Question

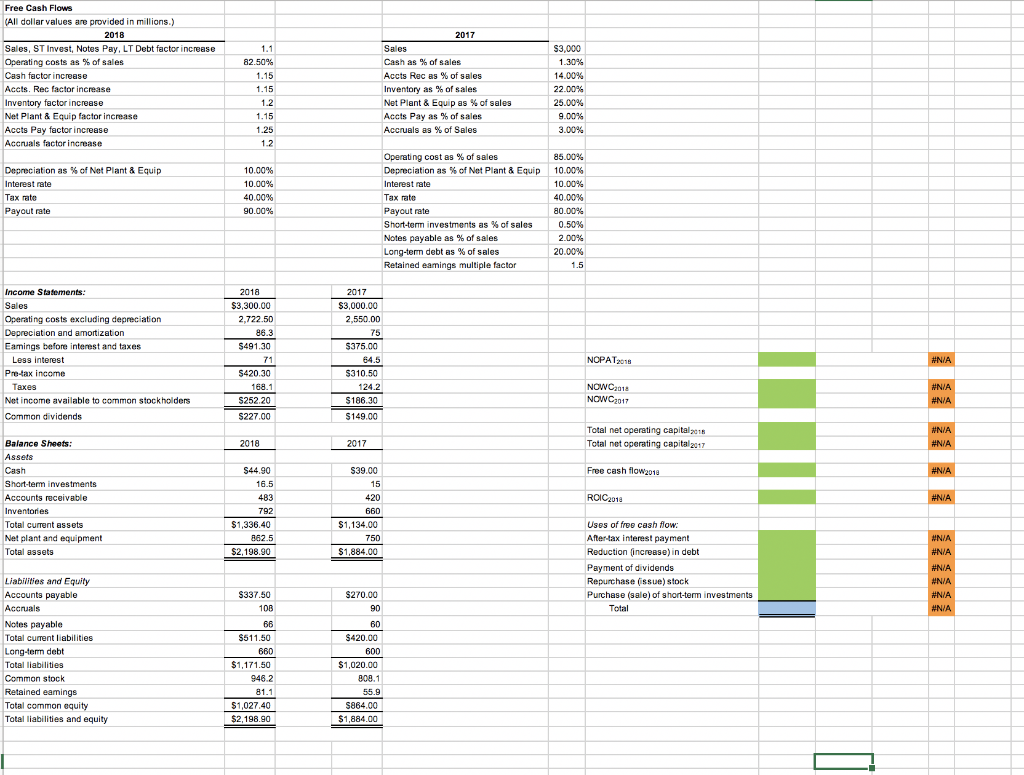

The data for Rhodes Corporation's has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer

The data for Rhodes Corporation's has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below.

What is the net operating profit after taxes (NOPAT) for 2018? Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not round intermediate calculations. Round your answer to one decimal place.

-

$ _______ million

-

What are the amounts of net operating working capital for both years? Enter your answers in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not round intermediate calculations. Round your answers to one decimal place.

2018 $ _______ million

2017 $ _______ million

-

What are the amounts of total net operating capital for both years? Enter your answers in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not round intermediate calculations. Round your answers to one decimal place.

2018 $ _______ million

2017 $ _______ million

-

What is the free cash flow for 2018? Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not round intermediate calculations. Round your answer to one decimal place.

$ _______ million

-

What is the ROIC for 2018? Round your answer to one decimal place.

_______%

-

How much of the FCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stock repurchases, and net purchases of short-term investments? (Hint: Remember that a net use can be negative.) Enter your answers in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not round intermediate calculations. Round your answers to one decimal place.

After-tax interest payment $ _______ million Reduction (increase) in debt $ _______ million Payment of dividends $ _______ million Repurchase (Issue) stock $ _______ million Purchase (Sale) of short-term investments $ _______ million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started