The current price of one share of stock is 70.00. The stock pays no dividends. The risk-free rate is 3%. One year call and

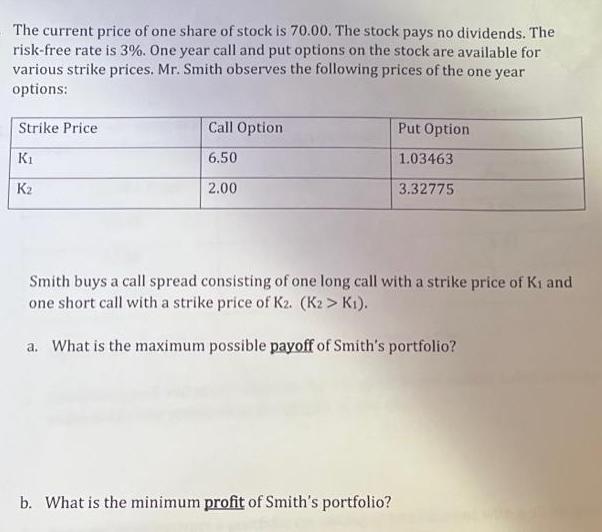

The current price of one share of stock is 70.00. The stock pays no dividends. The risk-free rate is 3%. One year call and put options on the stock are available for various strike prices. Mr. Smith observes the following prices of the one year options: Strike Price K Kz Call Option 6.50 2.00 Put Option 1.03463 3.32775 Smith buys a call spread consisting of one long call with a strike price of Ki and one short call with a strike price of K2. (K2> K1). a. What is the maximum possible payoff of Smith's portfolio? b. What is the minimum profit of Smith's portfolio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The maximum possible payoff of Smiths call spread portfolio is achieved when the stock price at ex...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started