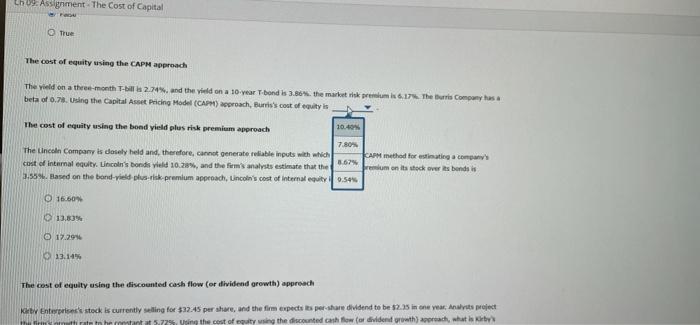

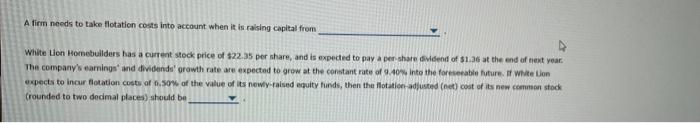

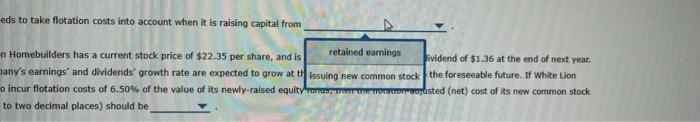

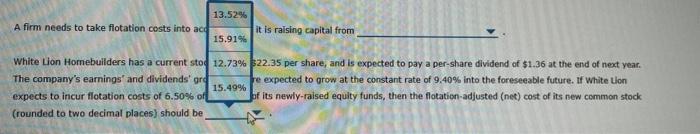

The cost of equity using the CAPM approach The yield on a three-month T-bil la 2.74%, and the Vield on a 10 year T-bond is 2.80% the market risk premium 16.17%. The Buntis Company has beta of 0.78. Using the Capital Asset Pricing Model (CAP) approach, Bunis's cost of equity is The cost of equity using the bond yield plus risk premium approach The Lincoln Company is closely held and therefore, cannot generate reliable inputs with which to use the CAP method for estimating a company cost of internal equity. Uncole's bonds yield 10.28%, and the firm's analysts estimate that the firm's tik premium on its stuck over its bonde is 3.55%. Based on the bond-yield plurk Premium approach, Uncoln's cost of interal coulis: 16.606 O 13.33% 17.29 13.14 The cost of equity using the discounted cash flow (or dividend growth) approach Kirby Enterprises's stock is currently selling for $32.45 per share, and the firm expects its per share dividend to be $2.35 incheye. Als project the firm's growth rate to be constant at 5.72%. Duing the cost of culty using the discounted cash flow or dividend routh) mereach, what is cost of internal equity 17.50% O 12.31 16.203 12.90 Ch 09. Assignment The Cost of Capital PO True The cost of equity using the CAPM approach The yield on a three- month T-bills 2.74% and the yield on a 10-year T-bond is 3.86%. the market risk premium is 6.17. The this Company has a beta of 0.78. Using the capital Asset Pricing Model (CAPM) proach, Burris's cost of equity is The cost of equity using the bond yield plus risk premium approach 10.40% 7.80% The Lincoln Company is dosely held and therefore, we generate reliable inputs with which KAM method for estimating a coman's 8.67% cost of internal equity. Lincoln's bonds veld 10.2%, and the firm's analysts estimate that the remium on its took over its bonds is 3.559. Based on the bond-yield plusrisk premium approach, Lincoln's cost of internal equity 0.54% O 16.60 13,60% 0 17.299 13.14% The cost of equity using the discounted cash flow (or dividend growth) approach Kit Enterprises stock is currently selling for $32.45 pershare, and the firm expects is pershare dividend to be $2.35 in one year, Analysts project mant 5.775 Vring the cost of equity using the discounted cash flow (o dividend growth approach, what is by A firm needs to take flotation costs into account when it is raising capital from White Lion Homebuilders has a current stock price of $22.35 per share, and is expected to pay a pershare vidend of $1.36 at the end of next year. The company's earnings and dividends' growth rate are expected to grow at the constant rate of 9.40 Into the foreseeable future. If White Lion expects to incur flotation costs of 0.50% of the value of its newly-raised equity funds, then the flotation-adjusted (net) cost of its new common stock (rounded to two decimal places) should be eds to take flotation costs into account when it is raising capital from Homebuilders has a current stock price of $22.35 per share, and is retained earnings Jividend of $1.36 at the end of next year. Dany's earnings' and dividends growth rate are expected to grow at tissuing new common stock the foreseeable future. If White Lion o incur flotation costs of 6.50% of the value of its newly-raised equity Skerrorysted (net) cost of its new common stock to two decimal places) should be 13.52% A firm needs to take flotation costs into aco 15.91% it is raising capital from White Lion Homebuilders has a current stod 12.73% $22.35 per share, and is expected to pay a per-share dividend of $1.36 at the end of next year. The company's earnings and dividends' gro re expected to grow at the constant rate of 9,40% into the foreseeable future. If White Lion 15.49% expects to incur flotation costs of 6.50% of Jof its newly-raised equity funds, then the flotation-adjusted (net) cost of its new common stock (rounded to two decimal places) should be