Question

The credit risk exposure of the bank is another issue that needs attention. Unibank obtained the following data regarding the national average exposure of all

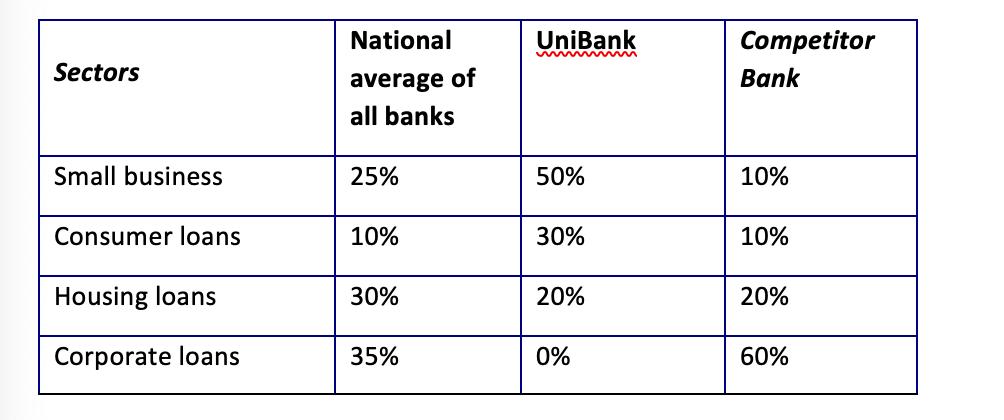

The credit risk exposure of the bank is another issue that needs attention. Unibank obtained the following data regarding the national average exposure of all banks and one competitor bank that serves the same target markets as Unibank

UniBank would like to estimate how much its loan portfolio deviate from the national average compared to the portfolio of the competitor bank. You are requested to calculate how much the loan portfolios of UniBank and the competitor bank deviate from the national average and to explain whether the deviation of UniBank is better or worse than the deviation of the competitor bank by providing reasons for it.

Sectors Small business Consumer loans Housing loans Corporate loans National average of all banks 25% 10% 30% 35% UniBank wwwmmmmmm 50% 30% 20% 0% Competitor Bank 10% 10% 20% 60%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the deviation of UniBanks loan portfolio from the national average and compare it with ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started