Question

The cost of the building was $140,000 and the cost of the furnishings was $30,000. The depreciation will be recorded annually. The estimated useful life

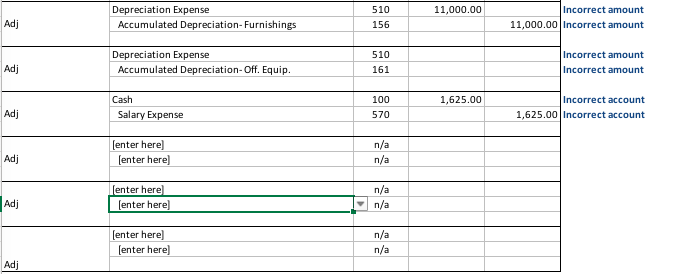

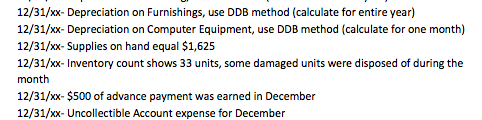

The cost of the building was $140,000 and the cost of the furnishings was $30,000. The depreciation will be recorded annually. The estimated useful life of the building is 20 years with a residual value of $10,000. The company uses the Straight line method to depreciate the building. The estimated useful life of the furnishings is 5 years with a residual value of $2,500. The company uses the Double Declining Balance method to depreciate furnishings. The current inventory consists of 30 units of software at a cost of $140.00 each. Inventory is costed using LIFO and the perpetual inventory system. The company uses an allowance method to account for uncollectible accounts. It is estimated that 1% of net credit revenue will be uncollectible, adjusted monthly. Employees are paid $2,500 salary twice a month, on the 16thfor the first half of the month and on the 2ndof the following month for the last half of the month. Ignore income tax calculations.

- Purchased Computer Equipment on Account, $4,800

Note:The equipment has an estimated useful life of 4 years, residual value of $50 and uses the DDB method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started