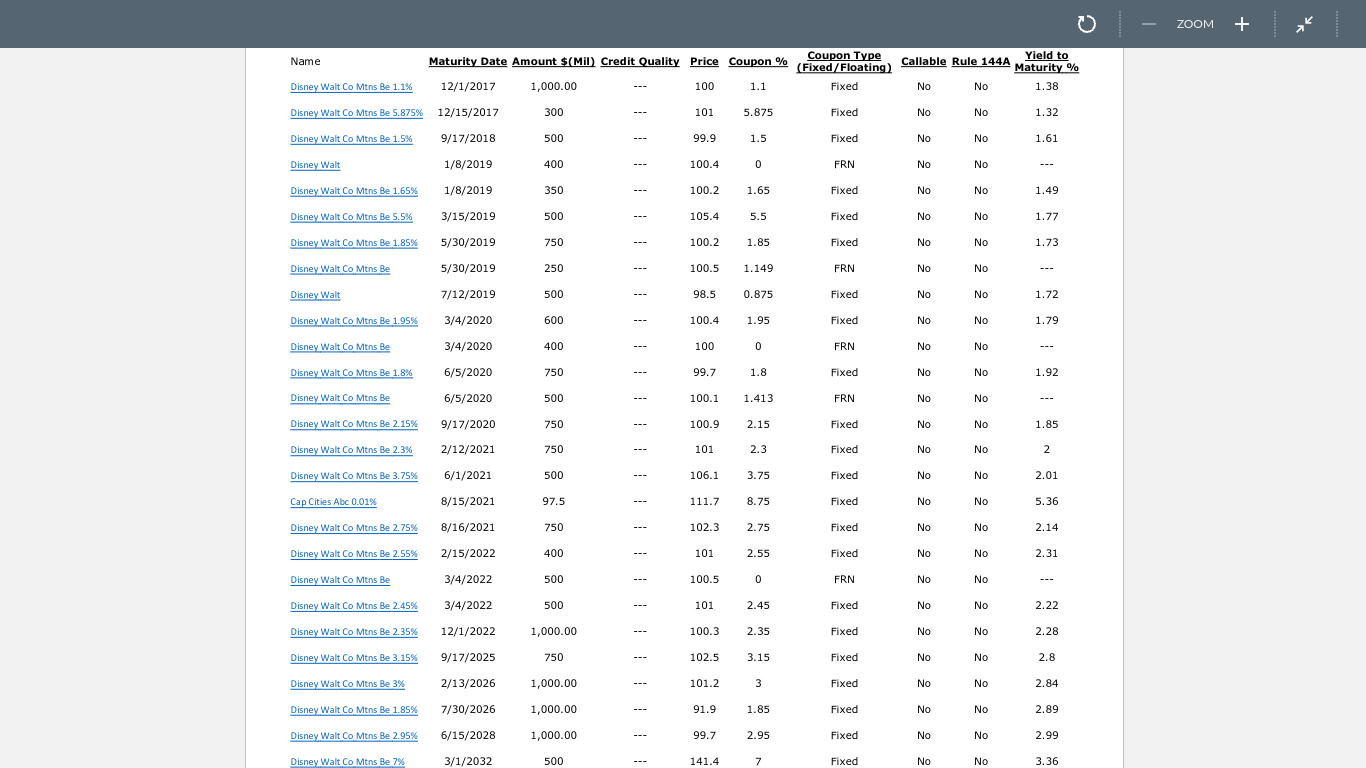

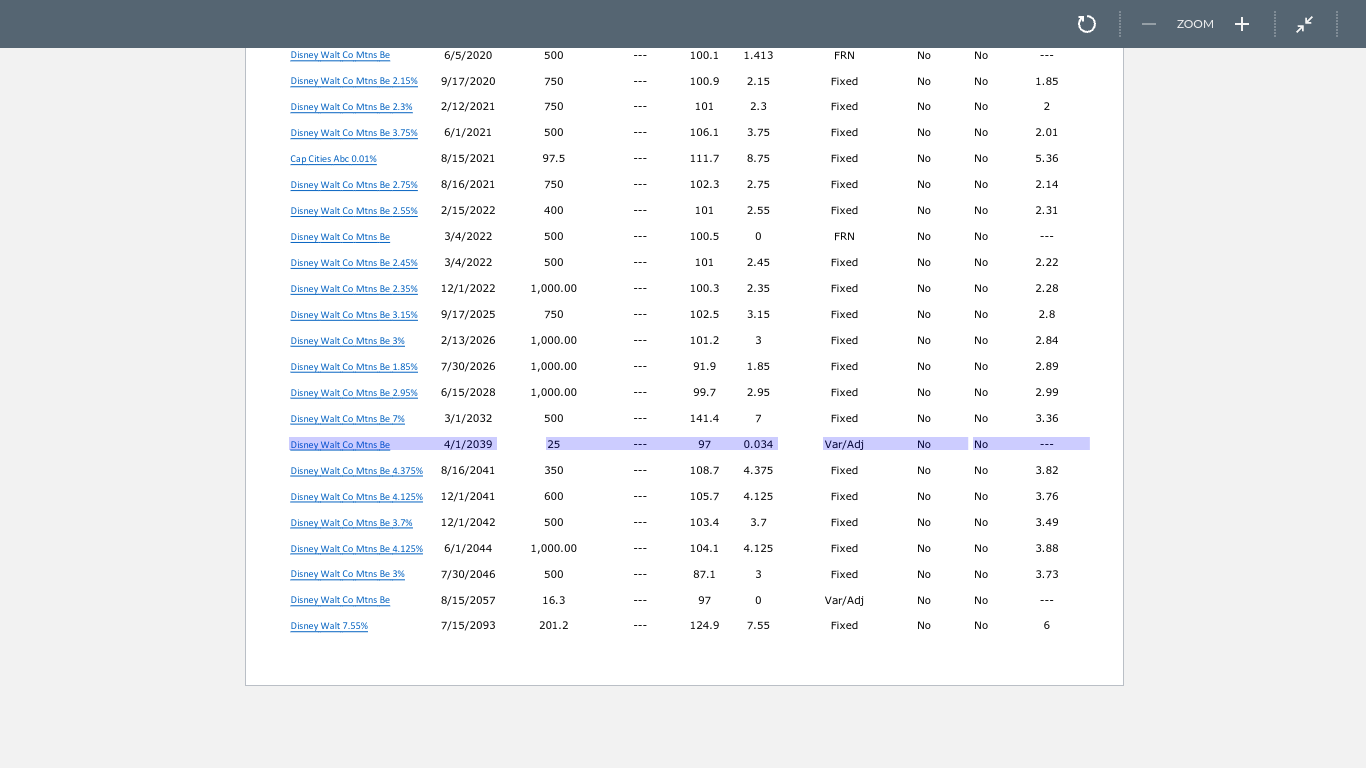

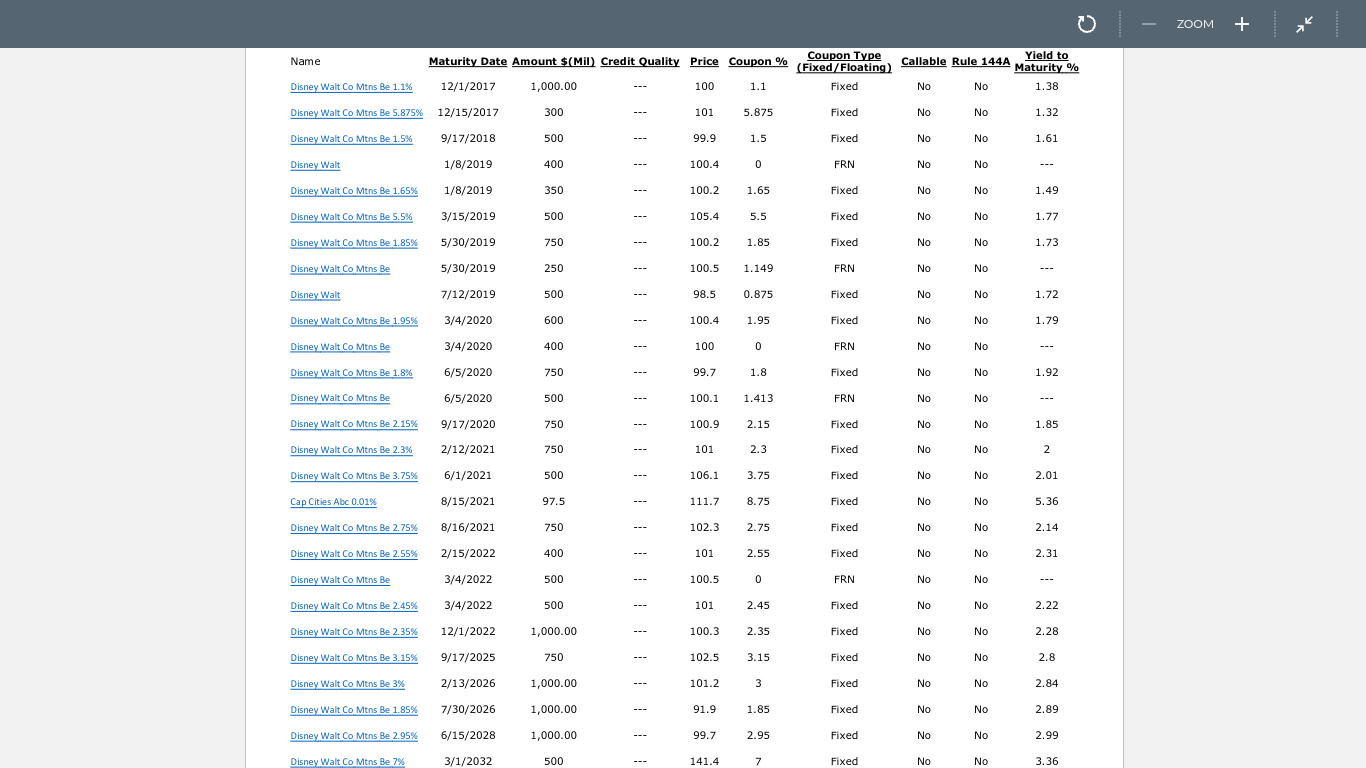

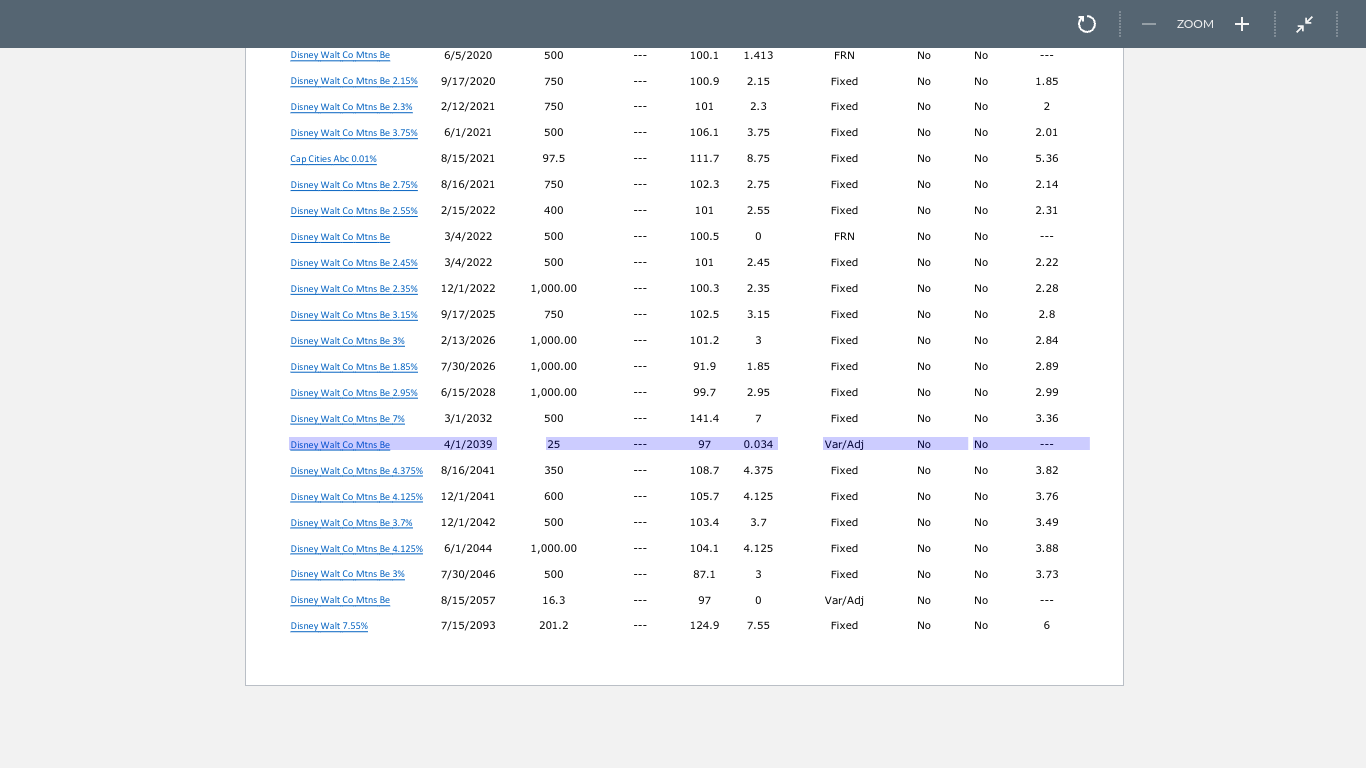

5. Cost of Equity Capital a. Include a label and input cell for Expected Market Return (() ) . b. Assume an Expected Market Return of 7%. c. Include a label for Cost of Equity (rE). d. Calculate Disneys cost of equity capital (rE) using the CAPM: Cost of Equity = Risk-Free Rate + Beta x (Expected Market Return Risk-Free Rate) = + x [() ] 6. Cost of Debt (Pre-Tax) a. Include a label and input cell for the Cost of Debt Pre-tax (rD). b. To get Disneys cost of debt you will need the yield to maturity on the firms existing long- term bonds. The bond data from Morningstar is provided in an excel file on canvas. Assume that Disneys policy is to use the yield to maturity on 10-year obligations as its cost of debt. Find the bond issue that is as close to 10 years from maturity as possible (look at Maturity Date). Hint: Ten years from now is 2032. Find the yield to maturity for your chosen bond issue (it is in the column titled Yield to Maturity %) and enter that yield as your pre-tax cost of debt on your spreadsheet. 7. Cost of Debt (After-Tax) a. Create a label and input cell for the Tax-Rate (Tc). b. Assume that Disney has a tax rate of 21%. c. Create a label for the Cost of Debt After-tax (rD After-tax). d. Calculate the after-tax cost of debt capital: After-tax Cost of Debt = Cost of Debt (pre-tax) x (1- Tax-Rate) rD After-tax = (rD x (1-Tc))

8. Market Value of Debt a. Include a label and input cell for the Market Value of Debt (MV Debt). b. To get Disneys market value of its long-term debt, you will need the price and yield to maturity on the firms existing long-term bonds. The bond data from Morningstar provided in an excel file on canvas includes the price and the amount outstanding of each bond issue. The price for each bond issue in your spreadsheet is reported as a percentage of the bonds par value. For example, 104.50 means that the bond issue is trading at 104.5% of its par value. The current amount outstanding for each bond is in the column Amount $ (Mil). Calculate the market value of each bond issue: = $ () ( c. Calculate the total market value of all bond issues by adding together the market value of each bond issue. This is the market value of Disneys debt. **NOTE: the market value of bonds is in millions of dollars. Make sure to put the total market value of bonds in billions of dollars so that it matches the total market value of equity. To get from millions to billions you can divide by 1000. For example, Total Market Value of Debt = sum(Market Value of each Bond) / 1000 9. Weight of Debt (XD) and Weight of Equity (XE) a. Include a label for Weight of Debt (XD) and Weight of Equity (XE). b. Calculate the weights for Disneys equity (XE) and debt (XD) based on Disneys market value of equity and market value of debt. (Hint: formulas at beginning might be helpful). 10. WACC (Weighted Average Cost of Capital) a. Include a label for the WACC. b. Calculate the WACC. (Hint: formulas at beginning might be helpful). 100 )

11. Calculate WACC for different values of Expected Market Returns. a. Create a table showing what the WACC will be for the following Expected Market Returns: 4%, 5%, 6%, 7%, 8%, 9%, 10%. b. You can build the table yourself (like we did in the Capital Budgeting project for NPV and Discount rates) OR you can use a data table (like the bonus section of the Capital Budgeting project for NPV and Discount rates). 12. Use a line graph to show the WACC for different values of Expected Market Returns. a. Include appropriate title, axis labels and axis values.

ZOOM + Coupon Type (Fixed/Floating) Fixed Name Maturity Date Amount $(Mil Credit Quality Price Coupon % Disney Walt Co Mens Be 1.1% % 12/1/2017 1,000.00 100 1.1 Disney Walt Co Mens Be 5.875% 12/15/2017 300 101 5.875 Callable Rule 144A Yield to Maturity % No No 1.38 Fixed No No 1.32 Disney Walt Co Mens Be 1.5% 9/17/2018 500 99.9 1.5 Fixed No No 1.61 Disney Walt 1/8/2019 400 100.4 0 0 FRN No No Disney Walt Co Mtns Be 1.65% 1/8/2019 350 --- 100.2 1.65 Fixed No No 1.49 Disney Walt Co Mens Be 5.5% 3/15/2019 500 105.4 5.5 Fixed No No 1.77 Disney Walt Co Mens Be 1.85% 5/30/2019 750 100.2 1.85 Fixed No No 1.73 Disney Walt Co Mtns Be 5/30/2019 250 100.5 1.149 FRN No No Disney Walt 7/12/2019 500 98.5 0.875 Fixed No No 1.72 Disney Walt Co Mtns Be 1.95% 3/4/2020 600 100.4 1.95 Fixed No No 1.79 Disney Walt Co Mtns Be 3/4/2020 400 100 0 FRN No No Disney Walt Co Mtns Be 1.8% 6/5/2020 750 99.7 1.8 Fixed No No 1.92 Disney Walt Co Mtns Be 6/5/2020 500 100.1 1.413 FRN Na No Disney Walt Co Mens Be 2.15% 9/17/2020 750 100.9 2.15 Fixed No No 1.85 Disney Walt Co Mtns Be 2.3% 2/12/2021 750 101 2.3 Fixed No No 2 Disney Walt Co Mtns Be 3.75% 6/1/2021 500 106.1 3.75 Fixed No No 2.01 Cap Cities Abc 0.01% 8/15/2021 97.5 111.7 8.75 Fixed No No 5.36 Disney Walt Co Mens Be 2.75% 8/16/2021 750 102.3 2.75 Fixed No No 2.14 Disney Walt Co Mtns Be 2.55% 2/15/2022 400 101 2.55 Fixed No No 2.31 Disney Walt Co Mtns Be 3/4/2022 500 100.5 0 FRN No No Disney Walt Co Mens Be 2.45% 3/4/2022 500 101 2.45 Fixed No No 2.22 Disney Walt Co Mens Be 2.35% % 12/1/2022 1,000.00 100.3 2.35 Fixed No No 2.28 Disney Walt Co Mtns Be 3.15% 9/17/2025 750 102.5 3.15 Fixed No No 2.8 Disney Walt Co Mens Be 3% 2/13/2026 1,000.00 101.2 3 Fixed No No 2.84 Disney Walt Co Mtns Be 1.85% 7/30/2026 1,000.00 91.9 1.85 Fixed No No 2.89 Disney Walt Co Mtns Be 2.95% 6/15/2028 1,000.00 99.7 2.95 Fixed No No 2.99 Disney Walt Co Mtns Be 7% 3/1/2032 500 --- 141.4 7 Fixed No No 3.36 ZOOM + Disney Walt Co Mens Be 6/5/2020 500 100.1 1.413 FRN No No Disney Walt Co Mens Be 2.15% 9/17/2020 750 100.9 2.15 Fixed No No 1.85 Disney Walt Co Mens Be 2.3% 2/12/2021 750 101 2.3 Fixed No No 2 Disney Walt Co Mtns Be 3.75% 6/1/2021 500 106.1 3.75 Fixed No No 2.01 Cap Cities Abc 0.01% 8/15/2021 97.5 --- 111.7 8.75 Fixed No No 5.36 Disney Walt Co Mens Be 2.75% 8/16/2021 750 102.3 2.75 Fixed No No 2.14 Disney Walt Co Mens Be 2.55% 2/15/2022 400 101 2.55 Fixed No No 2.31 Disney Walt Co Mens Be 3/4/2022 500 100.5 0 FRN No No Disney Walt Co Mens Be 2.45% % 3/4/2022 500 101 2.45 Fixed No No 2.22 Disney Walt Co Mens Be 2.35% 12/1/2022 1,000.00 100.3 2.35 Fixed No No 2.28 Disney Walt Co Mens Be 3.15% 9/17/2025 750 102.5 3.15 Fixed No No 2.8 Disney Walt Co Mens Be 3% 2/13/2026 1,000.00 101.2 3 3 Fixed No No 2.84 Disney Walt Co Mtns Be 1.85% 7/30/2026 1,000.00 91.9 1.85 Fixed No No 2.89 Disney Walt Co Mens Be 2.95% 6/15/2028 1,000.00 99.7 2.95 Fixed No No 2.99 Disney Walt Co Mtns Be 7% 3/1/2032 500 141.4 7 Fixed No No 3.36 Disney Walt Co Mtns Be 4/1/2039 25 --- 97 0.034 Var/Adj No No --- Disney Walt Co Mtns Be 4.375% 8/16/2041 350 108.7 4.375 Fixed No No 3.82 12/1/2041 Disney Walt Co Mtns Be 4.125% 600 --- 105.7 4.125 Fixed No No 3.76 Disney Walt Co Mtns Be 3.7% 12/1/2042 500 --- 103.4 3.7 Fixed No No 3.49 Disney Walt Co Mens Be 4.125% 6/1/2044 1,000.00 104.1 4.125 Fixed No No 3.88 Disney Walt Co Mens Be 3% 7/30/2046 500 87.1 3 Fixed No No 3.73 Disney Walt Co Mens Be 8/15/2057 16.3 97 0 0 Var/Adj No No Disney Walt 7.55% 7/15/2093 201.2 124.9 7.55 Fixed No No 6 ZOOM + Coupon Type (Fixed/Floating) Fixed Name Maturity Date Amount $(Mil Credit Quality Price Coupon % Disney Walt Co Mens Be 1.1% % 12/1/2017 1,000.00 100 1.1 Disney Walt Co Mens Be 5.875% 12/15/2017 300 101 5.875 Callable Rule 144A Yield to Maturity % No No 1.38 Fixed No No 1.32 Disney Walt Co Mens Be 1.5% 9/17/2018 500 99.9 1.5 Fixed No No 1.61 Disney Walt 1/8/2019 400 100.4 0 0 FRN No No Disney Walt Co Mtns Be 1.65% 1/8/2019 350 --- 100.2 1.65 Fixed No No 1.49 Disney Walt Co Mens Be 5.5% 3/15/2019 500 105.4 5.5 Fixed No No 1.77 Disney Walt Co Mens Be 1.85% 5/30/2019 750 100.2 1.85 Fixed No No 1.73 Disney Walt Co Mtns Be 5/30/2019 250 100.5 1.149 FRN No No Disney Walt 7/12/2019 500 98.5 0.875 Fixed No No 1.72 Disney Walt Co Mtns Be 1.95% 3/4/2020 600 100.4 1.95 Fixed No No 1.79 Disney Walt Co Mtns Be 3/4/2020 400 100 0 FRN No No Disney Walt Co Mtns Be 1.8% 6/5/2020 750 99.7 1.8 Fixed No No 1.92 Disney Walt Co Mtns Be 6/5/2020 500 100.1 1.413 FRN Na No Disney Walt Co Mens Be 2.15% 9/17/2020 750 100.9 2.15 Fixed No No 1.85 Disney Walt Co Mtns Be 2.3% 2/12/2021 750 101 2.3 Fixed No No 2 Disney Walt Co Mtns Be 3.75% 6/1/2021 500 106.1 3.75 Fixed No No 2.01 Cap Cities Abc 0.01% 8/15/2021 97.5 111.7 8.75 Fixed No No 5.36 Disney Walt Co Mens Be 2.75% 8/16/2021 750 102.3 2.75 Fixed No No 2.14 Disney Walt Co Mtns Be 2.55% 2/15/2022 400 101 2.55 Fixed No No 2.31 Disney Walt Co Mtns Be 3/4/2022 500 100.5 0 FRN No No Disney Walt Co Mens Be 2.45% 3/4/2022 500 101 2.45 Fixed No No 2.22 Disney Walt Co Mens Be 2.35% % 12/1/2022 1,000.00 100.3 2.35 Fixed No No 2.28 Disney Walt Co Mtns Be 3.15% 9/17/2025 750 102.5 3.15 Fixed No No 2.8 Disney Walt Co Mens Be 3% 2/13/2026 1,000.00 101.2 3 Fixed No No 2.84 Disney Walt Co Mtns Be 1.85% 7/30/2026 1,000.00 91.9 1.85 Fixed No No 2.89 Disney Walt Co Mtns Be 2.95% 6/15/2028 1,000.00 99.7 2.95 Fixed No No 2.99 Disney Walt Co Mtns Be 7% 3/1/2032 500 --- 141.4 7 Fixed No No 3.36 ZOOM + Disney Walt Co Mens Be 6/5/2020 500 100.1 1.413 FRN No No Disney Walt Co Mens Be 2.15% 9/17/2020 750 100.9 2.15 Fixed No No 1.85 Disney Walt Co Mens Be 2.3% 2/12/2021 750 101 2.3 Fixed No No 2 Disney Walt Co Mtns Be 3.75% 6/1/2021 500 106.1 3.75 Fixed No No 2.01 Cap Cities Abc 0.01% 8/15/2021 97.5 --- 111.7 8.75 Fixed No No 5.36 Disney Walt Co Mens Be 2.75% 8/16/2021 750 102.3 2.75 Fixed No No 2.14 Disney Walt Co Mens Be 2.55% 2/15/2022 400 101 2.55 Fixed No No 2.31 Disney Walt Co Mens Be 3/4/2022 500 100.5 0 FRN No No Disney Walt Co Mens Be 2.45% % 3/4/2022 500 101 2.45 Fixed No No 2.22 Disney Walt Co Mens Be 2.35% 12/1/2022 1,000.00 100.3 2.35 Fixed No No 2.28 Disney Walt Co Mens Be 3.15% 9/17/2025 750 102.5 3.15 Fixed No No 2.8 Disney Walt Co Mens Be 3% 2/13/2026 1,000.00 101.2 3 3 Fixed No No 2.84 Disney Walt Co Mtns Be 1.85% 7/30/2026 1,000.00 91.9 1.85 Fixed No No 2.89 Disney Walt Co Mens Be 2.95% 6/15/2028 1,000.00 99.7 2.95 Fixed No No 2.99 Disney Walt Co Mtns Be 7% 3/1/2032 500 141.4 7 Fixed No No 3.36 Disney Walt Co Mtns Be 4/1/2039 25 --- 97 0.034 Var/Adj No No --- Disney Walt Co Mtns Be 4.375% 8/16/2041 350 108.7 4.375 Fixed No No 3.82 12/1/2041 Disney Walt Co Mtns Be 4.125% 600 --- 105.7 4.125 Fixed No No 3.76 Disney Walt Co Mtns Be 3.7% 12/1/2042 500 --- 103.4 3.7 Fixed No No 3.49 Disney Walt Co Mens Be 4.125% 6/1/2044 1,000.00 104.1 4.125 Fixed No No 3.88 Disney Walt Co Mens Be 3% 7/30/2046 500 87.1 3 Fixed No No 3.73 Disney Walt Co Mens Be 8/15/2057 16.3 97 0 0 Var/Adj No No Disney Walt 7.55% 7/15/2093 201.2 124.9 7.55 Fixed No No 6