Question

The current yield on 10-year Treasury notes is 2.92%. You estimate the market risk premium to be 5.5%. Using this information, along with the beta

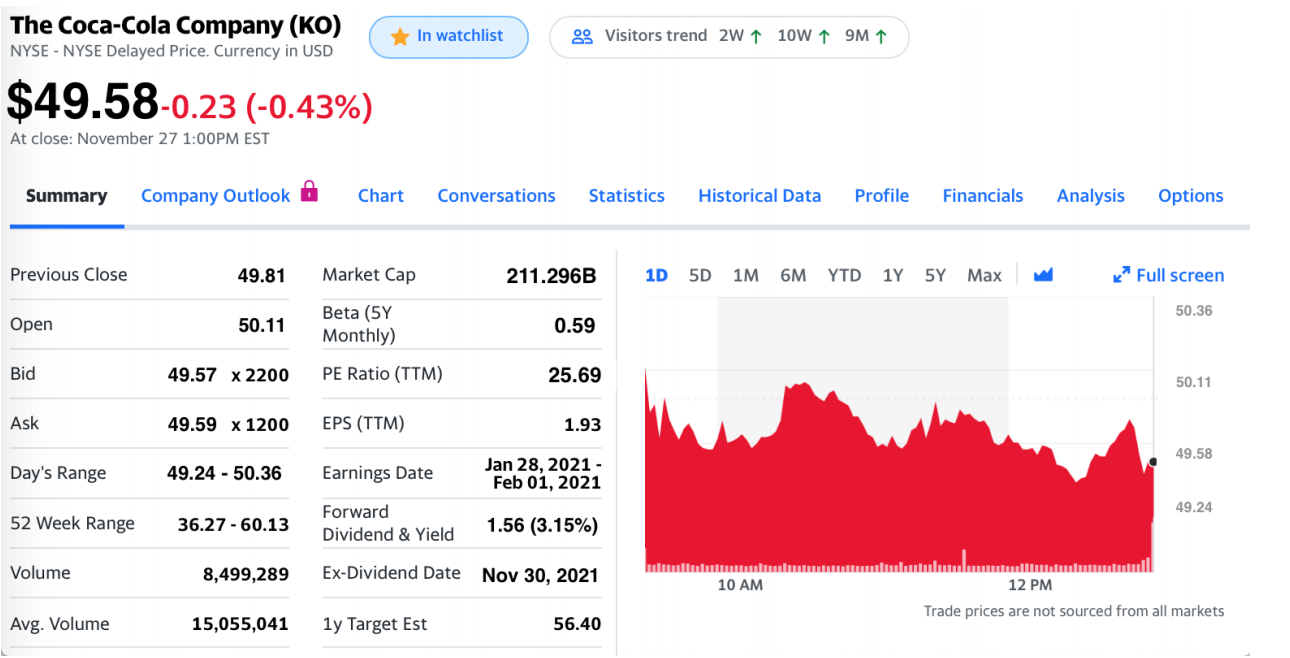

The current yield on 10-year Treasury notes is 2.92%. You estimate the market risk premium to be 5.5%. Using this information, along with the beta of KOs common equity provided by Yahoo! in the above quote, calculate KOs cost of common equity using the capital asset pricing model (CAPM). Question 3) KOs cost of equity using CAPM is _________________%

KO stock is priced at $49.58, you anticipate next years dividend to be $1.56, and long-run earnings are expected to grow at 4%. Calculate the firms cost of common equity capital using the constant dividend growth model (CDGM). Question 4) KOs cost of equity using CDGM is __________________%

KO stock is priced at $49.58, you anticipate next years dividend to be $1.56, and long-run earnings are expected to grow at 4%. Calculate the firms cost of common equity capital using the constant dividend growth model (CDGM). Question 4) KOs cost of equity using CDGM is __________________%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started