Answered step by step

Verified Expert Solution

Question

1 Approved Answer

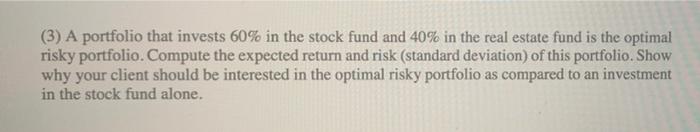

the data. (3) A portfolio that invests 60% in the stock fund and 40% in the real estate fund is the optimal risky portfolio. Compute

the data.

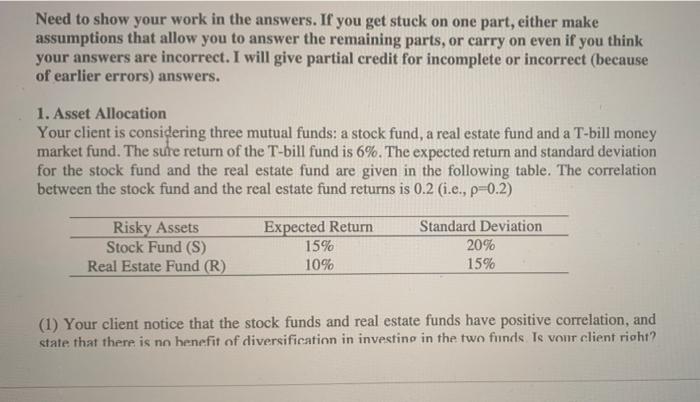

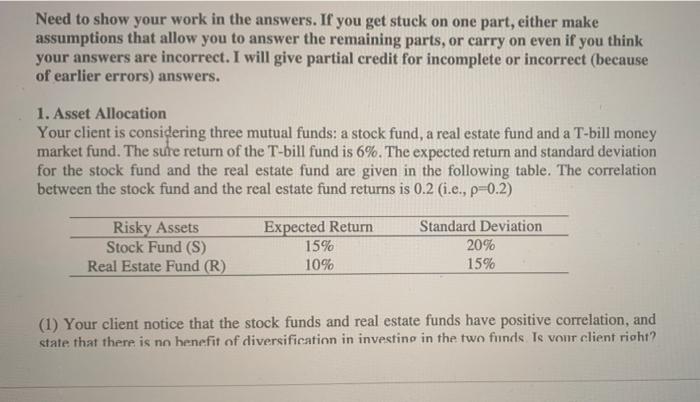

(3) A portfolio that invests 60% in the stock fund and 40% in the real estate fund is the optimal risky portfolio. Compute the expected return and risk (standard deviation) of this portfolio Show why your client should be interested in the optimal risky portfolio as compared to an investment in the stock fund alone. Need to show your work in the answers. If you get stuck on one part, either make assumptions that allow you to answer the remaining parts, or carry on even if you think your answers are incorrect. I will give partial credit for incomplete or incorrect (because of earlier errors) answers. a 1. Asset Allocation Your client is considering three mutual funds: a stock fund, a real estate fund and a T-bill money market fund. The sure return of the T-bill fund is 6%. The expected return and standard deviation for the stock fund and the real estate fund are given in the following table. The correlation between the stock fund and the real estate fund returns is 0.2 (i.e., p=0.2) Risky Assets Stock Fund (S) Real Estate Fund (R) Expected Return 15% 10% Standard Deviation 20% 15% (1) Your client notice that the stock funds and real estate funds have positive correlation, and state that there is no benefit of diversification in investing in the two funds Is vont client richt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started