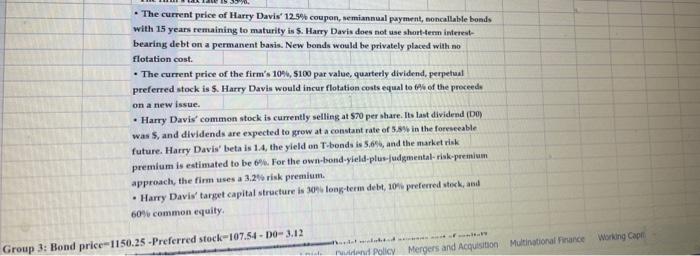

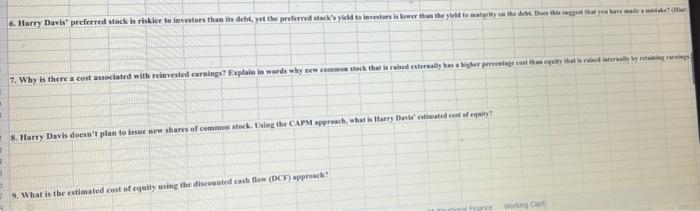

- The current price of Harry Davis" 1250 coupon, semianmual payment, eoncallable bonds With 15 years remuaining to maturity is 5 . Harry Davis does not use shart-tenm intereotbearing debt on a permanent basis. New bonds would be privately placed wish no flotation cost. - The current price of the firm's 10\%6, 5100 par value, quarterly dividend, perpetual preferred atock is 5 . Harry Davis would incur flotation costs equal to for of the proceede on anew issue. - Harry Davis' commmon stock is currently selling at 570 per share. Its last dividend (D0P) Was $, and dividends are expected to grow at a constant rate of 5.9% in the foreseeable future. Harry Davis" beta is 1.4, the yield on T-bonds is 5.650, and the market risk premium is estimated to be 6% For the own-bond-yield-plus-fudgmental-risk-premiam approach, the firm uses a 3,2 th risk premium. - Harry Davis' target capital stracture is 30-4 long-tera debt, 10nie preferred stodk, abal 60 - common evaity, 9. What is the cstimated cost ef cquity using the discuested cath fow (DCH) apprasch? Wharcs of common stock. Using the CAPNI approach, what is Harry Davis' catimatrd cest of cquity? singt the discousted cash flow (DC'F) *ppreach? - The current price of Harry Davis" 1250 coupon, semianmual payment, eoncallable bonds With 15 years remuaining to maturity is 5 . Harry Davis does not use shart-tenm intereotbearing debt on a permanent basis. New bonds would be privately placed wish no flotation cost. - The current price of the firm's 10\%6, 5100 par value, quarterly dividend, perpetual preferred atock is 5 . Harry Davis would incur flotation costs equal to for of the proceede on anew issue. - Harry Davis' commmon stock is currently selling at 570 per share. Its last dividend (D0P) Was $, and dividends are expected to grow at a constant rate of 5.9% in the foreseeable future. Harry Davis" beta is 1.4, the yield on T-bonds is 5.650, and the market risk premium is estimated to be 6% For the own-bond-yield-plus-fudgmental-risk-premiam approach, the firm uses a 3,2 th risk premium. - Harry Davis' target capital stracture is 30-4 long-tera debt, 10nie preferred stodk, abal 60 - common evaity, 9. What is the cstimated cost ef cquity using the discuested cath fow (DCH) apprasch? Wharcs of common stock. Using the CAPNI approach, what is Harry Davis' catimatrd cest of cquity? singt the discousted cash flow (DC'F) *ppreach