Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The country of tax is Canada Assignment Problem Nine - 4 (Pension Income Splitting - With OAS) Felipe and Martina Gomez are both 66 years

The country of tax is Canada

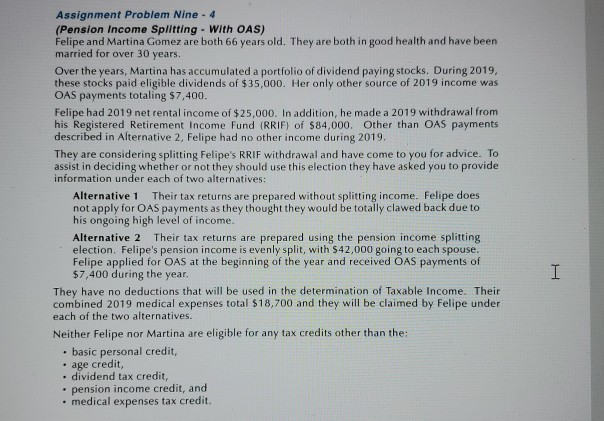

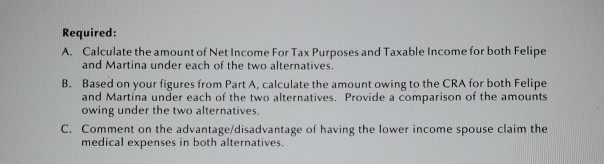

Assignment Problem Nine - 4 (Pension Income Splitting - With OAS) Felipe and Martina Gomez are both 66 years old. They are both in good health and have been married for over 30 years. Over the years, Martina has accumulated a portfolio of dividend paying stocks. During 2019, these stocks paid eligible dividends of $35,000. Her only other source of 2019 income was OAS payments totaling $7,400. Felipe had 2019 net rental income of $25,000. In addition, he made a 2019 withdrawal from his Registered Retirement Income Fund (RRIF) of $84,000. Other than OAS payments described in Alternative 2, Felipe had no other income during 2019, They are considering splitting Felipe's RRIF withdrawal and have come to you for advice. To assist in deciding whether or not they should use this election they have asked you to provide information under each of two alternatives: Alternative 1 Their tax returns are prepared without splitting income. Felipe does not apply for OAS payments as they thought they would be totally clawed back due to his ongoing high level of income. Alternative 2 Their tax returns are prepared using the pension income splitting election. Felipe's pension income is evenly split, with $42,000 going to each spouse. Felipe applied for OAS at the beginning of the year and received OAS payments of $7,400 during the year. They have no deductions that will be used in the determination of Taxable income. Their combined 2019 medical expenses total $18,700 and they will be claimed by Felipe under each of the two alternatives. Neither Felipe nor Martina are eligible for any tax credits other than the basic personal credit, . age credit, dividend tax credit, pension income credit, and medical expenses tax credit. Required: A. Calculate the amount of Net Income For Tax Purposes and Taxable income for both Felipe and Martina under each of the two alternatives. B. Based on your figures from Part A, calculate the amount owing to the CRA for both Felipe and Martina under each of the two alternatives. Provide a comparison of the amounts owing under the two alternatives. C. Comment on the advantage/disadvantage of having the lower income spouse claim the medical expenses in both alternatives. Assignment Problem Nine - 4 (Pension Income Splitting - With OAS) Felipe and Martina Gomez are both 66 years old. They are both in good health and have been married for over 30 years. Over the years, Martina has accumulated a portfolio of dividend paying stocks. During 2019, these stocks paid eligible dividends of $35,000. Her only other source of 2019 income was OAS payments totaling $7,400. Felipe had 2019 net rental income of $25,000. In addition, he made a 2019 withdrawal from his Registered Retirement Income Fund (RRIF) of $84,000. Other than OAS payments described in Alternative 2, Felipe had no other income during 2019, They are considering splitting Felipe's RRIF withdrawal and have come to you for advice. To assist in deciding whether or not they should use this election they have asked you to provide information under each of two alternatives: Alternative 1 Their tax returns are prepared without splitting income. Felipe does not apply for OAS payments as they thought they would be totally clawed back due to his ongoing high level of income. Alternative 2 Their tax returns are prepared using the pension income splitting election. Felipe's pension income is evenly split, with $42,000 going to each spouse. Felipe applied for OAS at the beginning of the year and received OAS payments of $7,400 during the year. They have no deductions that will be used in the determination of Taxable income. Their combined 2019 medical expenses total $18,700 and they will be claimed by Felipe under each of the two alternatives. Neither Felipe nor Martina are eligible for any tax credits other than the basic personal credit, . age credit, dividend tax credit, pension income credit, and medical expenses tax credit. Required: A. Calculate the amount of Net Income For Tax Purposes and Taxable income for both Felipe and Martina under each of the two alternatives. B. Based on your figures from Part A, calculate the amount owing to the CRA for both Felipe and Martina under each of the two alternatives. Provide a comparison of the amounts owing under the two alternatives. C. Comment on the advantage/disadvantage of having the lower income spouse claim the medical expenses in both alternativesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started