Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the cost of debt after tax is 17% The owner of Eleven's Cupcake Emporium wants to determine the NPV of their garage expansion to determine

the cost of debt after tax is 17%

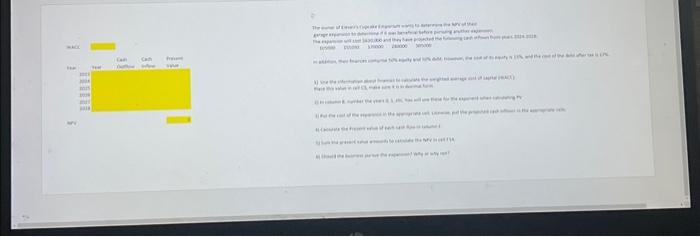

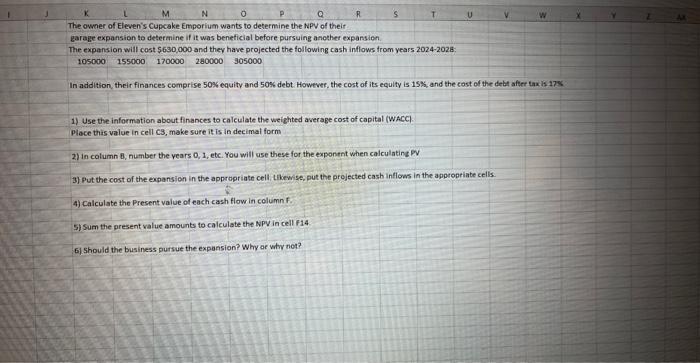

The owner of Eleven's Cupcake Emporium wants to determine the NPV of their garage expansion to determine if it was beneficial before pursuing another expansion. The expansion will cost $630,000 and they have projected the following cash inflows from years 2024-2028: 105000155000170000280000305000 In addition, their finances comprise 50% equity and 50% debt. However, the cost of its equity is 15%, and the cost of the deb 1) Use the information about finances to calculate the weighted average cost of capital (WACC). Place this value in cell C3, make sure it is in decimal form 2) In column 8 , number the years 0,1 , etc. You will use these for the exponent when calculating PV 3) Put the cost of the expansion in the appropriate cell. Likewise, put the projected cash inflows in the appropriate cells. 4) Calculate the Present value of each cash flow in column F. 5) Sum the present value amounts to calculate the NPV in cell F14. 6) Should the business pursue the expansion? Why or why not? The owner of Eleven's Cupcake Emporium wants to determine the NPV of their garage expansion to determine if it was beneficial before pursuing another expansion. The expansion will cost $630,000 and they have projected the following cash inflows from years 2024-2028: 105000155000170000280000305000 In addition, their finances comprise 50\%, equity and 50\% debt. However, the cost of its equilty is 15%, and the cast of the deth after tax is 178 1) Use the information about finances to calculate the weighted average cost of capital (WACC) place this value in cell cs, make sure it is in decimal form 2) in column 6 , number the vears 0, 1, etc. You will use these for the expontnt when calculatinc PV 3) Put the cost of the expansion in the apprupriate cell, thewise, put the projected cash inflows in the appropriate cells. 4) Calculate the Present value of each cash flow in column f. 5) Sum the present value amounts to calculate the NPV in cell f14 5) Should the business pursue the expansion? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started