Answered step by step

Verified Expert Solution

Question

1 Approved Answer

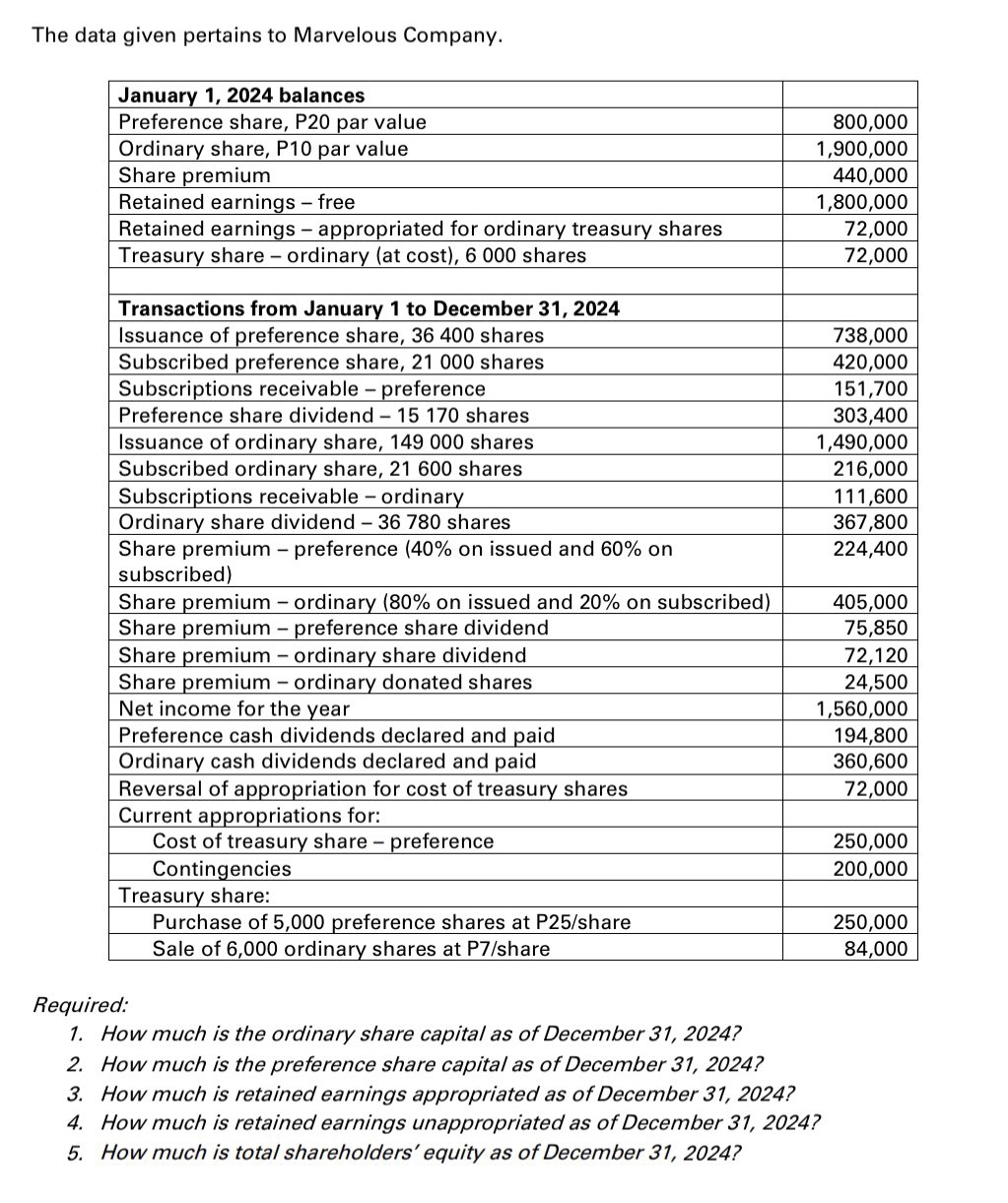

The data given pertains to Marvelous Company. January 1, 2024 balances Preference share, P20 par value 800,000 Ordinary share, P10 par value 1,900,000 Share

The data given pertains to Marvelous Company. January 1, 2024 balances Preference share, P20 par value 800,000 Ordinary share, P10 par value 1,900,000 Share premium 440,000 Retained earnings - free 1,800,000 Retained earnings - appropriated for ordinary treasury shares 72,000 Treasury share - ordinary (at cost), 6 000 shares 72,000 Transactions from January 1 to December 31, 2024 Issuance of preference share, 36 400 shares Subscribed preference share, 21 000 shares Subscriptions receivable - preference Preference share dividend - 15 170 shares Issuance of ordinary share, 149 000 shares Subscribed ordinary share, 21 600 shares Subscriptions receivable - ordinary Ordinary share dividend - 36 780 shares 738,000 420,000 151,700 303,400 1,490,000 216,000 111,600 367,800 Share premium - preference (40% on issued and 60% on 224,400 subscribed) Share premium - ordinary (80% on issued and 20% on subscribed) 405,000 Share premium - preference share dividend 75,850 Share premium - ordinary share dividend 72,120 Share premium - ordinary donated shares 24,500 Net income for the year 1,560,000 Preference cash dividends declared and paid 194,800 Ordinary cash dividends declared and paid 360,600 Reversal of appropriation for cost of treasury shares 72,000 Current appropriations for: Cost of treasury share - preference 250,000 Contingencies 200,000 Treasury share: Purchase of 5,000 preference shares at P25/share Sale of 6,000 ordinary shares at P7/share 250,000 84,000 Required: 1. How much is the ordinary share capital as of December 31, 2024? 2. How much is the preference share capital as of December 31, 2024? 3. How much is retained earnings appropriated as of December 31, 2024? 4. How much is retained earnings unappropriated as of December 31, 2024? 5. How much is total shareholders' equity as of December 31, 2024?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started