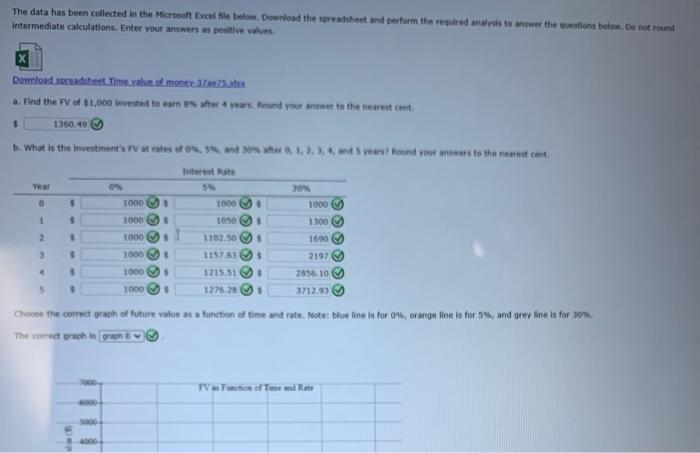

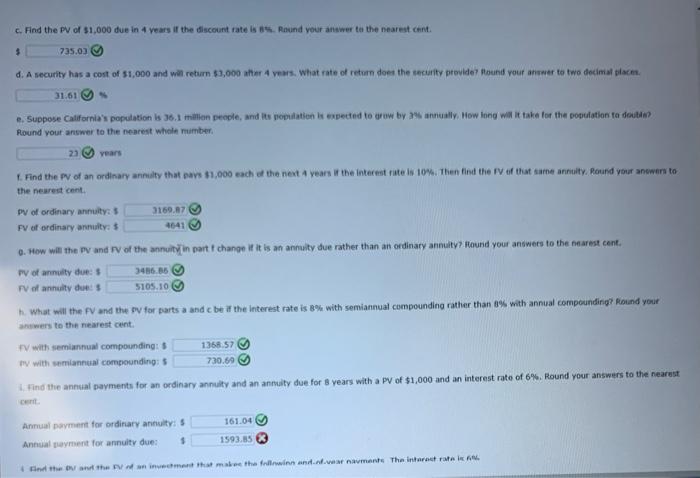

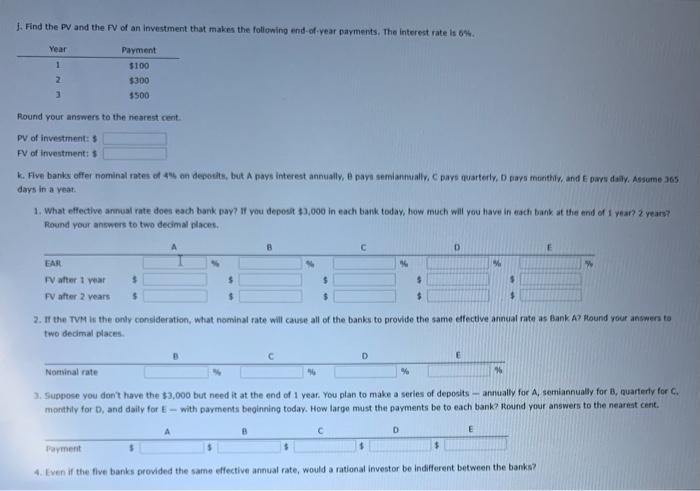

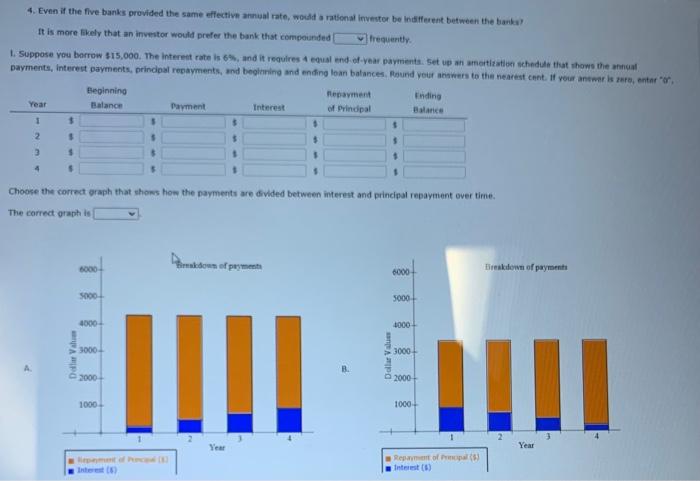

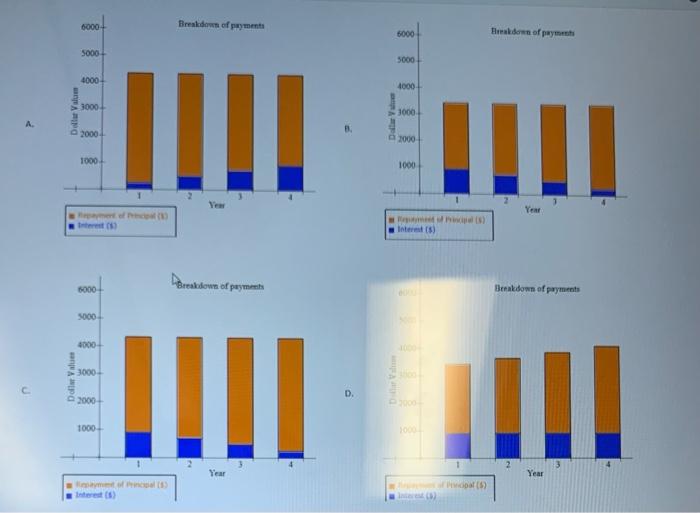

The data has been collected in the Microsoft Excel file below, Download the spreadsheet and perform the required analysis to swer the questions below. Do not found Intermediate calculations. Enter your answers as positive values. X Download readsheet Time.monte:3775x15 a. Find the FV of $1,000 invested to water 4 years. Round your answer to the nearest cent 1960:49 b. What is the investment's retraites, and so we , 1, 2, 3, 4, and are found your answer to the nearest cent Yen 30% 1000 0 5 1000 $ 1000 5 1 1000 $ 1050 1300 2 1000 1690 3 1000 $ 2192 1107.50 1157.53 1215.51 1276.28 4 5 . 1000 : 1000 . 2856.10 3712.92 5 $ Choose the correct graph of future value as a function of time and rate. Note: blue line is for 0%, orange line is for 5%, and grey line is for 30%. The correct graph is graphe 000 TV Function of wate NO 000 c. Find the PV of $1,000 due in 4 years if the discount rate is 1. Round your answer to the nearest cont. 735.03 d. A security has a cost of $1,000 and will return $3,000 after years. what rate of return does the county provide? Hound your answer to two decimat blacm. 31.61 Suppose California's population is 36.1 million people, and its population is expected to grow by annually. How long will it take for the population to death Round your answer to the nearest whole number 23 years Find the PV of an ordinary annuity that pays $1,000 each of the next years in the interest rate is 10%. Then find the IV of that same annuity. Round your answers to the nearest cont py of ordinary annuty: 3 3169.87 PV of ordinary annut: $ 4641 Q. How will the P and IV of the annuity in partt change if it is an annuity due rather than an ordinary annuity? Hound your answers to the nearest cont. PV of alty du: 348686 PV of annuity dues 5105.10 hWhat will the FV and the p for parts a and be of the Interest rate is 8% with semiannual compounding rather than 1% with annual compounding Round your wers to the nearest cent. V with semiannual compounding: 1368.57 tv with semiannual compounding: 5 730.69 Find the annual payments for an ordinary annuity and an annuity due for 8 years with a PV of $1,000 and an interest rate of 6%. Round your answers to the nearest Annual payment for ordinary annuity: 5 Annual payment for annuity due: 161.04 1593.85 find that the invece that make the winn and navmont The interest rate J. Find the PV and the IV of an investment that makes the following end-of-year payments. The interest rate is 0%. Payment $100 $300 Year 1 2 3 $500 Round your answers to the nearest cent PV of investment: FV of investments k. Five banks offer nominal rates of 4 on deposits, but A rays interest annually, pays semiannually. pars quarterly, pays monthly and we dwly. Assume 365 days in a year 1. What effective annual rate does each bank pay? If you deposit $3,000 in each bank today, how much will you have in each bank at the end of 1 year 2 years? Round your answers to two decimal places B D EAR $ $ PV after 1 year FV after 2 years $ $ $ $ $ $ $ $ 2. If the TVM is the only consideration, what nominal rate will cause all of the banks to provide the same effective annual rate as Bank A Hound your answers to two decimal places D E Nominal rate 36 56 3. Suppose you don't have the $3,000 but need it at the end of 1 year. You plan to make a series of deposits annually for A, semiannually for B, Quarterly for monthly for D, and daily for E-with payments beginning today. How large must the payments be to each bank? Round your answers to the nearest cent. B D E Payment $ 4. Even if the five banks provided the same effective annual rate, would a rational investor be indifferent between the banks? 4. Even if the five banks provided the same effective annual rate, would rational investor be Indifferent between the banks It is more likely that an investor would prefer the bank that compounded Frequently 1. Suppose you borrow $15,000. The Interest rate is 6, and it requires 4 equal end-of-year payments set up an amortization schedule that shows the annual payments, interest payments, principal repayments, and beginning and ending loan balances. Round your answers to the nearest cont. If your answer is maro, entro Beginning repayment Year Balance Payment Interest of Principal 1 $ $ $ 2 $ $ $ 3 $ $ 5 1 Choose the correct graph that shows how the payments are divided between interest and principal repayment over time The correct graphis Parmakdown of payment 6000 6000 Breakdown of payment 5000 5000+ 1000 1000 3000 Di Val 3000+ Dal Values A 2000 III 2000+ III 1000 1000 Year Year Rent of Interest +0009 Baldones of payment 0009 Bakdown of payment tooos 5000 1000 4000 3000+ 3000 A 2000 2000 Im 1000+ 1000 Yew Year Interests) 5000 Breakdown of paymes Beatdown of payments 5000 4000 3000 Dolle Value . D. I 3000+ 1000+ 200 2 3 Year Year mamos Interest (8) (