Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The current price of a non-dividend-paying stock is $100 and you expect the stock price to be either $210 or $40 after 0.5 years. A

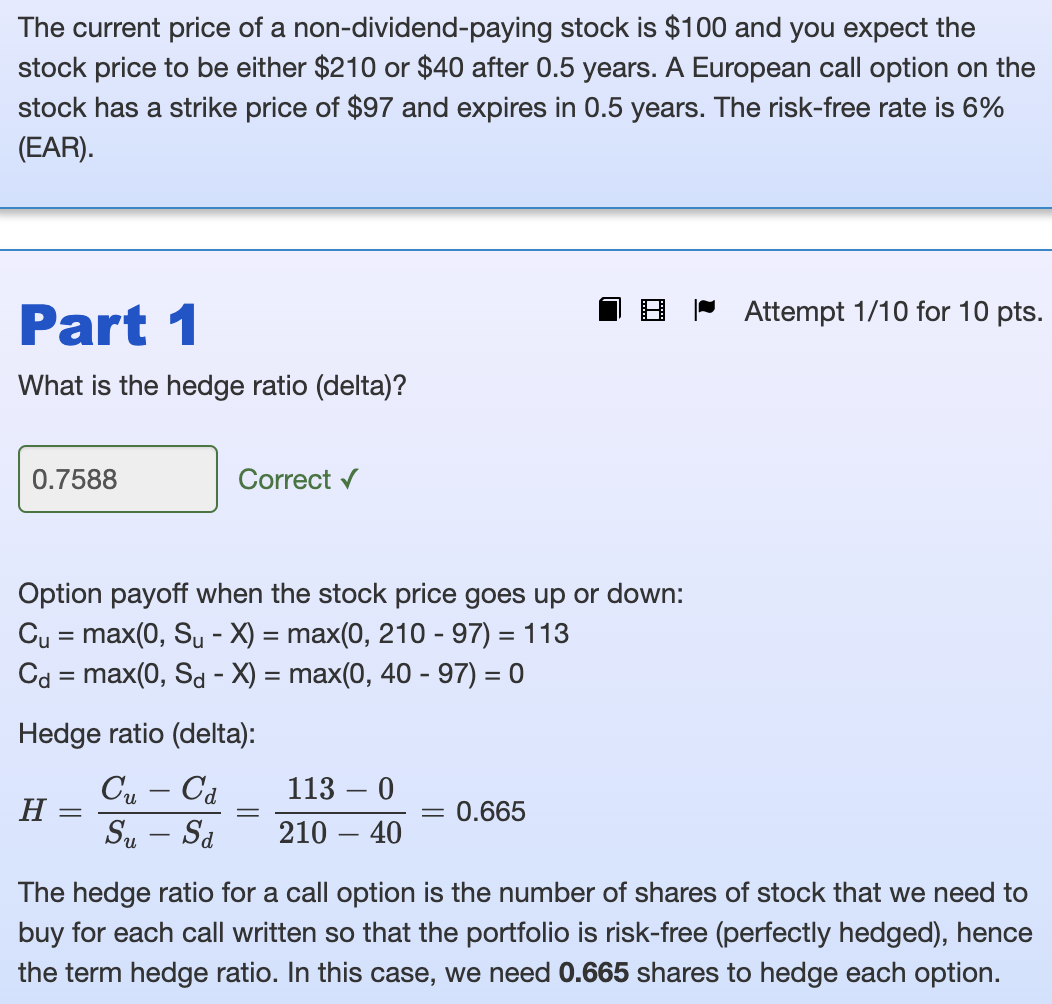

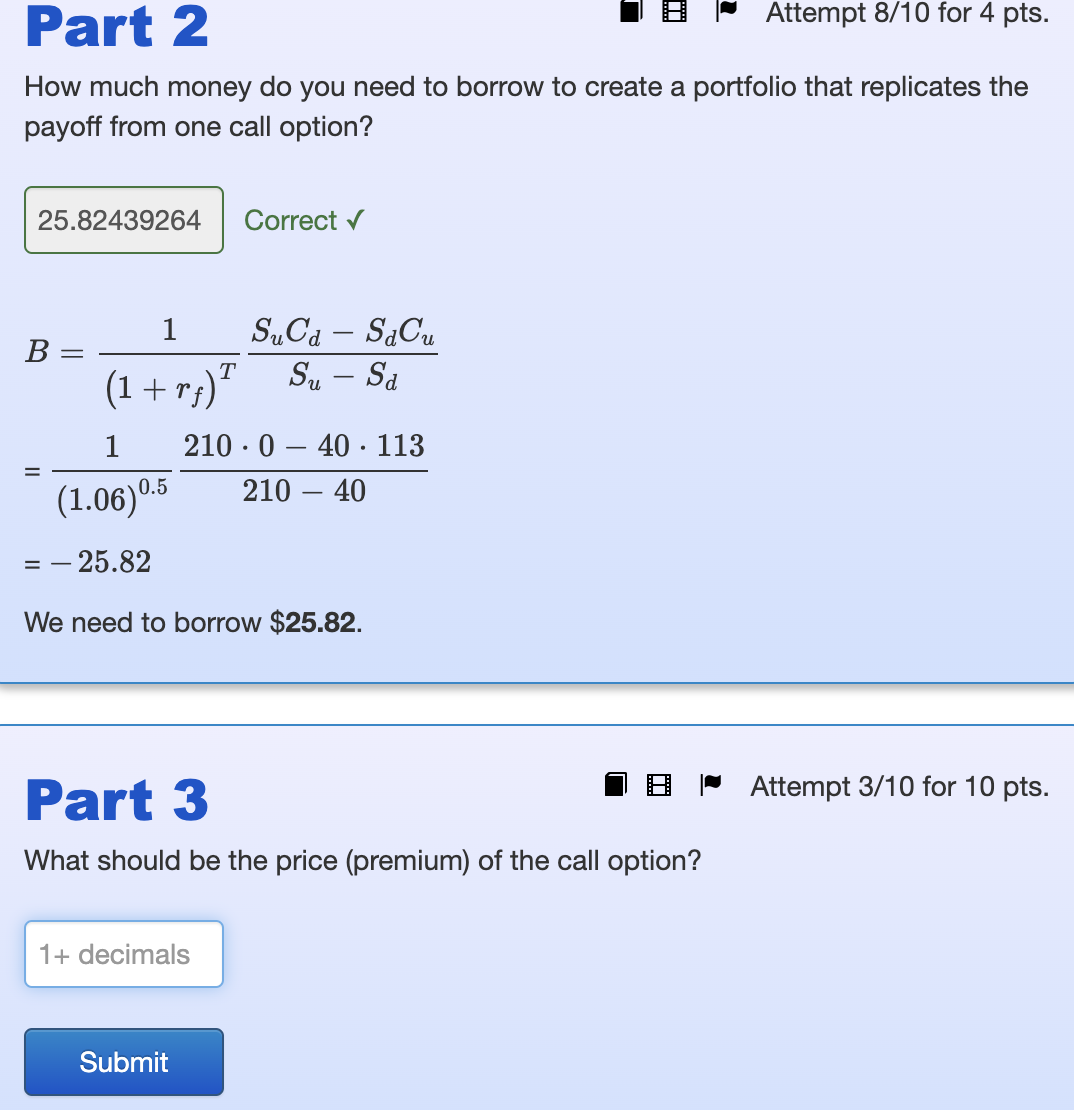

The current price of a non-dividend-paying stock is $100 and you expect the stock price to be either $210 or $40 after 0.5 years. A European call option on the stock has a strike price of $97 and expires in 0.5 years. The risk-free rate is 6% (EAR). Part 1 Attempt 1/10 for 10 pts. What is the hedge ratio (delta)? Correct Option payoff when the stock price goes up or down: Cu=max(0,SuX)=max(0,21097)=113Cd=max(0,SdX)=max(0,4097)=0 Hedge ratio (delta): H=SuSdCuCd=210401130=0.665 The hedge ratio for a call option is the number of shares of stock that we need to buy for each call written so that the portfolio is risk-free (perfectly hedged), hence the term hedge ratio. In this case, we need 0.665 shares to hedge each option. How much money do you need to borrow to create a portfolio that replicates the payoff from one call option? Correct B=(1+rf)T1SuSdSuCdSdCu=(1.06)0.5121040210040113=25.82 We need to borrow $25.82. Part 3 Attempt 3/10 for 10 pts. What should be the price (premium) of the call option

The current price of a non-dividend-paying stock is $100 and you expect the stock price to be either $210 or $40 after 0.5 years. A European call option on the stock has a strike price of $97 and expires in 0.5 years. The risk-free rate is 6% (EAR). Part 1 Attempt 1/10 for 10 pts. What is the hedge ratio (delta)? Correct Option payoff when the stock price goes up or down: Cu=max(0,SuX)=max(0,21097)=113Cd=max(0,SdX)=max(0,4097)=0 Hedge ratio (delta): H=SuSdCuCd=210401130=0.665 The hedge ratio for a call option is the number of shares of stock that we need to buy for each call written so that the portfolio is risk-free (perfectly hedged), hence the term hedge ratio. In this case, we need 0.665 shares to hedge each option. How much money do you need to borrow to create a portfolio that replicates the payoff from one call option? Correct B=(1+rf)T1SuSdSuCdSdCu=(1.06)0.5121040210040113=25.82 We need to borrow $25.82. Part 3 Attempt 3/10 for 10 pts. What should be the price (premium) of the call option Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started