Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The course is compensation and benefits..could you find the last answer I have picture of formula they used below for the answer I just could

The course is compensation and benefits..could you find the last answer I have picture of formula they used below for the answer I just could not figure it out

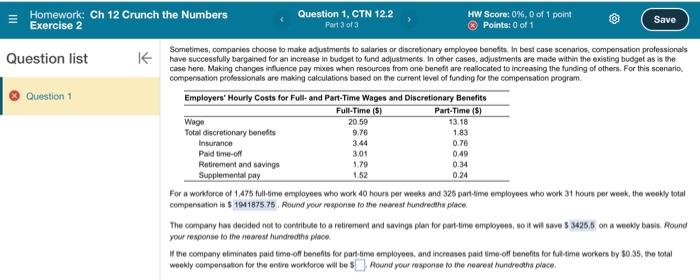

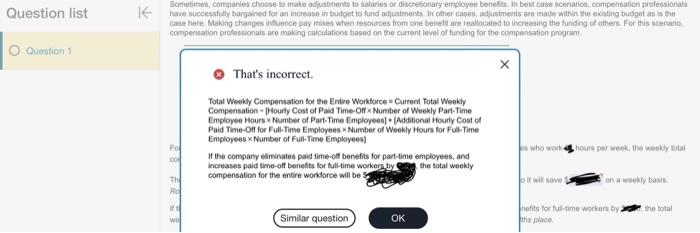

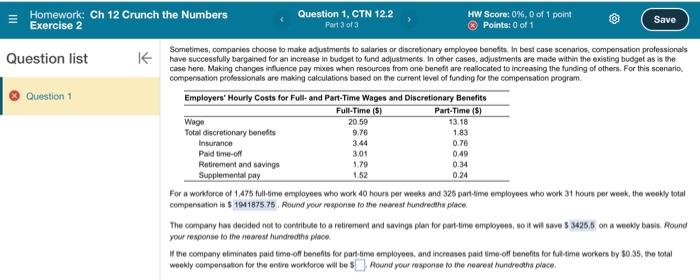

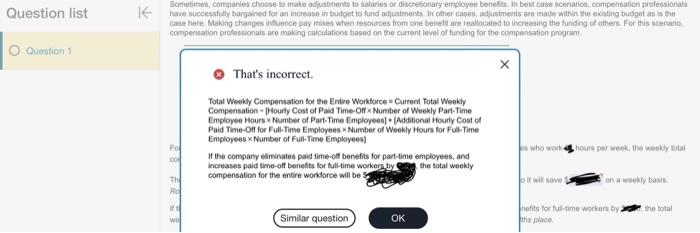

Sometimes, comparies choose to make adiustments to salaries or discretionary employee benefis. In best case scenarics, compensation professionals have successfully bargained for an increase in budget to fund adjustments. In other cases, adjustments are made within the existing budget as is the case here. Making changes infuence pay mixes when resources from one benefit are reallocated to increasing the funding of others. For this scenario. compensation probessionals are making calculations based on the current level of funding for the compensation program. For a worklorce of 1,475 full-time employees who work 40 hours per weeks and 325 part-5ime employees who work 31 hours per week, the weekly total compensation is $1941875.75, Round your response fo the nearest hundrectehs place. The company has decided not to contribule to a retirement and savings plan for part-time employees, so it wil save 5 3425.5 on a weebly basis. Round your response to the nearest hindredths place. If the compary eliminates paid time-off benefis for part time employees, and increases paid time-off benefits for fultime workers by 50.35 , the total weekly compensation for the entre workforce will be \& flochd your response to the nearest hundreaths place. Sometimes, companies choose to make adjustments to salaries or discrefionary employee benefta in best case scenarics, compensatien profeasionals case hert. Making changes intluence pay mokes when resources from one benelit are reallocated to increasing the furnding of others. For this scenarib. compensation profossionals are making calculations based on the current level of funding for the compensation program. (3) That's incorrect. Total Weokly Compensation for the Entire Workforce = Current Total Weakly Compensation - phourly Cost of Paid Time-Off Number of Weekly Part-Teme Employee Hours x Number of Part-Time Employees) + (Additional Hourly Cost of Paid Time-Olf for Full-Time Employees Number of Weekly Hours for Ful-Time Employees Number of Full-Time Employees] If the compary eliminates paid time-oft benefins for part-time employees, and increases paid time-off benefts for full-time workers by 987 the total weekly compensation for the enfire workforce will be who work hovis per week, the woekly total b it wil sawe Ton a weekly basis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started