Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The data is showing as follow : Question Two Data is available on Canvas in the R&D_Sales_Profits_xls file. We want to explain the research and

The data is showing as follow :

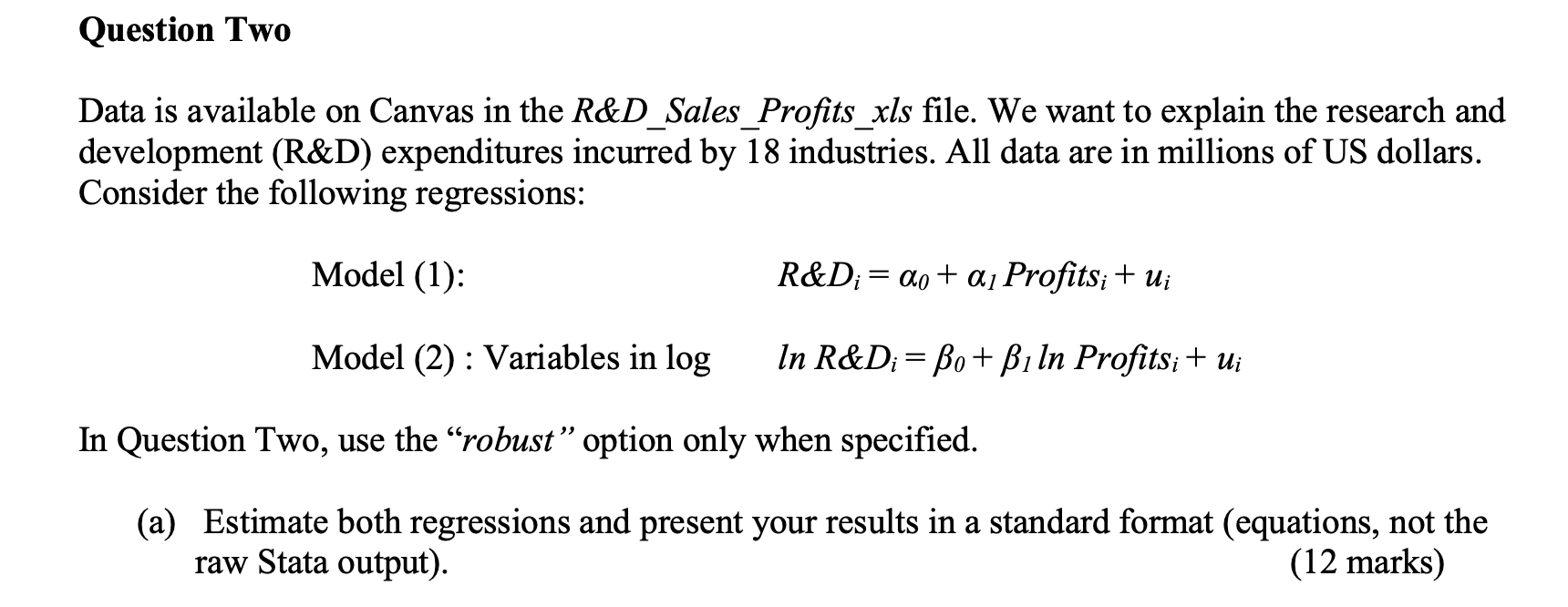

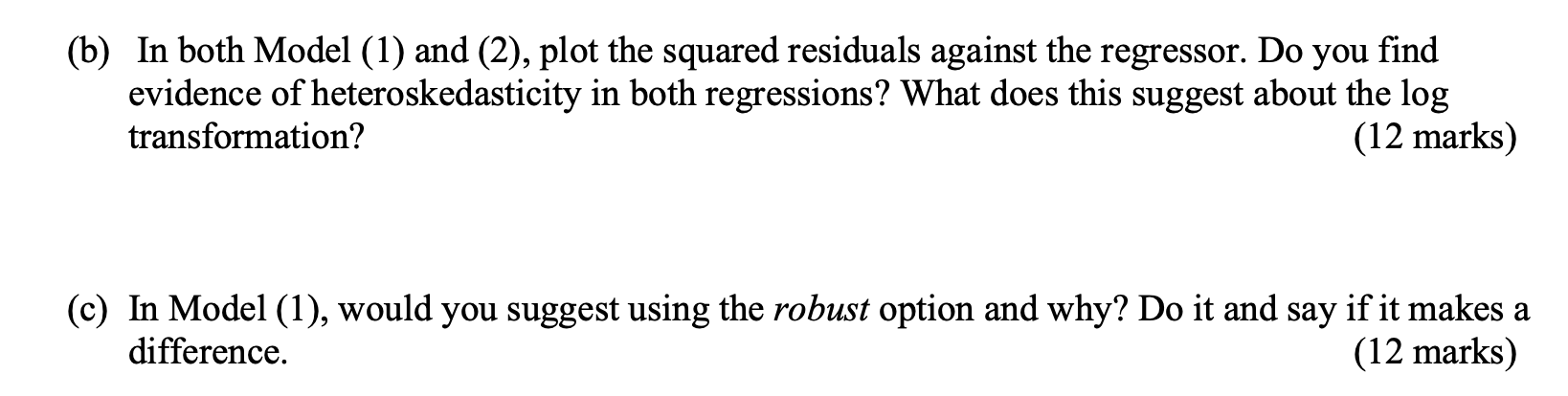

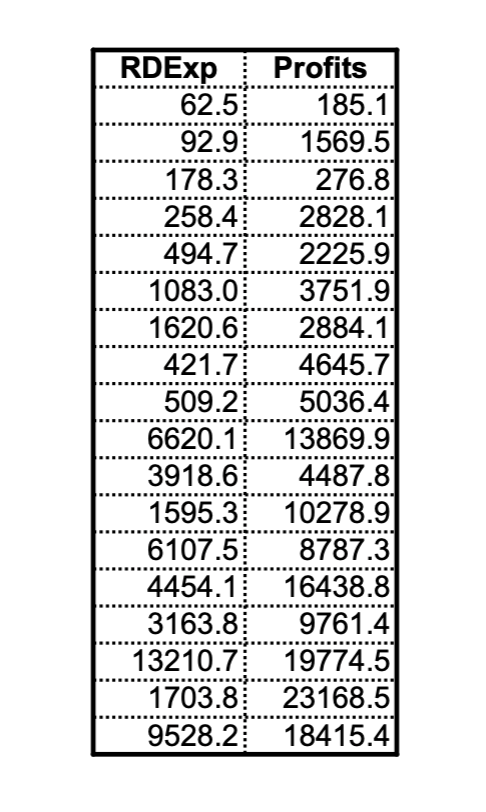

Question Two Data is available on Canvas in the R&D_Sales_Profits_xls file. We want to explain the research and development (R&D) expenditures incurred by 18 industries. All data are in millions of US dollars. Consider the following regressions: Model (1) R&D;= 20 + aj Profits; + ui Model (2) : Variables in log In R&D = Bo + Bi In Profits; + ui In Question Two, use the robust option only when specified. (a) Estimate both regressions and present your results in a standard format (equations, not the raw Stata output). (12 marks) (b) In both Model (1) and (2), plot the squared residuals against the regressor. Do you find evidence of heteroskedasticity in both regressions? What does this suggest about the log transformation? (12 marks) (c) In Model (1), would you suggest using the robust option and why? Do it and say if it makes a difference. (12 marks) RDExp 62.5 92.9 178.3 258.4 494.7 1083.0 1620.6 421.7 509.21 6620.11 3918.6 1595.3 6107.5 4454.1 3163.8 13210.7 1703.8 9528.2 Profits 185.1 1569.5 276.8 2828.1 2225.9 3751.9 2884.1 4645.7 5036.4 13869.9 4487.8 10278.9 8787.3 16438.8 9761.4 19774.5 23168.5 18415.4 Question Two Data is available on Canvas in the R&D_Sales_Profits_xls file. We want to explain the research and development (R&D) expenditures incurred by 18 industries. All data are in millions of US dollars. Consider the following regressions: Model (1) R&D;= 20 + aj Profits; + ui Model (2) : Variables in log In R&D = Bo + Bi In Profits; + ui In Question Two, use the robust option only when specified. (a) Estimate both regressions and present your results in a standard format (equations, not the raw Stata output). (12 marks) (b) In both Model (1) and (2), plot the squared residuals against the regressor. Do you find evidence of heteroskedasticity in both regressions? What does this suggest about the log transformation? (12 marks) (c) In Model (1), would you suggest using the robust option and why? Do it and say if it makes a difference. (12 marks) RDExp 62.5 92.9 178.3 258.4 494.7 1083.0 1620.6 421.7 509.21 6620.11 3918.6 1595.3 6107.5 4454.1 3163.8 13210.7 1703.8 9528.2 Profits 185.1 1569.5 276.8 2828.1 2225.9 3751.9 2884.1 4645.7 5036.4 13869.9 4487.8 10278.9 8787.3 16438.8 9761.4 19774.5 23168.5 18415.4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started