Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the d= monthly payment is 1093.13 R= interst tate 4.63 Find the future value of the home 10 years after you purchased it assuming a

the d= monthly payment is 1093.13

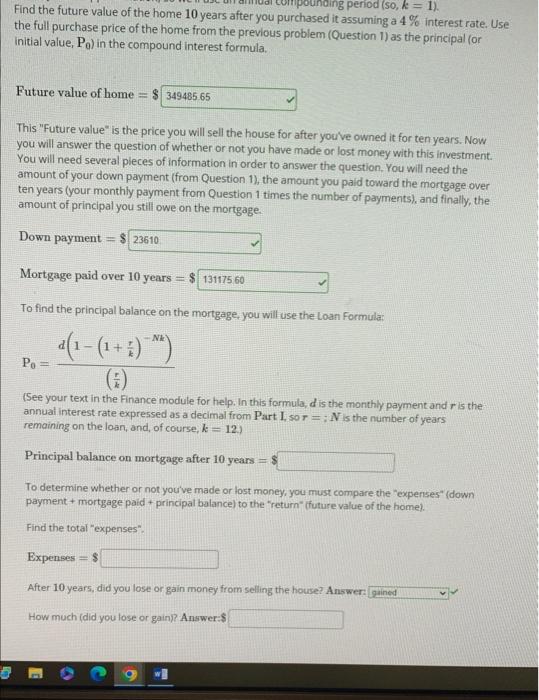

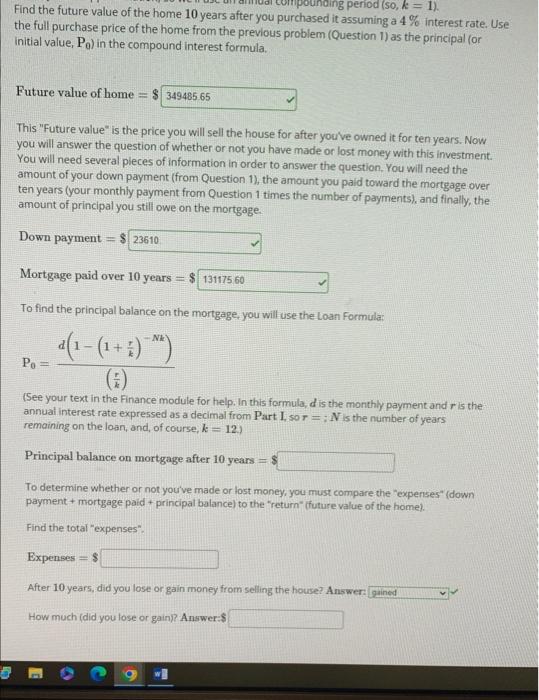

Find the future value of the home 10 years after you purchased it assuming a 4% interest rate. Use the full purchase price of the home from the previous problem (Question 1) as the principal (or initial value, P0 ) in the compound interest formula. Future value of home =$ This "Future value" is the price you will sell the house for after you've owned it for ten years. Now you will answer the question of whether or not you have made or lost money with this investment. You will need several pleces of information in order to answer the question. You will need the amount of your down payment (from Question 1), the amount you paid toward the mortgage over ten years (your monthly payment from Question 1 times the number of payments), and finally, the amount of principal you still owe on the mortgage. Down payment =$ Mortgage paid over 10 years =$ To find the principal balance on the mortgage, you will use the Loan Formula: P0=(kr)d(1(1+kr)Nk) (See your text in the Finance module for help, In this formula, d is the monthly payment and r is the: annual interest rate expressed as a decimal from Part I, so r=;N is the number of years remaining on the loan, and, of course, k=12.) Principal balance on mortgage after 10 years =? To determine whether or not you've made or lost money, you must compare the "expenses" (down payment + mortgage paid + principal balance) to the "return" (future value of the home). Find the total "expenses". Expenses=$ After 10 years, did you lose or gain money from selling the house? Answer: How much (did you lose or gain)? Answer-\$ R= interst tate 4.63

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started