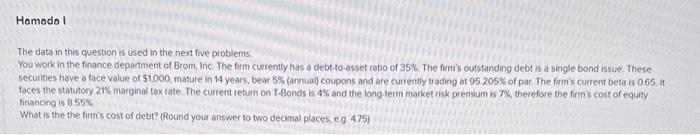

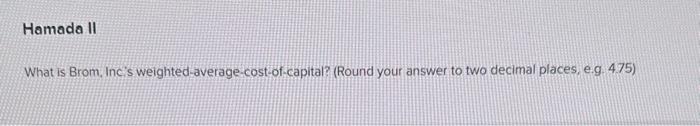

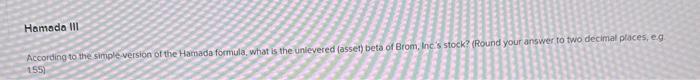

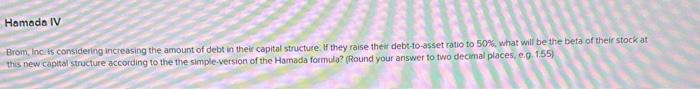

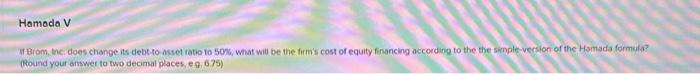

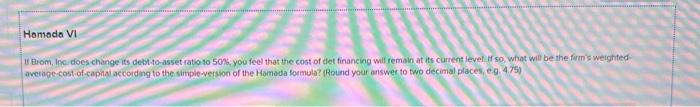

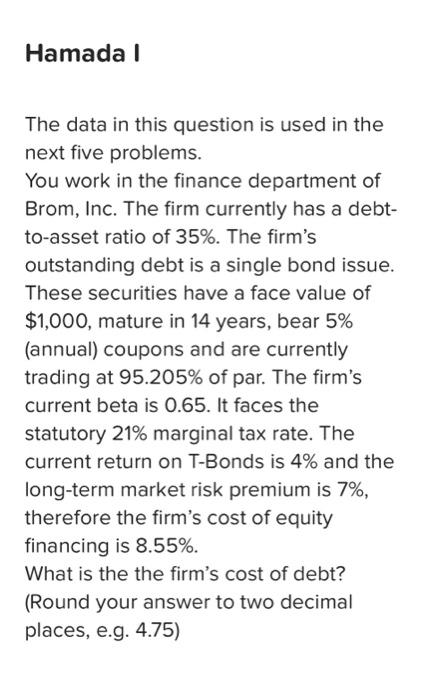

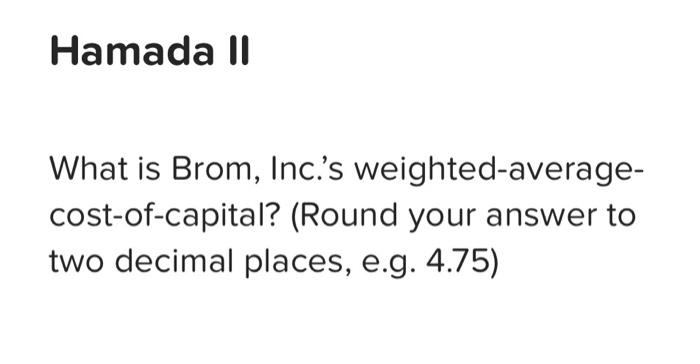

The data in this question is used in the next five problems. You work in the finance department of Brom, lnc. The firm currently has a debt:to-asset ratio of 35%. The firm's outstanding debt is a single bond issue. These 5ecurities have a face value of $1,000, mature in 14 years, bear 5% (anmuaf coupons and are currently trading of 95.205% of par. The firm's current beta is 0.65, it faces the statutory 21% marginal tax tate. The current retum on T-Bonds is 4% and the long term market risk preasium is 7%, therefore the firmis cost of equity financing is 8.55% What is the the firm's cost of debt? (Round your answer to two decimal places, e.9.475) What is Brom, Inc's weighted-average-cost-of-capital? (Round your answer to two decimal places, e.g 475) Hamada III According to the simple version of the Hamada formula, what is the unlevered (assei) beta of Brom, Inc's stock? (Round your answer to two decimal places, eg 155) Brom, inc is considering increasing the amount of debt in their capital structure. If they raise their debt-to-asset ratio to 50% what will be the beta of their stock at this new capltal structure accorcing to the the simple-version of the Hamada formula? (Round your answer to two decimal places, e.9. 1.55) If Brom, inci does change its debt to asset tatio to 50%, what will be the fiems cost of equity financing according to the the simple-version of the Hamada formula? (Round your anwer to two decinsal places, eq, 6.75) if tiom, lnc does change its debt to-asset ratio $0.50%, you feel that the cost of tet financing wilf remain at its current level tf so, what will be the firm's weighted average-cost-of-capaal accoiding to the simpie-version of the Hamada formula? (Round your answer to two decimal places, e.g. 4.75) The data in this question is used in the next five problems. You work in the finance department of Brom, Inc. The firm currently has a debtto-asset ratio of 35%. The firm's outstanding debt is a single bond issue. These securities have a face value of $1,000, mature in 14 years, bear 5% (annual) coupons and are currently trading at 95.205% of par. The firm's current beta is 0.65. It faces the statutory 21% marginal tax rate. The current return on T-Bonds is 4% and the long-term market risk premium is 7%, therefore the firm's cost of equity financing is 8.55%. What is the the firm's cost of debt? (Round your answer to two decimal places, e.g. 4.75) What is Brom, Inc.'s weighted-averagecost-of-capital? (Round your answer to two decimal places, e.g. 4.75) According to the simple-version of the Hamada formula, what is the unlevered (asset) beta of Brom, Inc.'s stock? (Round your answer to two decimal places, e.g. 1.55) Brom, Inc. is considering increasing the amount of debt in their capital structure. If they raise their debt-to-asset ratio to 50%, what will be the beta of their stock at this new capital structure according to the the simple-version of the Hamada formula? (Round your answer to two decimal places, e.g. 1.55) If Brom, Inc. does change its debt-toasset ratio to 50%, what will be the firm's cost of equity financing according to the the simple-version of the Hamada formula? (Round your answer to two decimal places, e.g. 6.75) If Brom, Inc. does change its debt-toasset ratio to 50%, you feel that the cost of det financing will remain at its current level. If so, what will be the firm's weighted-average-cost-of-capital according to the simple-version of the Hamada formula? (Round your answer to two decimal places, e.g. 4.75)