Answered step by step

Verified Expert Solution

Question

1 Approved Answer

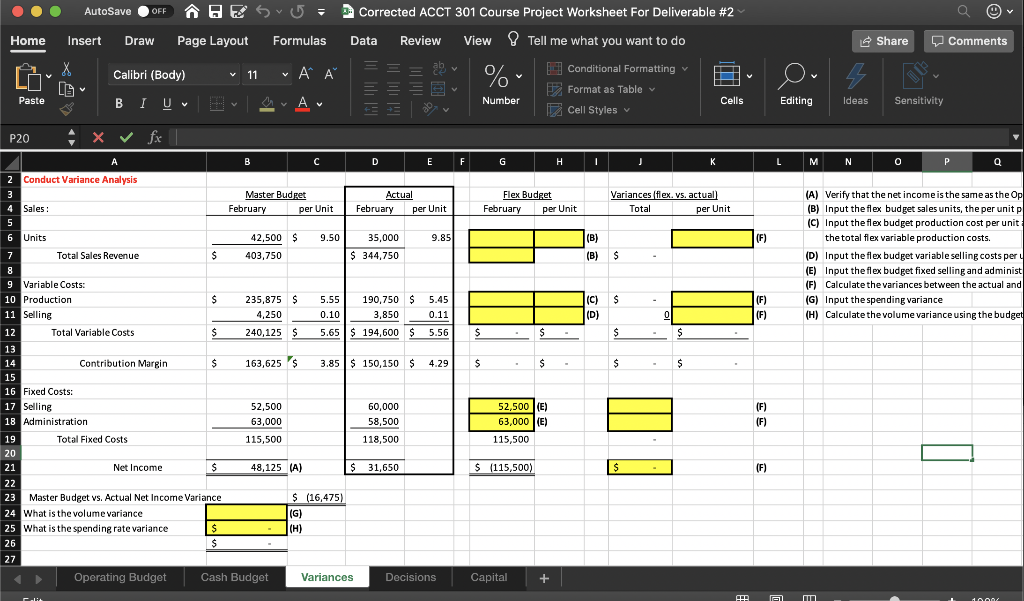

The data for the February master budget columns should come over from the operating budget worksheet. The corrected operating budget worksheet will be provided. Please

The data for the February master budget columns should come over from the operating budget worksheet. The corrected operating budget worksheet will be provided. Please do not use your submission from Deliverable #1. Verify that the master budget Net Income is the same as that reported in Sheet #1. Complete a flexible budget for February, showing what net income should have been using the operating budget revenue rate, variable expenses' rates, and fixed costs.

- Given actual results and the operating budgeted rates, prepare a flexible budget for 1 month. Actual operating results for the month are provided. DO NOT CHANGE THIS DATA.

- Calculate the variances between the flexible budget and actual results, as being either F for favorable or U for unfavorable. Determine how much of the Net Income variance was due to volume and how much was rate-related. Explain deviations from plan. How would you evaluate the actual results? What steps would you take to further investigate and possibly adjust your budget for the rest of the year?

Incremental Analysis: Do We Outsource?

- Given the relevant costs from the operating budget, prepare a worksheet comparing the relevant data to a vendor's price quote for doing the production currently done in-house.

- Given avoidable costs, calculate whether the outsourcing decision will save costs in total. Provide an opinion as to whether this business deal is acceptable. Are there any nonfinancial considerations?

- Given actual results and the operating budgeted rates, prepare a flexible budget for 1 month.

- Explain deviations from plan.

Incremental Analysis: Do We Outsource? (Week 5)

- Using the operating budget for the quarter, prepare the relevant costs for in-house production.

- Given avoidable costs, calculate whether the outsourcing decision will save costs in total.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started