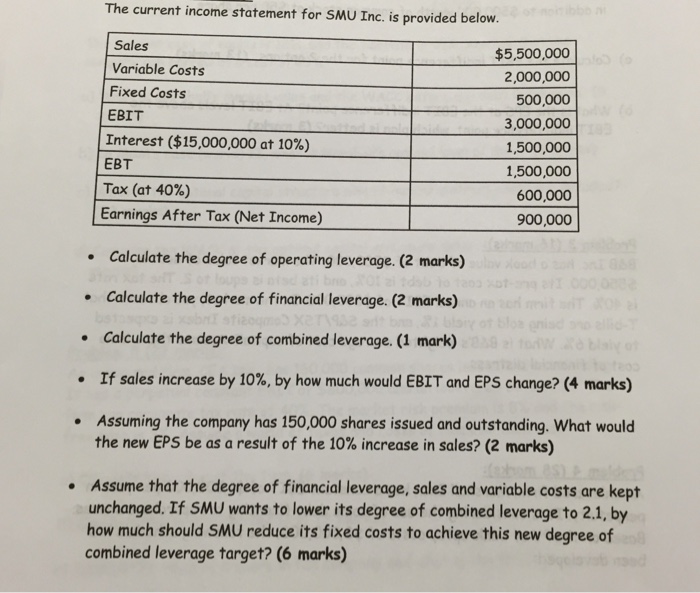

Question: The current income statement for SMU Inc. is provided below. Calculate the degree of operating leverage. Calculate the degree of financial leverage. Calculate the degree

The current income statement for SMU Inc. is provided below. Calculate the degree of operating leverage. Calculate the degree of financial leverage. Calculate the degree of combined leverage. If sales increase by 10%, by how much would EBIT and EPS change? Assuming the company has 150,000 shares issued and outstanding. What would the new EPS be as a result of the 10% increase in sales? Assume that the degree of financial leverage, sales and variable costs are kept unchanged. If SMU wants to lower its degree of combined leverage to 2.1, by how much should SMU reduce its fixed costs to achieve this new degree of combined leverage target

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts