Question

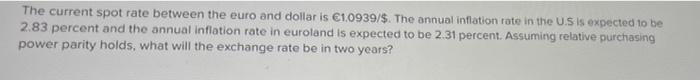

The current spot rate between the euro and dollar is 1.0939/$. The annual inflation rate in the US is expected to be 2.83 percent

The current spot rate between the euro and dollar is 1.0939/$. The annual inflation rate in the US is expected to be 2.83 percent and the annual inflation rate in euroland is expected to be 2.31 percent. Assuming relative purchasing power parity holds, what will the exchange rate be in two years?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the exchange rate in two years based on relative purchasing power parity PPP we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Finance Applications and Theory

Authors: Marcia Cornett, Troy Adair

3rd edition

1259252221, 007786168X, 9781259252228, 978-0077861681

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App