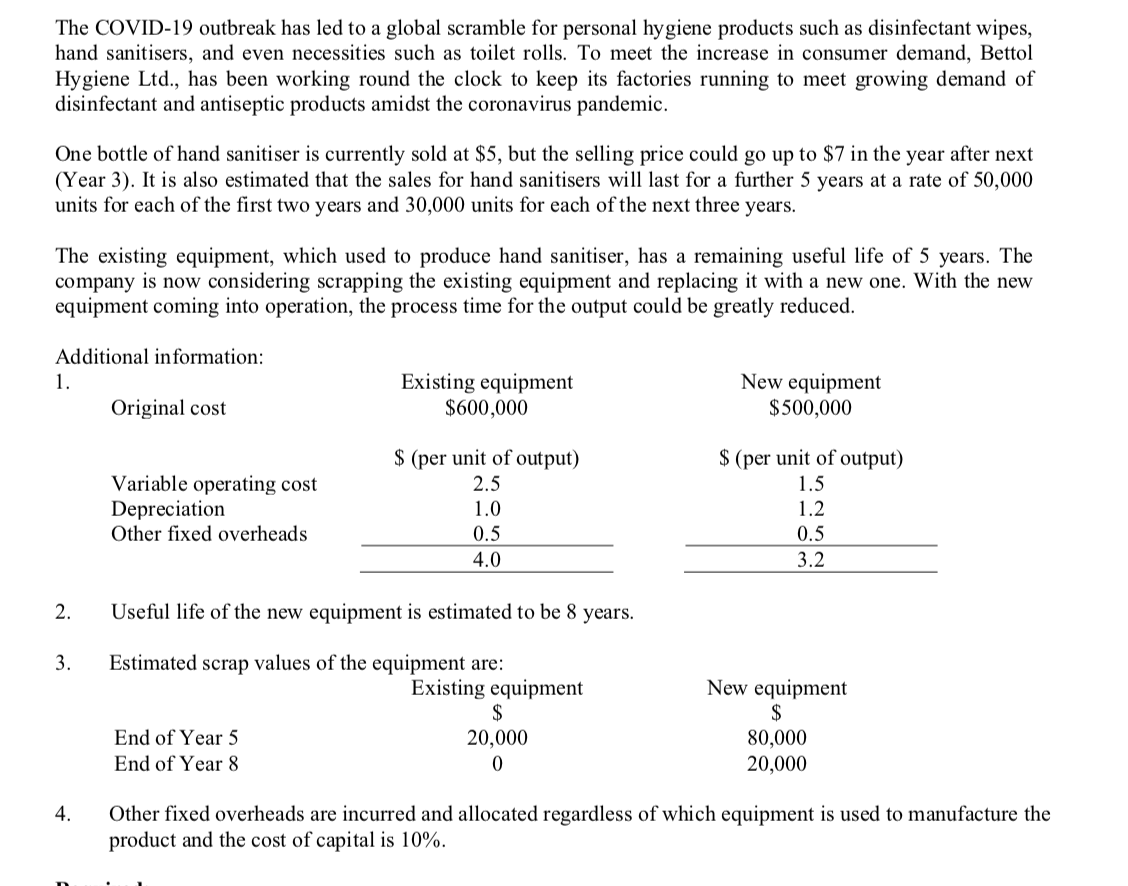

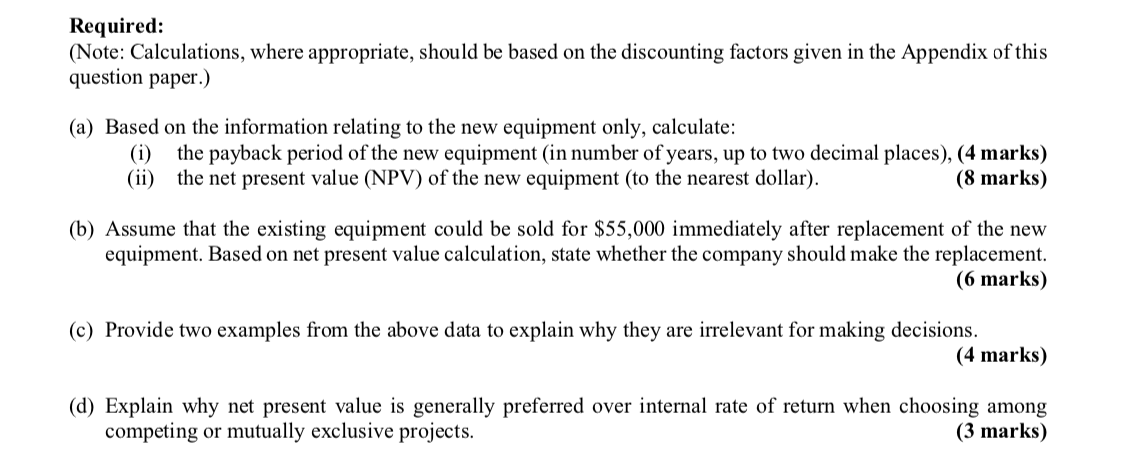

The COVID-19 outbreak has led to a global scramble for personal hygiene products such as disinfectant wipes, hand sanitisers, and even necessities such as toilet rolls. To meet the increase in consumer demand, Bettol Hygiene Ltd., has been working round the clock to keep its factories running to meet growing demand of disinfectant and antiseptic products amidst the coronavirus pandemic. One bottle of hand sanitiser is currently sold at $5, but the selling price could go up to $7 in the year after next (Year 3). It is also estimated that the sales for hand sanitisers will last for a further 5 years at a rate of 50,000 units for each of the first two years and 30,000 units for each of the next three years. The existing equipment, which used to produce hand sanitiser, has a remaining useful life of 5 years. The company is now considering scrapping the existing equipment and replacing it with a new one. With the new equipment coming into operation, the process time for the output could be greatly reduced. Additional information: 1. Original cost Existing equipment $600,000 New equipment $500,000 Variable operating cost Depreciation Other fixed overheads $ (per unit of output) 2.5 1.0 0.5 4.0 $ (per unit of output) 1.5 1.2 0.5 3.2 2. Useful life of the new equipment is estimated to be 8 years. 3. Estimated scrap values of the equipment are: Existing equipment $ End of Year 5 20,000 End of Year 8 0 New equipment $ 80,000 20,000 4. Other fixed overheads are incurred and allocated regardless of which equipment is used to manufacture the product and the cost of capital is 10%. Required: (Note: Calculations, where appropriate, should be based on the discounting factors given in the Appendix of this question paper.) (a) Based on the information relating to the new equipment only, calculate: (i) the payback period of the new equipment (in number of years, up to two decimal places), (4 marks) (ii) the net present value (NPV) of the new equipment (to the nearest dollar). (8 marks) (b) Assume that the existing equipment could be sold for $55,000 immediately after replacement of the new equipment. Based on net present value calculation, state whether the company should make the replacement. (6 marks) (c) Provide two examples from the above data to explain why they are irrelevant for making decisions. (4 marks) (d) Explain why net present value is generally preferred over internal rate of return when choosing among competing or mutually exclusive projects