Answered step by step

Verified Expert Solution

Question

1 Approved Answer

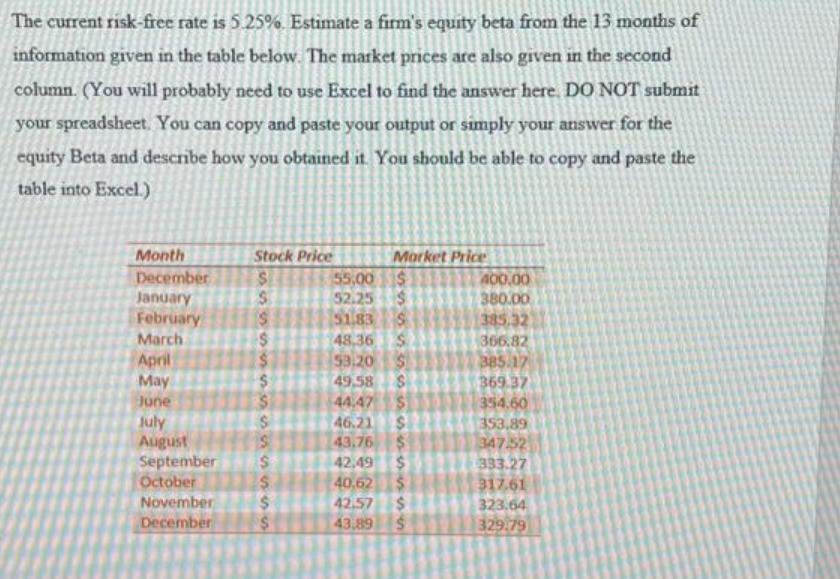

The current risk-free rate is 5.25%. Estimate a firm's equity beta from the 13 months of information given in the table below. The market

The current risk-free rate is 5.25%. Estimate a firm's equity beta from the 13 months of information given in the table below. The market prices are also given in the second column. (You will probably need to use Excel to find the answer here. DO NOT submit your spreadsheet. You can copy and paste your output or simply your answer for the equity Beta and describe how you obtained it. You should be able to copy and paste the table into Excel.) Month December January February March April May June July August September October November December Stock Price S S $ $ $ $ $ $ $ SSSS $ $ $ Market Price 55.00 1$ 52.25 5555 49,58 44.47 51.83 S 48,36 $ 53.20 $ $ $ 46.21 $ 43.76 $ 42.49 $ 40,62 42.57 $ 43.89 $ 400,00 380.00 385.32 366.82 385.17 369.37 354.60 353,89 347.52 333.27 317.61 323.64 329.79

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started