Answered step by step

Verified Expert Solution

Question

1 Approved Answer

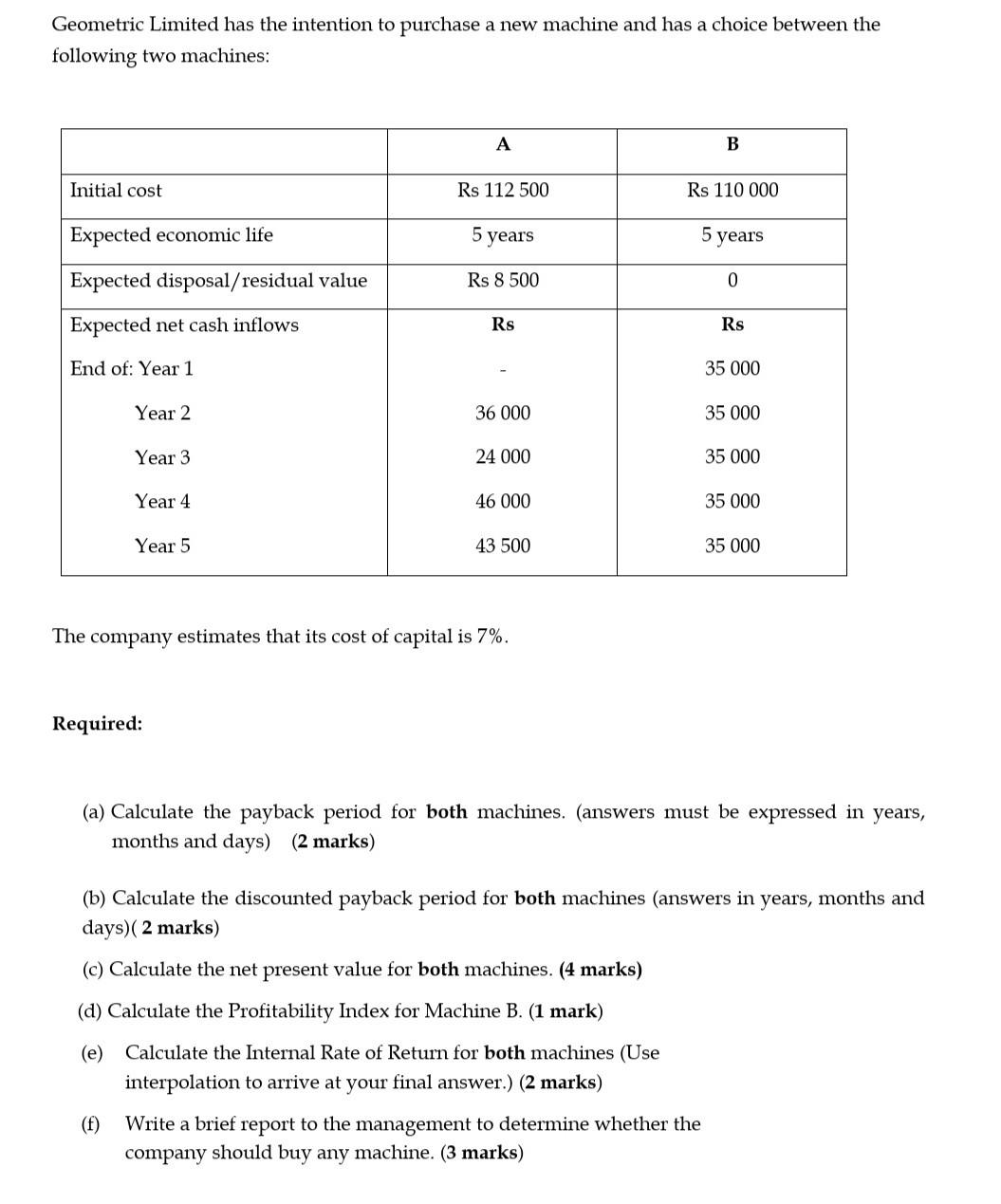

Geometric Limited has the intention to purchase a new machine and has a choice between the following two machines: Initial cost Expected economic life

Geometric Limited has the intention to purchase a new machine and has a choice between the following two machines: Initial cost Expected economic life Expected disposal/residual value Expected net cash inflows End of: Year 1 Year 2 Year 3 Year 4 Year 5 Required: (f) A Rs 112 500 5 years Rs 8 500 Rs. 36 000 24 000 46 000 The company estimates that its cost of capital is 7%. 43 500 (c) Calculate the net present value for both machines. (4 marks) (d) Calculate the Profitability Index for Machine B. (1 mark) (e) Calculate the Internal Rate of Return for both machines (Use interpolation to arrive at your final answer.) (2 marks) Rs 110 000 5 B years 0 Write a brief report to the management to determine whether the company should buy any machine. (3 marks) Rs 35 000 35 000 35 000 (a) Calculate the payback period for both machines. (answers must be expressed in years, months and days) (2 marks) 35 000 (b) Calculate the discounted payback period for both machines (answers in years, months and days) (2 marks) 35 000

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a Payback Period For Machine A Year 1 Rs 35000 Year 2 Rs 36000 Year 3 Rs 24000 Year 4 Rs 46000 Year 5 Rs 43500 Cumulative Cash Flow Year 1 Rs 35000 Year 2 Rs 71000 35000 36000 Year 3 Rs 95000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started