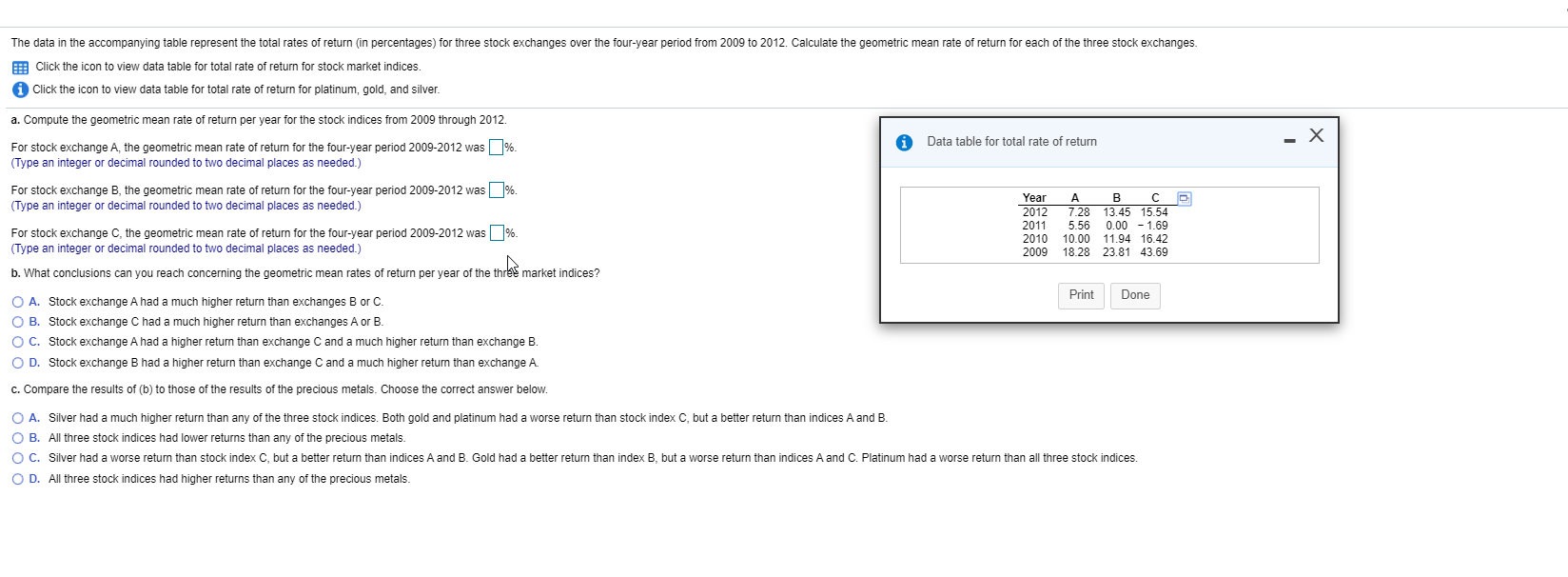

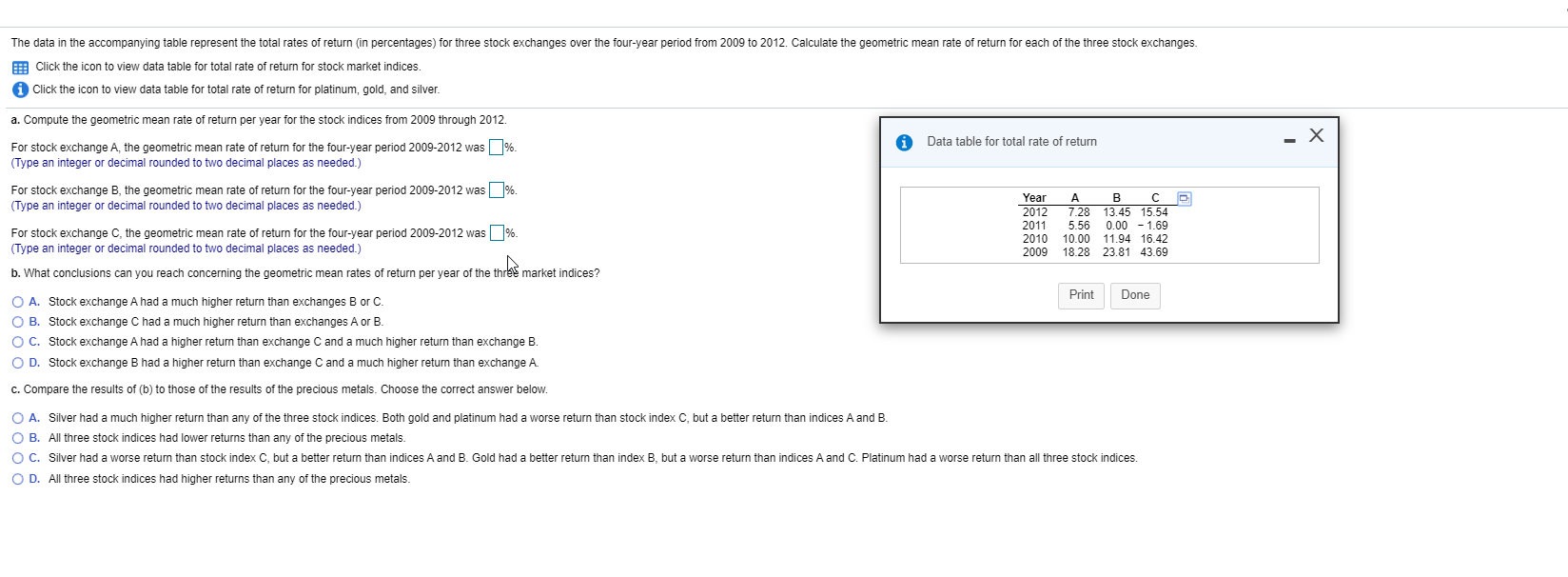

The data in the accompanying table represent the total rates of return (in percentages) for three stock exchanges over the four-year period from 2009 to 2012. Calculate the geometric mean rate of return for each of the three stock exchanges. Click the icon to view data table for total rate of return for stock market indices. Click the icon to view data table for total rate of return for platinum, gold, and silver. Data table for total rate of return a. Compute the geometric mean rate of return per year for the stock indices from 2009 through 2012 For stock exchange A, the geometric mean rate of return for the four-year period 2009-2012 was %. (Type an integer or decimal rounded to two decimal places as needed.) For stock exchange B, the geometric mean rate of return for the four-year period 2009-2012 was %. (Type an integer or decimal rounded to two decimal places as needed.) For stock exchange C, the geometric mean rate of return for the four-year period 2009-2012 was %. (Type an integer or decimal rounded to two decimal places as needed.) b. What conclusions can you reach concerning the geometric mean rates of return per year of the three market indices? Year 2012 2011 2010 2009 B 7.28 13.45 15.54 5.56 0.00 - 1.69 10.00 11.94 16.42 18.28 23.81 43.69 Print Done O A. Stock exchange A had a much higher return than exchanges B or C. OB. Stock exchange Chad a much higher return than exchanges A or B. O C. Stock exchange A had a higher return than exchange C and a much higher return than exchange B. OD. Stock exchange B had a higher return than exchange C and a much higher return than exchange A c. Compare the results of (b) to those of the results of the precious metals. Choose the correct answer below. O A. Silver had a much higher return than any of the three stock indices. Both gold and platinum had a worse return than stock index C, but a better return than indices A and B. O B. All three stock indices had lower returns than any of the precious metals. O C. Silver had a worse return than stock index C, but a better return than indices A and B. Gold had a better return than index B, but a worse return than indices A and C. Platinum had a worse return than all three stock indices. OD. All three stock indices had higher returns than any of the precious metals