Question

The course project for this course will use scenarios from Panache, Inc., a company that is experiencing each of the complex financial reporting issues presented

The course project for this course will use scenarios from Panache, Inc., a company that is experiencing each of the complex financial reporting issues presented in the course. Each scenario will present a different topic, tied together by the company specifics. The final component will connect the topics through a review of disclosures and supplemental information, as well as through an evaluation of the company's disclosure and reporting policies.

The course project for this course will use scenarios from Panache, Inc., a company that is experiencing each of the complex financial reporting issues presented in the course. Each scenario will present a different topic, tied together by the company specifics. The final component will connect the topics through a review of disclosures and supplemental information, as well as through an evaluation of the company's disclosure and reporting policies.

Each week, the course project assignment will approach a different piece of Panache Inc. and will use the concepts covered during the week. At the end of the five weeks, the entire analysis will be due and will be a compilation of what was accomplished during the prior weeks.

Course Project Scenario

Panache Inc. is a small specialty automobile manufacturer. The company's long-time controller, Celia Brown, retired on January 10, 2016, at the age of eighty-eight years, and the president of the company, Andrew Cartwright, has hired you to be the company's new controller.

Andrew would like to take Panache public in the near future, which will require audited financial statements. He has retained the public accounting firm of Booker and Helwig to audit the 2015 financial statements as a preliminary step. He knows that Celia was not always up to date on current issues, and he has asked you to review all of the company's accounting policies and procedures. Your first task is to identify problem areas and make any corrections needed before the audit begins.

Andrew wants to be kept informed at all times, and when any problems are identified, he wants to be made aware of the problem as well as your solution.

You've spent your first week on the job getting familiar with the company's products and processes. It's time to dig into the company's financial statements, and you decide to look at the company's investment accounting first.

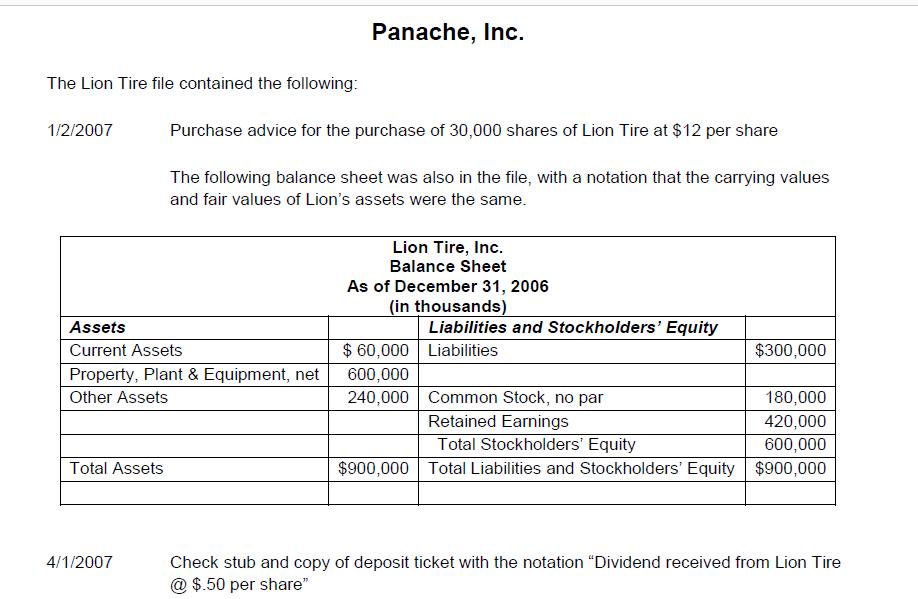

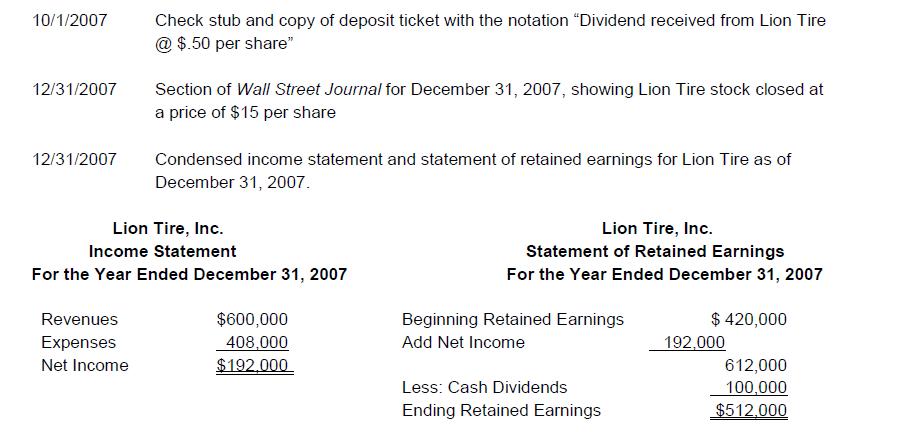

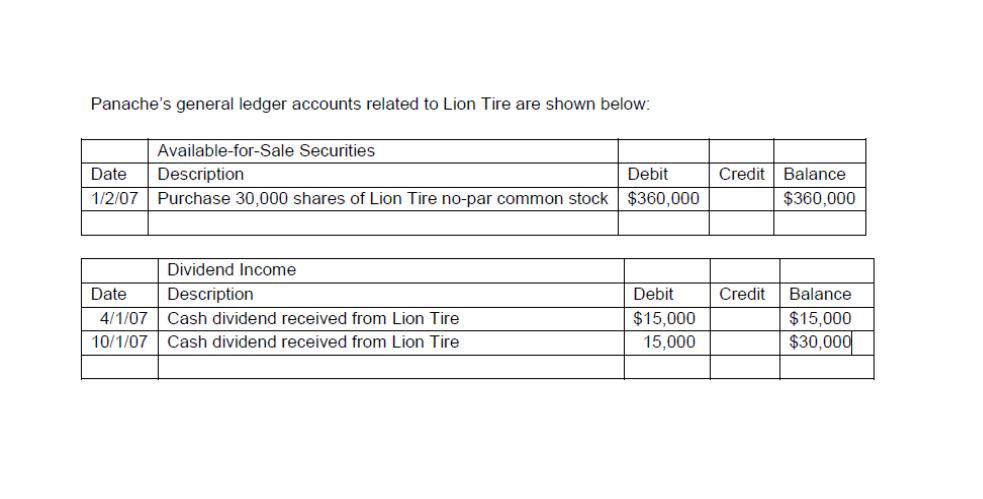

The company purchased several securities in 2014, including 30,000 of the 100,000 outstanding shares of Lion Tire. Lion Tire supplies the tires used on all of Panache's vehicles. Mr. Cartwright was asked and agreed to become a member of Lion Tire's board. You find the detailed records for the investment transactions and the financial statements in the Lion Tire file. During your review, you find that all of the investment transactions were properly recorded and reported except for the investment in Lion Tire.

Click here to view the Lion Tire file.

This Week's Task:

Based on your analysis of the Lion Tire transactions, draft the journal entries that should have been made in an Excel spreadsheet. Then, write a memo to Andrew explaining the accounting principles that should have been followed for Panache's investment in Lion Tire. In your memo:

Illustrate how the investment will be reported in the company's balance sheet and income statement.

Summarize how and why the accounting for this investment is different from the accounting for Panache's other investment securities.

Devise three ways, based on past practices, that Panache can improve its future accounting principles for the Lion Tire transactions. Use examples from the Excel spreadsheet when necessary.

Panache, Inc. Purchase advice for the purchase of 30,000 shares of Lion Tire at $12 per share The following balance sheet was also in the file, with a notation that the carrying values and fair values of Lion's assets were the same. Lion Tire, Inc. Balance Sheet As of December 31, 2006 (in thousands) Liabilities and Stockholders' Equity Liabilities $ 60,000 $300,000 600,000 240,000 Common Stock, no par 180,000 Retained Earnings 420,000 Total Stockholders' Equity 600,000 $900,000 Total Liabilities and Stockholders' Equity $900,000 Check stub and copy of deposit ticket with the notation "Dividend received from Lion Tire @ $.50 per share" The Lion Tire file contained the following: 1/2/2007 Assets Current Assets Property, Plant & Equipment, net Other Assets Total Assets 4/1/2007

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

As Panache had acquired 30000 shares of the total of 100000 shares of Lion Tire ie 3000010000030 of the total outstanding shares GAAP requires this in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started