Answered step by step

Verified Expert Solution

Question

1 Approved Answer

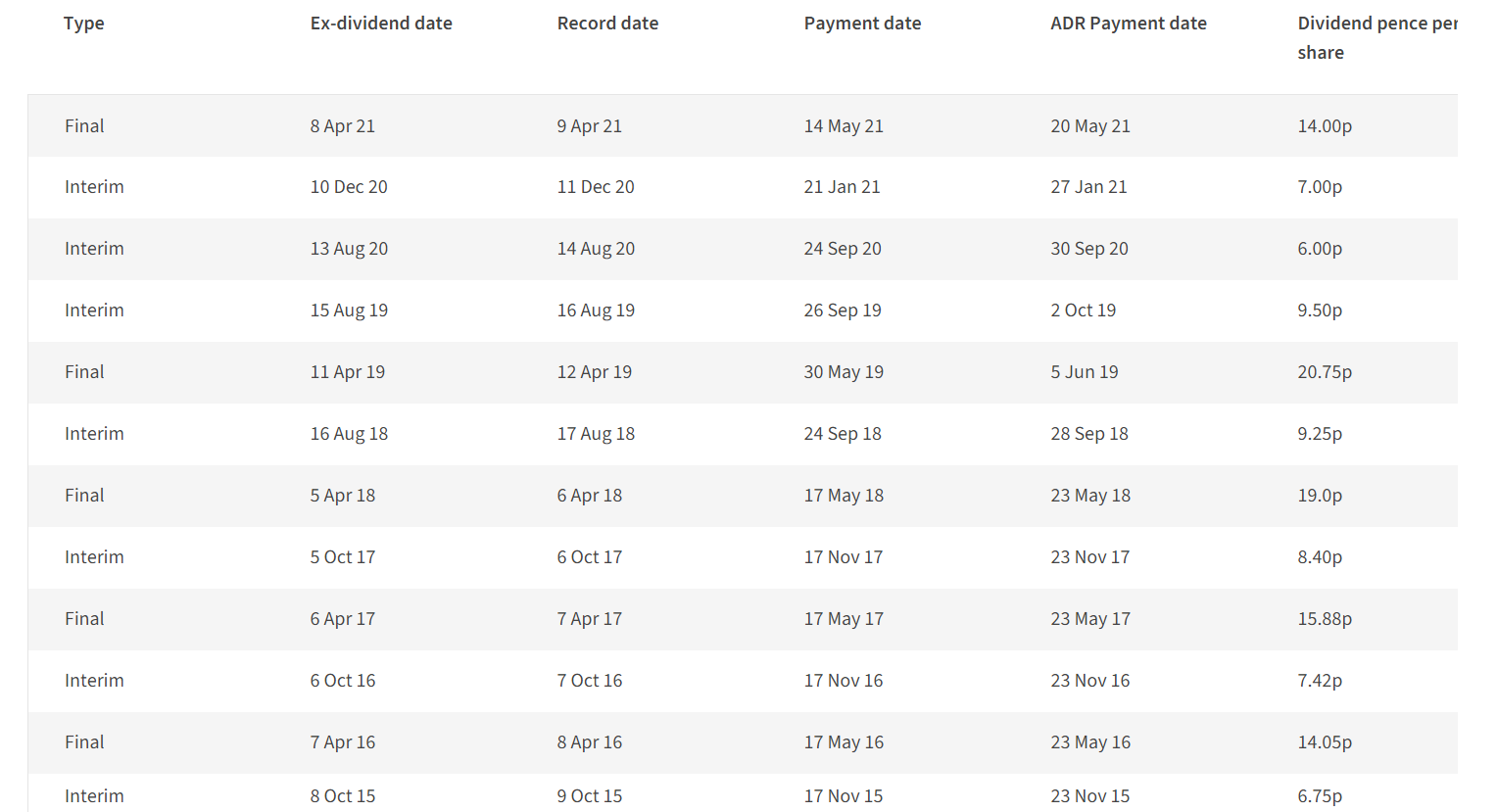

the current share price is 415.7 GBP and the annual total dividend is 14 pence a) Locate your company's annual dividend per share and calculate

the current share price is 415.7 GBP and the annual total dividend is 14 pence

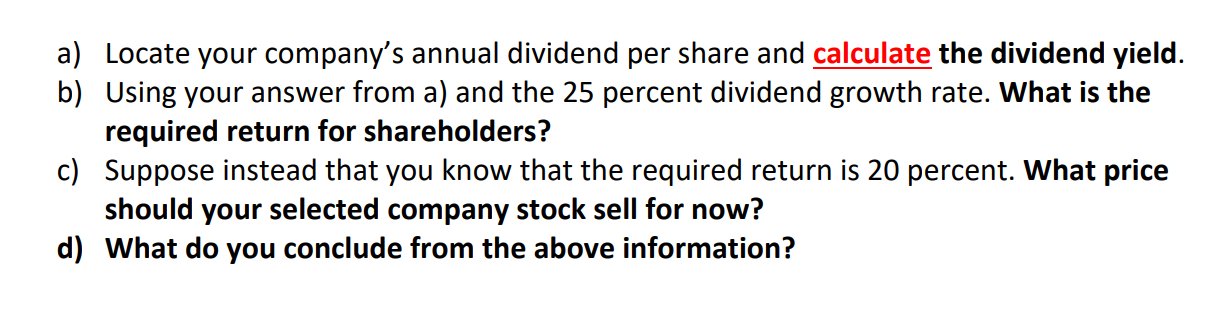

a) Locate your company's annual dividend per share and calculate the dividend yield. b) Using your answer from a) and the 25 percent dividend growth rate. What is the required return for shareholders? c) Suppose instead that you know that the required return is 20 percent. What price should your selected company stock sell for now? d) What do you conclude from the above information? Latest dividend 14p 14/05/21 Final dividend Payment date 09/04/21 08/04/21 Record date Ex-dividend date Type Ex-dividend date Record date Payment date ADR Payment date Dividend pence per share Final 8 Apr 21 9 Apr 21 14 May 21 20 May 21 14.00p Interim 10 Dec 20 11 Dec 20 21 Jan 21 27 Jan 21 7.00p Interim 13 Aug 20 14 Aug 20 24 Sep 20 30 Sep 20 6.00p Interim 15 Aug 19 16 Aug 19 26 Sep 19 2 Oct 19 9.50p Final 11 Apr 19 12 Apr 19 30 May 19 5 Jun 19 20.75p Interim 16 Aug 18 17 Aug 18 24 Sep 18 28 Sep 18 9.25p Final 5 Apr 18 6 Apr 18 17 May 18 23 May 18 19.0p Interim 5 Oct 17 6 Oct 17 17 Nov 17 23 Nov 17 8.40p Final 6 Apr 17 7 Apr 17 17 May 17 23 May 17 15.88p Interim 6 Oct 16 7 Oct 16 17 Nov 16 23 Nov 16 7.42p Final 7 Apr 16 8 Apr 16 17 May 16 23 May 16 14.05p Interim 8 Oct 15 9 Oct 15 17 Nov 15 23 Nov 15 6.75p a) Locate your company's annual dividend per share and calculate the dividend yield. b) Using your answer from a) and the 25 percent dividend growth rate. What is the required return for shareholders? c) Suppose instead that you know that the required return is 20 percent. What price should your selected company stock sell for now? d) What do you conclude from the above information? Latest dividend 14p 14/05/21 Final dividend Payment date 09/04/21 08/04/21 Record date Ex-dividend date Type Ex-dividend date Record date Payment date ADR Payment date Dividend pence per share Final 8 Apr 21 9 Apr 21 14 May 21 20 May 21 14.00p Interim 10 Dec 20 11 Dec 20 21 Jan 21 27 Jan 21 7.00p Interim 13 Aug 20 14 Aug 20 24 Sep 20 30 Sep 20 6.00p Interim 15 Aug 19 16 Aug 19 26 Sep 19 2 Oct 19 9.50p Final 11 Apr 19 12 Apr 19 30 May 19 5 Jun 19 20.75p Interim 16 Aug 18 17 Aug 18 24 Sep 18 28 Sep 18 9.25p Final 5 Apr 18 6 Apr 18 17 May 18 23 May 18 19.0p Interim 5 Oct 17 6 Oct 17 17 Nov 17 23 Nov 17 8.40p Final 6 Apr 17 7 Apr 17 17 May 17 23 May 17 15.88p Interim 6 Oct 16 7 Oct 16 17 Nov 16 23 Nov 16 7.42p Final 7 Apr 16 8 Apr 16 17 May 16 23 May 16 14.05p Interim 8 Oct 15 9 Oct 15 17 Nov 15 23 Nov 15 6.75pStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started