Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me solve this problem with excel formulas please and thank you!! A financial planning service offers a unique program for parents to save

please help me solve this problem with excel formulas please and thank you!!

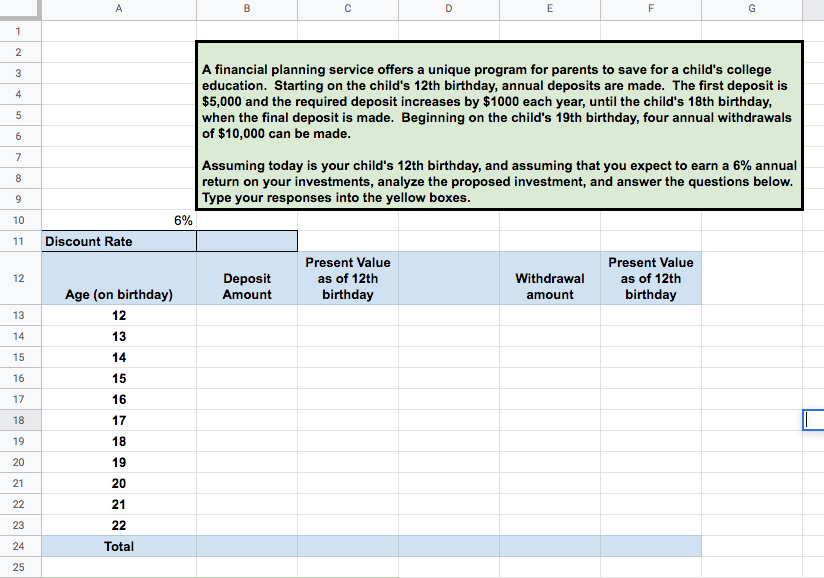

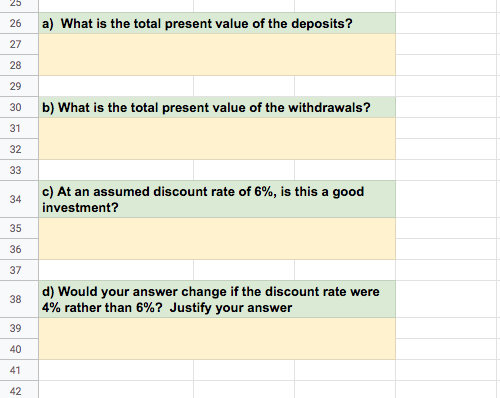

A financial planning service offers a unique program for parents to save for a child's college education. Starting on the child's 12th birthday, annual deposits are made. The first deposit is $5,000 and the required deposit increases by $1000 each year, until the child's 18th birthday, when the final deposit is made. Beginning on the child's 19th birthday, four annual withdrawals of $10,000 can be made. Assuming today is your child's 12th birthday, and assuming that you expect to earn a 6% annual return on your investments, analyze the proposed investment, and answer the questions below. Type your responses into the yellow boxes. 6% Discount Rate Present Value as of 12th birthday Deposit Amount Age (on birthday) Present Value as of 12th birthday Withdrawal amount 13 21 22 Total 25 a) What is the total present value of the deposits? 27 29 30 b) What is the total present value of the withdrawals? c) At an assumed discount rate of 6%, is this a good investment? d) Would your answer change if the discount rate were 4% rather than 6%? Justify your answer 41Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started