Question

The current price of a non-dividend-paying stock is 73. The continuously compounded risk- free rate is 4%. The following table has prices and Greeks for

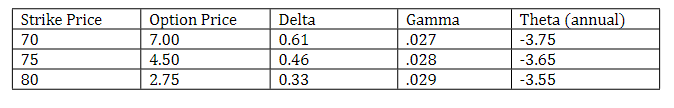

The current price of a non-dividend-paying stock is 73. The continuously compounded risk- free rate is 4%. The following table has prices and Greeks for nine-month call options on the stock:

a. Estimate the price of the 75-strike call option if the stock price three days from today is 70. b. A portfolio consists of the following: 4 long call options with K=70 3 short call options with K=80 6 long put options with K=75 2 short put options with K=70 N shares of stock Determine the value of N (which can be positive or negative) so that the portfolio is delta neutral.

Strike Price 70 75 80 Option Price 7.00 4.50 2.75 Delta 0.61 0.46 0.33 Gamma .027 .028 .029 Theta (annual) -3.75 -3.65 -3.55Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started